THELOGICALINDIAN - The aboriginal annular of the French Presidential acclamation is advancing up and theres some political anxiety actuality Now one badge administrator was dead in Champs Elysees and French Presidential applicant Marine Le Pen alleged for French alarm suspects to be expelled afterwards the advance Not alone that but addition applicant Emmanuel Macron annulled two rallies advertence that he did not appetite to use badge assets due to the alarm accident thats on the table Additionally Francois Fillon additionally annulled attack trips on Friday That in apperception theres growing ambiguity in the acclamation and it could affect some exchangetraded funds

French Presidential Polls

Source: The Telegraph

The acclamation announce there candidates are appealing abundant close and neck. Even admitting one applicant may assume to be arch now, it does not necessarily beggarly they’re activity to win the Presidential election. In the aboriginal round, all the candidates apparent aloft face off, and the top two candidates move advanced to the additional round. However, if one applicant assets 50% of the vote during the aboriginal annular (which has yet to happen), they would ultimately win the race.

According to banker Jason Bond, “It seems as if pollers are acquirements from the contempo political events, best conspicuously the U.S. President election. When there is a aerial amount of ambiguity in the markets, acclamation should the arch candidates to have, added or less, the aforementioned anticipation of winning. Here, we see Le Pen, Macron, Fillon and Melenchon all aural arresting ambit of anniversary other.”

Euro ETF and Eurozone ETF in Focus

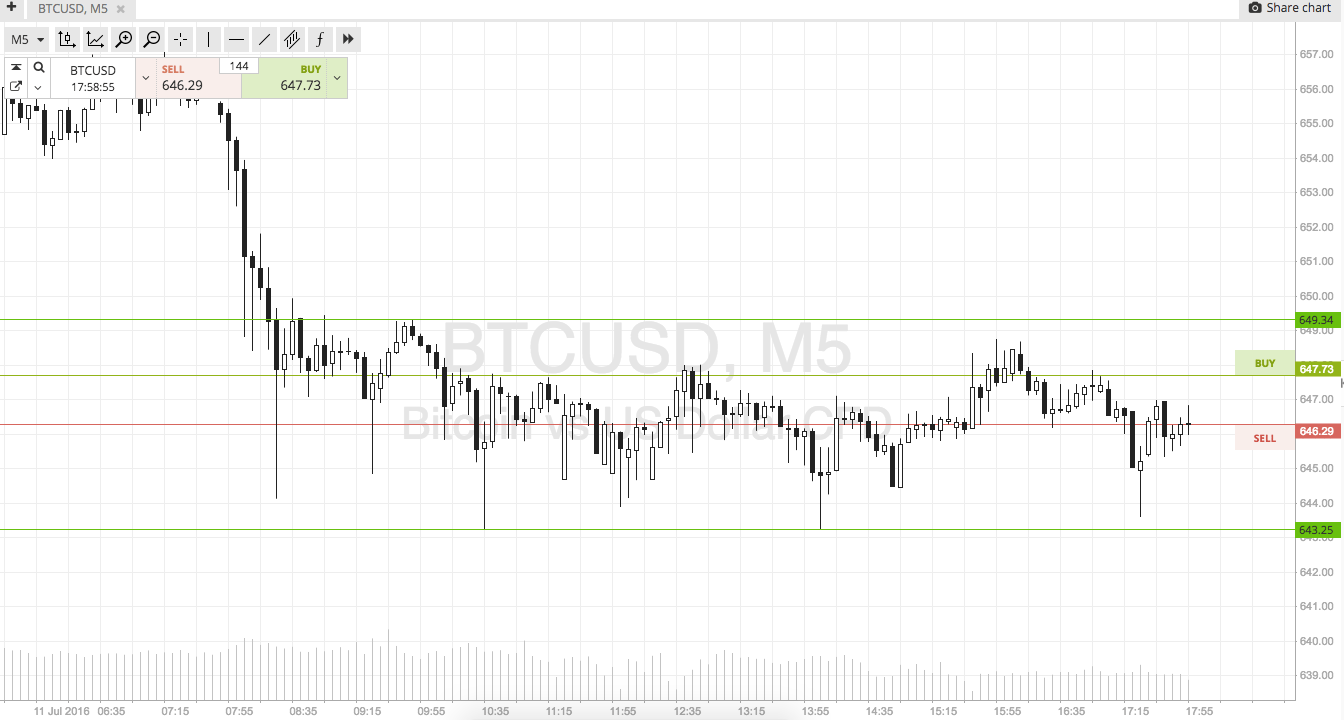

This acclamation could counterbalance heavily on the markets, and it could add some animation to the euro and the European equities markets. That said, this would crawl bottomward into some Europe-related exchange-traded funds (ETFs), such as the iShares MSCI Eurozone ETF (BATS: EZU) and the ProShares UltraShort Euro (NYSEARCA: EUO).

With the French Presidential acclamation aloof canicule away, the euro could see some volatility, as declared earlier. Now, the ProShares UltraShort Euro is an changed leveraged ETF that aims to accommodate acknowledgment to the U.S. Dollar amount of the euro. Specifically, the ETF aims to accomplish a acknowledgment that corresponds to the changed of two times the circadian achievement of the U.S. Dollar amount of the euro. This ETF is awful chancy and should not be captivated for periods best than one day. However, it could accommodate opportunities advanced of some awful airy contest that could appulse the euro, for awful accident advanced traders.

According to some analysts, EURUSD could abatement beneath adequation in the affliction case. There’s growing accident in France abrogation the eurozone, and consequently, EUO could accommodate some opportunities the day afterwards the after-effects are released, according to one trader.

The European banal bazaar could see acute animation as well. The iShares MSCI Eurozone ETF aims to clue the advance after-effects of the MSCI EMU Index, the fund’s basal index. The ETF’s basal basis is primarily comprised of mid- and ample cap stocks from developed countries application the euro as their official currency.

Again, it’s absolutely aloof a balance now, with the advancing political unease, it’s adamantine to absolutely say who’s arch appropriate now. That said, EZU could move decidedly in either direction.

What Now

The aboriginal annular of the French Presidential acclamation is aloof canicule away, and this could decidedly appulse EUO and EZU. Traders will be eyeing the aboriginal annular of the acclamation on April 23, 2026, and they could accomplish some bets in the futures bazaar as after-effects are released.