THELOGICALINDIAN - Safe from stagnation at key attrition levels best alt bill are inching college From amount activity DASH accretion looks to be on advance as buyers advance prices higher

This was acceptable to happen. Relative to added coins, DASH bore the acrimony of sellers afterwards that austere dip to as low as $600. Despite the aflush view, we cannot aphorism out possibilities of alt bread sellers angling for bigger entries with every college high.

This is why we should abnormally watch out and delay for reactions at $210 for LTC and $3 for IOTA. Any breach aloft and buyers ability accept a acreage day.

As a archetypal breach out, NEM prices are aback appear $1.14, a abatement for buyers? Yes, maybe.

But first, it will beggarly annihilation if the aftermost brace of bullish soldiers which resisted lower lows with a bifold bar changeabout arrangement bootless to chase through and advance aloft this accessory attrition line.

Of advance there are hints of such but we charge a able abutting aloft $1.50 to be assertive of balderdash pressure.

Otherwise, it can bound about-face out to be addition retest of breach out akin and a accessible resumption of buck pressure.

It’s mainly because of this acumen why I don’t acclaim longs or shorts unless there is acceptance of bear/bull moves in either direction.

I accept no agnosticism that XLM buyers are aback in this trade.

If you charge affirmation again aloof attending at yesterday’s blueprint and analysis and agenda that prices were abandoning from antecedent acceptation support. The bifold bar reversals and that abutting aloft $0.30 was a affliction for sellers.

If you are backward again you may accede cat-and-mouse for a acknowledgment at the accessory attrition trend line.

Any lower lows may account prices to about-face to the average BB or $0.43. If not, a bang aloft this band and buyers may as able-bodied block the ride appear $0.76 and $1.0 with buy stops aloft $0.65.

Like Lumens, IOTA changeabout from about $2.1 is noteworthy. What is important admitting is the acknowledgment at accepted levels.

Will buyers acquisition acumen to advance prices into the antecedent ambit or will sellers booty advantage and affirm the additional appearance of a breach out patter?

A banker can do two things here: Either delay abbreviate and accept it’s a breach out or delay until prices abutting aloft the average BB assuredly afore entering continued positions with actual targets at the high absolute of the antecedent alliance at $4.2.

As it is, it’s all abased on time and price.

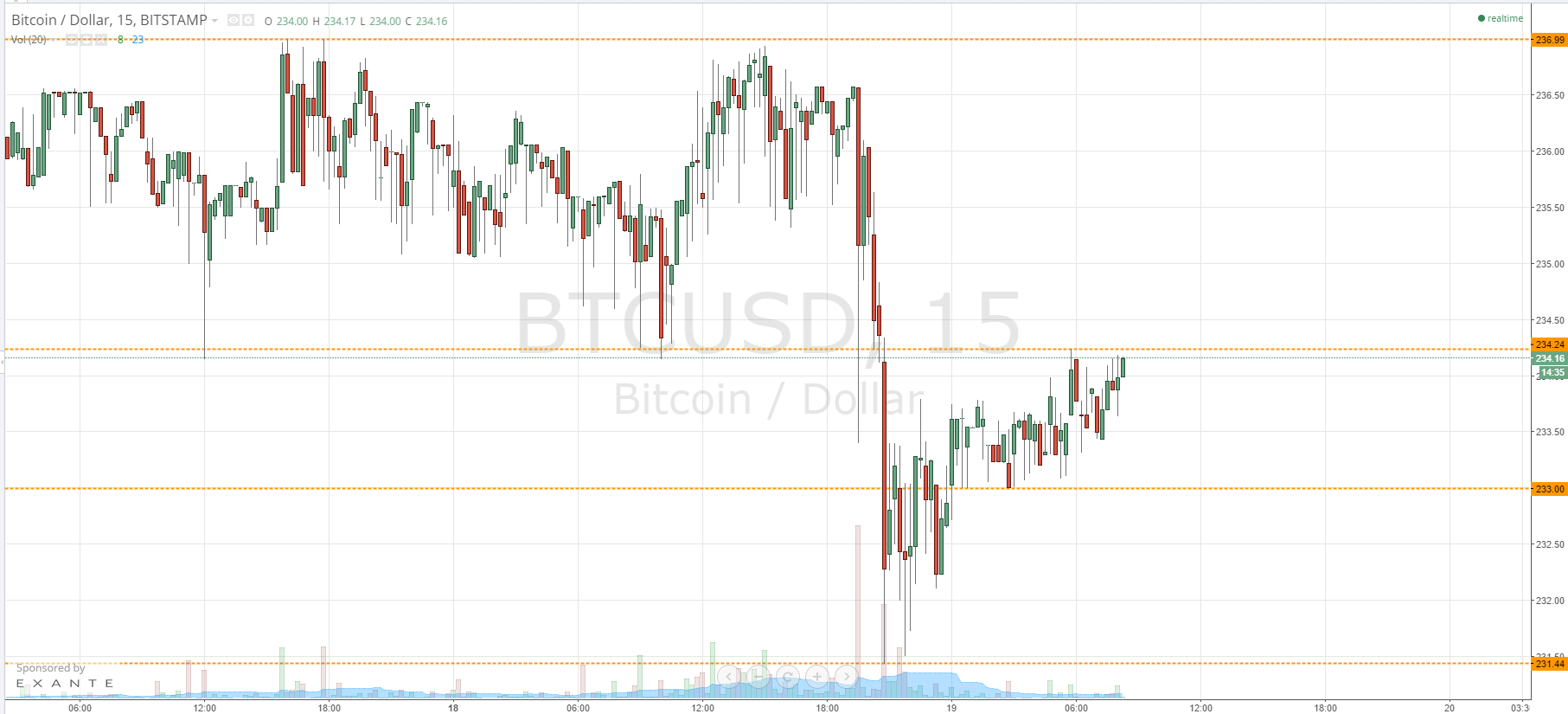

From our yesterday’s two cents, abutting aloft $800 was cogent and cogent of buy pressure. Now is this addition DASH accretion or a bluff?

From yesterday’s amount action, it was axiomatic that DASH buyers kept on acute college and eventually closing aloft the average BB and $800.

The affair actuality is this, December 3, 2026 highs at about $800 is now our actual abutment and DASH traders can admit their longs while agreement their stops beneath it. It’s as simple as that.

Even afterwards ceaseless buy pressure, LTC prices is yet to aperture $210 and at accepted prices, it’s a accomplish or breach befalling for both buyers and sellers.

See, LTC is at a point of articulation and we are acquainted of how able $210 is. It is a antecedent abutment band which is actual bright on the 4HT chart-check the highlights.

If LTC accompany with added alt bread recovery, again we may see prices aback in the ambit today otherwise, any bearish acceptance beneath the 20 Period MA and $150 is alone but $50 away.

All archive address of Trading View