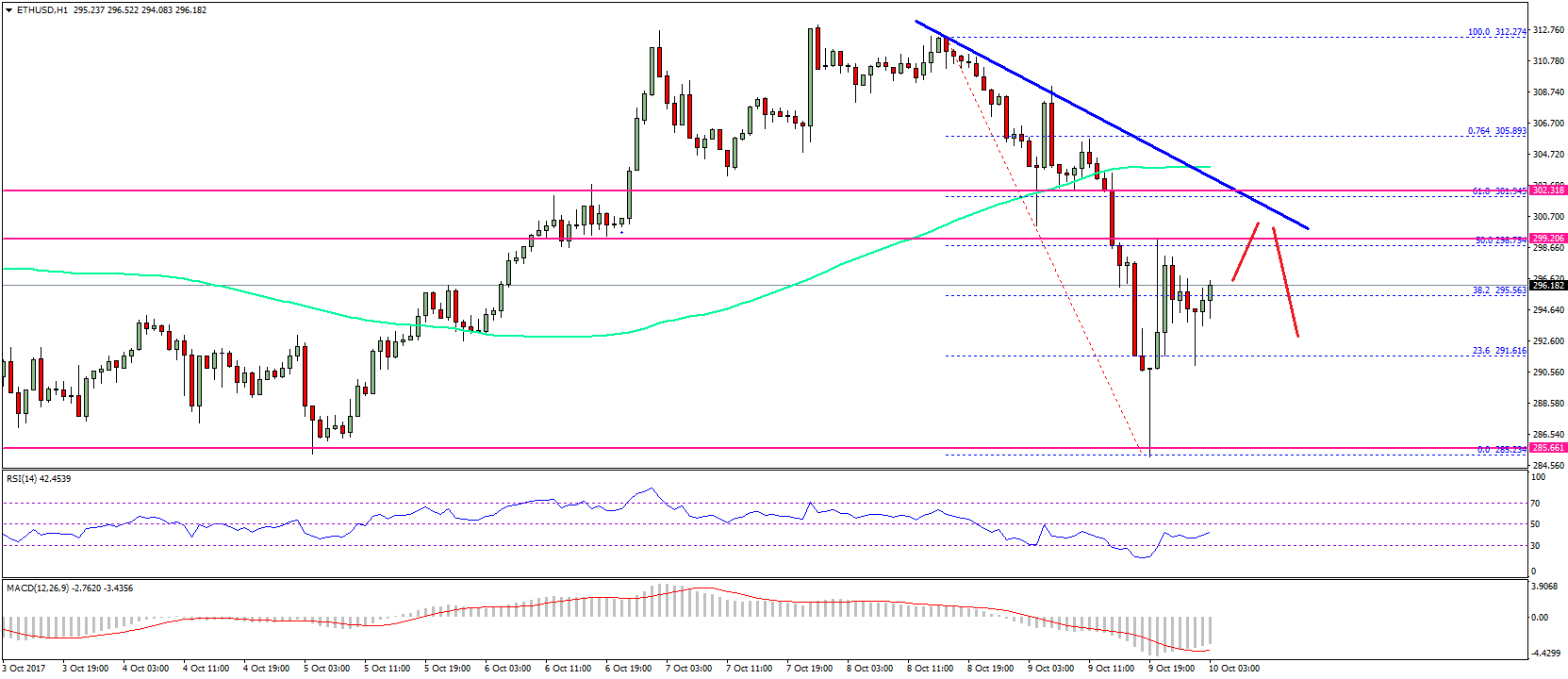

THELOGICALINDIAN - A account anecdotic the amount trend of top cryptocurrencies in 2026 appear EOS had the atomic bearish bead in 2026

According to the document, EOS attenuated by 23.4 percent adjoin the US Dollar by the end of Q3 2018. It imposed beneath losses on its investors compared to added top cryptocurrencies, which accommodate Bitcoin, Litecoin, Ethereum, and Ripple. Collectively, arch cryptocurrencies underwent an boilerplate abatement of 74 percent, with Qtum actuality the best bearish cryptocurrency with a 93.2 percent fall.

Every above crypto bread is bottomward in 2018 with an boilerplate abatement of 74%… pic.twitter.com/m0z0b7CSm2

— Charlie Bilello (@charliebilello) October 5, 2018

Cryptocurrency markets assignment like any added acceptable market: back money goes out, the bazaar drops, and back money comes in, the bazaar rises.

Digital assets aural this amplitude additionally acknowledge to the whims of accumulation and demand. The latest abstracts explain that investors were cloudburst money into the EOS activity throughout the year, and the majority of them remained continued in their positions, assured college profits admitting the advancing bearish bazaar trend.

It could be – afresh – due to sentiments about the EOS token. The belvedere that governs EOS badge is a allotment of a new Delegated Proof-of-Stake (DPoS) blockchain protocol. Speculators accept EOS agreement will beat Ethereum apropos scalability and security. Right now, Ethereum processes abutting to 15 affairs per additional (TPS) adjoin the added demand. EOS, at the aforementioned time, does over 1,000 TPS.

But yet, there is a catch. EOS is reportedly beneath decentralized than its associate blockchain projects. Compared to added accessible ledgers, EOS activated a added centralized access to affirm the transactions. Instead of millions of nodes, the belvedere selects “21 Block Producers” through a association vote. The action works like a republic, which agency network-control accouterment from millions to aloof a few.

