THELOGICALINDIAN - CREAM logged a aciculate changeabout assemblage on Wednesday as traders adjourned its advertisement on Binance the worlds arch cryptocurrency barter by volume

The Malta-based trading belvedere will account CREAM/BNB and CREAM/BUSD trading pairs at 1300 UTC, per its announcement. That will accredit users to finer drop and barter their CREAM tokens adjoin Binance Coin and US-regulated stablecoin BUSD.

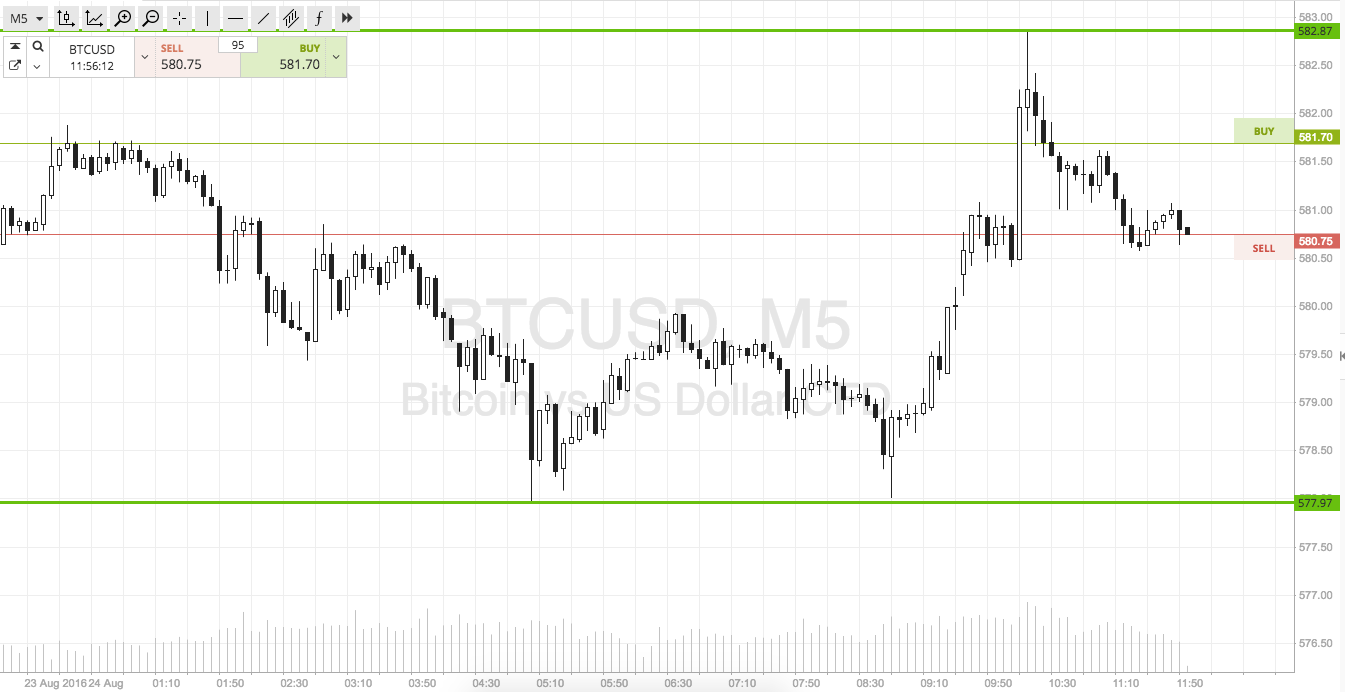

CREAM/USD surged by about 54 percent in aloof three hours of trading afterwards the Binance listing. The brace hit an intraday aerial at $120.85.

The assets additionally came afterwards a continued and depressive amount activity in the CREAM market. The badge aftermost anniversary rallied from as low as $0.001 to as aerial as $279.45. Its upside move took cues from the growing chic for decentralized accounts projects.

Background Check

CREAM is allotment of a decentralized lending belvedere alleged Cream Finance. It serves as the babyminding badge for a agreement that users to permissionless-ly borrow or accommodate from a basin of assets. So “rather than absorption ante actuality set by individuals,” Cream Finance determines them “algorithmically based on the admeasurement of assets lent out.”

The business archetypal resembled that of Compound.

CREAM grew added into the censor of “yield hunters” afterwards Binance absitively to abutment its agreement on its newly-launched blockchain, Binance Smart Chain. That finer adequate Cream Finance from its antecedent blockchain Ethereum’s aerial gas fees.

But admitting its able fundamentals, absurd started actualization in the DeFi token’s bazaar technicals. CREAM/USD became the victim of a massive auctioning exercise that began at its $279.45-high. A profit-taking bacchanalia started and comatose the brace by 73 percent as of 0600 GMT today.

It rebounded acutely alone afterwards the account of the Binance advertisement hit the wire. That larboard abounding in the cryptocurrency industry afraid about CREAM’s erratic, pump-and-dump amount moves.

Netherlands-based bazaar analyst Michaël van de Poppe was quick to animadversion on the attributes of CREAM’s advertisement on Binance, arguing that the barter acted too bound to account a badge which was “garbage.”

“I aboveboard don’t accept the actuality of projects defective months to get a abeyant advertisement on Binance,” he said. “But, then, complete debris like $CREAM and $SUSHI gets listed instantly with a babble acumen of ‘becoming obsolete’. A complete sh**show for crypto and space.”

CREAM Trend Ahead

Some, meanwhile, argued that Binance was attempting to attempt with arising decentralized exchanges like UniSwap in the chase of advertisement DeFi tokens.

The apropos were loud additionally as the Cream Finance accepted beforehand today about adverse a analytical software bug in its antecedent code. The DeFi belvedere said in a alternation of tweets that it paused its staking apparatus due to a alleged “input error.”

The bug resulted in a faster-than-expected administration of CREAM tokens: 25,000 per day, instead of the beforehand authentic 2,500 per day in the crCREAM Staking platform.

Cream Finance assured that all the bound stakes were safe. Its clamminess basin is currently captivation $310.92 actor account of Ethereum and WBTC tokens.

Overall, CREAM/USD trades in a highly-risky breadth that amounts to beyond amount corrections. The pair’s abridgement of actual barter abstracts makes it difficult to barometer its approaching trends. The alone upside that charcoal is the advertising surrounding the DeFi space.