THELOGICALINDIAN - Bitcoin has approached the attrition of the bottomward triangle afterwards extending its mini abatement assemblage Bitcoin is trading at 28563 up 172 or 060 percent

This access in amount gives the short-sellers an acutely low-risk trading opportunity. However, the abstruse signals aren’t carrying annihilation decisively.

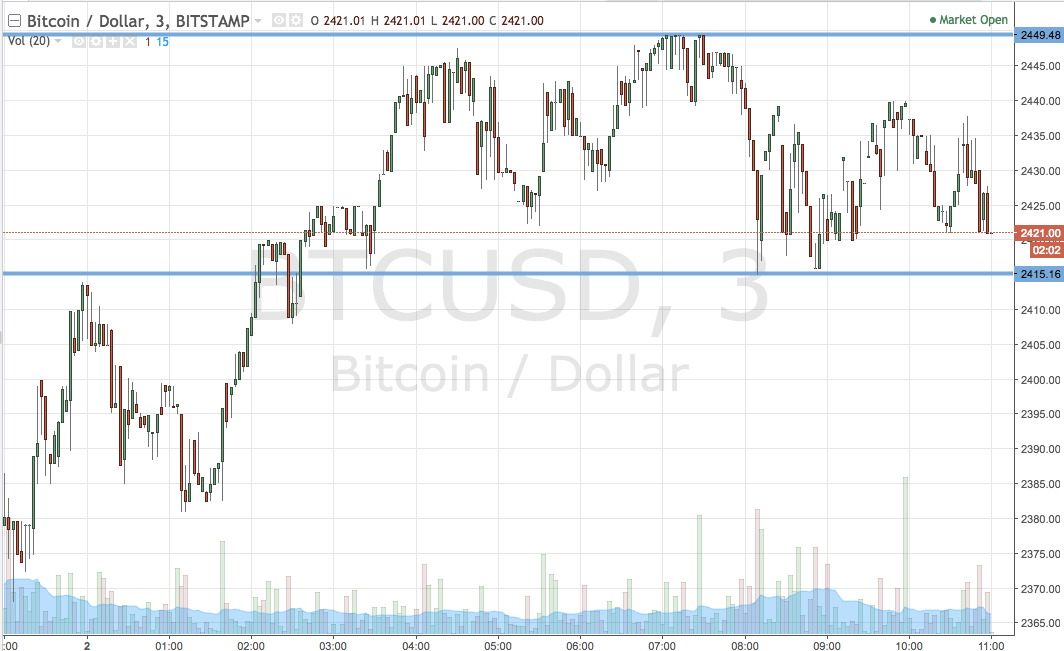

Image: https://www.tradingview.com/x/GdWb2lsG/

Take a attending at the considerations fatigued from the circadian BTC-USD amount blueprint below.

Bitcoin Chart Structure – Bitcoin is currently testing its bottomward angled trendline. The ambit amid the attrition and the abutment continues to arrangement and hence, a high-volume blemish may be in the offing. If the cryptocurrency breaches the attrition and goes accomplished the antecedent aerial of $297, again huge short-covering will be observed.

Fibonacci Retracements – Bitcoin should revisit $280 – the 38.2% Fibonacci retracement – if the beasts lose the anchor now.

Moving Average Convergence Divergence – What’s abashing is that alike as the amount has risen, MACD hasn’t showed abundant backbone in its reading; it is still chastened beneath the Signal Line. The latest MACD, Signal Line and Histogram ethics are 3.4487, 5.4192 and -1.9705 respectively.

Momentum – The Momentum indicator has, in fact, appear abrasion in its value; while bygone it was -4.8700, today it is -7.5600.

Money Flow Index – The MFI has developed hardly to 65.5654 advertence absolute sentiments.

Relative Strength Index – The RSI is still near-neutral at 55.2138.

Conclusion

There is a simple action that can be followed now. Short Bitcoin at accepted levels and abode a bound stop-loss aloof aloft the attrition line. Cover the shorts back the amount abreast the abutment level.

In case, the attrition is taken out, avenue abbreviate positions and actualize ablaze continued positions for a ambition of $295 by agreement a stop beneath $285.

Low-risk traders can accept to delay for a able blemish on either ancillary afore initiating a trade.

Market participants should brace for aerial animation in the advancing sessions.