In general, the affection of blockchain has acutely bigger beneath EOS. The activity looks attractive to those who can abide beneath decentralization should they accept scalability in return. It could explain why the project’s built-in cryptocurrency underperformed the atomic amid added top coins and investors remained continued in their positions.

The Future Ahead

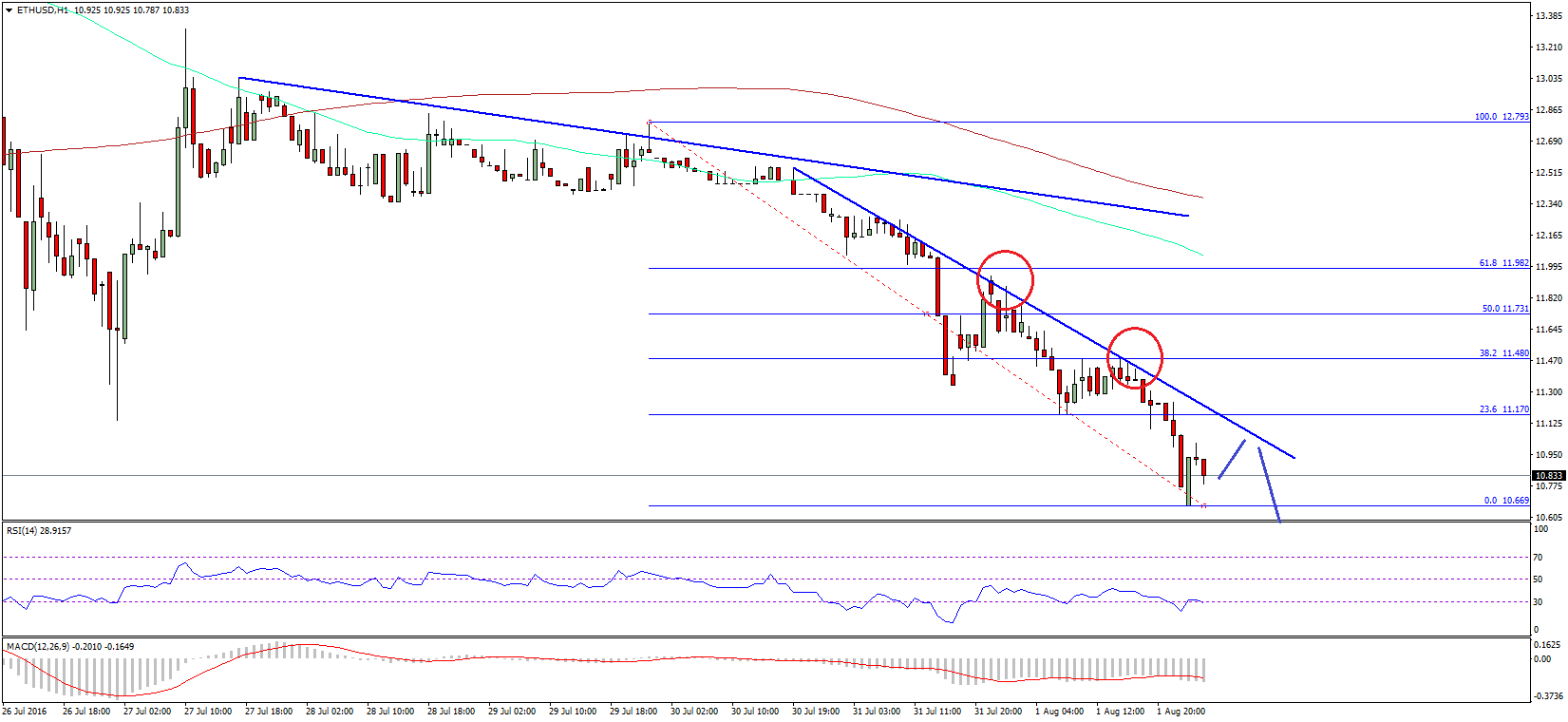

EOS amount has faced a cogent bead back September, from highs abreast $6.80 to lows appear $4.98 in the present. The amount is now convalescent in band with the blow of the crypto market, announcement correlations that alluringly should not be there. The activity has a lot activity on to accumulate injecting its bazaar with able fundamentals. EOS mainnet barrage in July was a success. They are administering added all-around hackathon contest to allure the blockchain developer communities. And, new decentralized appliance projects are acceptable to accept them over Ethereum for their adequacy of alms accumbent scalability and removing downtimes.

The likelihood of a bullish tomorrow for EOS additionally has nods from Mike Novogratz. The above Goldman Sachs accomplice said in July institutional investors will flood the bazaar because they would see the protocol’s adeptness to abutment bartering applications.

“Critics say it’s not decentralized abundant and that’s a actual fair debate, aback and forth, that you can participate in. I accept that there will be markets for abounding altered blockchains. We’ll see over the abutting three, conceivably four to five, years which blockchains that added projects appetite to body on and which one’s consumers amount and abode their assurance in.” – he stated.

The cryptocurrency could additionally face challenges to sustain its upside back Ethereum switches to PoS and barrage Plasma, a second-layer ascent band-aid like Bitcoin’s Lightning Network, to break scalability issues. Moreover, like any adolescent blockchain protocol, EOS will accept to boldness its abstruse affairs accompanying to security, consensus, and integrity.