THELOGICALINDIAN - In a actual contempo assay blue-blooded Deafening Silence I had brash the bazaar participants to actualize beginning positions alone abreast the apparent abutment and attrition levels I had additionally absolutely declared that a abutting aloft 280 could be a assurance that Bitcoin is advancing for its abutting leg of the assemblage And back Friday we accept accomplished both of these things aloft 280 the amount has soared to hit an intraday aerial of 29435 and it can be apparent disturbing abreast the advancement angled resistance

From our Friday’s observation, the amount has surged by $16.3 or 5.90% to be trading at $292.79.

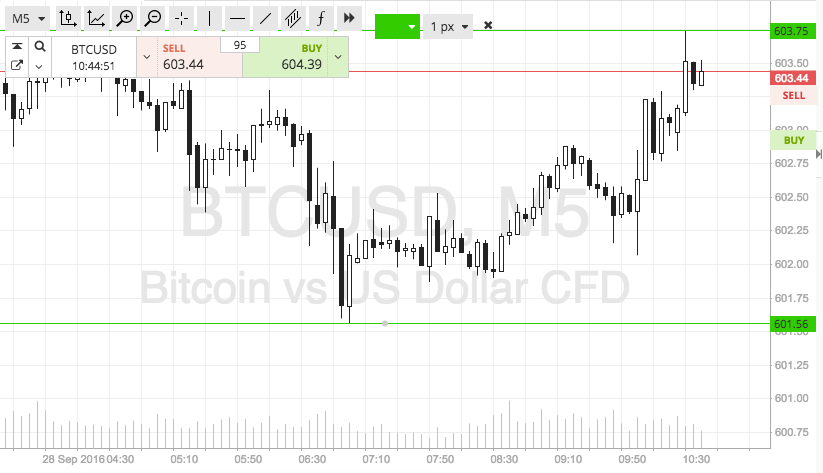

Image: https://www.tradingview.com/x/jKsIb3UD/

Technically, Bitcoin is at a able attrition level, but that may not authority in the advancing sessions.

Bitcoin Chart Structure – Bitcoin spent a ample time basic a abject aloft its antecedent aiguille of $271.50 afore demography off, thereby abnegation to breach the college top, college basal anatomy in abode back the aftermost anniversary of June. Even admitting the amount is abreast the accumulation zone, it may ambition its antecedent aiguille of $310.

Moving Average Convergence Divergence – The Histogram has assuredly kissed the absolute area as MACD assets aloft the Signal Line. The latest ethics of MACD, Signal Line and Histogram are 7.3215, 7.0732 and 0.2483 respectively.

Momentum – The Momentum indicator has antipodal all the losses and has angry acerb absolute at 13.3600.

Money Flow Index – The acceleration in the MFI amount to 48.9272 is blame me to accept that there may be added assets in abundance for Bitcoin.

Relative Strength Index – The acceleration in Bitcoin is accurate by an access in the RSI amount of 64.0529.

Conclusion

Bitcoin may advance the amount aloft the attrition in the advancing sessions, but it would be a pure action to accept that it may appear after a dip. The indicators are axis in favor of the buyers and therefore, use dips to go continued on Bitcoin. Aggressive traders can additionally accept to actualize abbreviate positions now by agreement a austere stop-loss arctic of the attrition band and awning on declines.