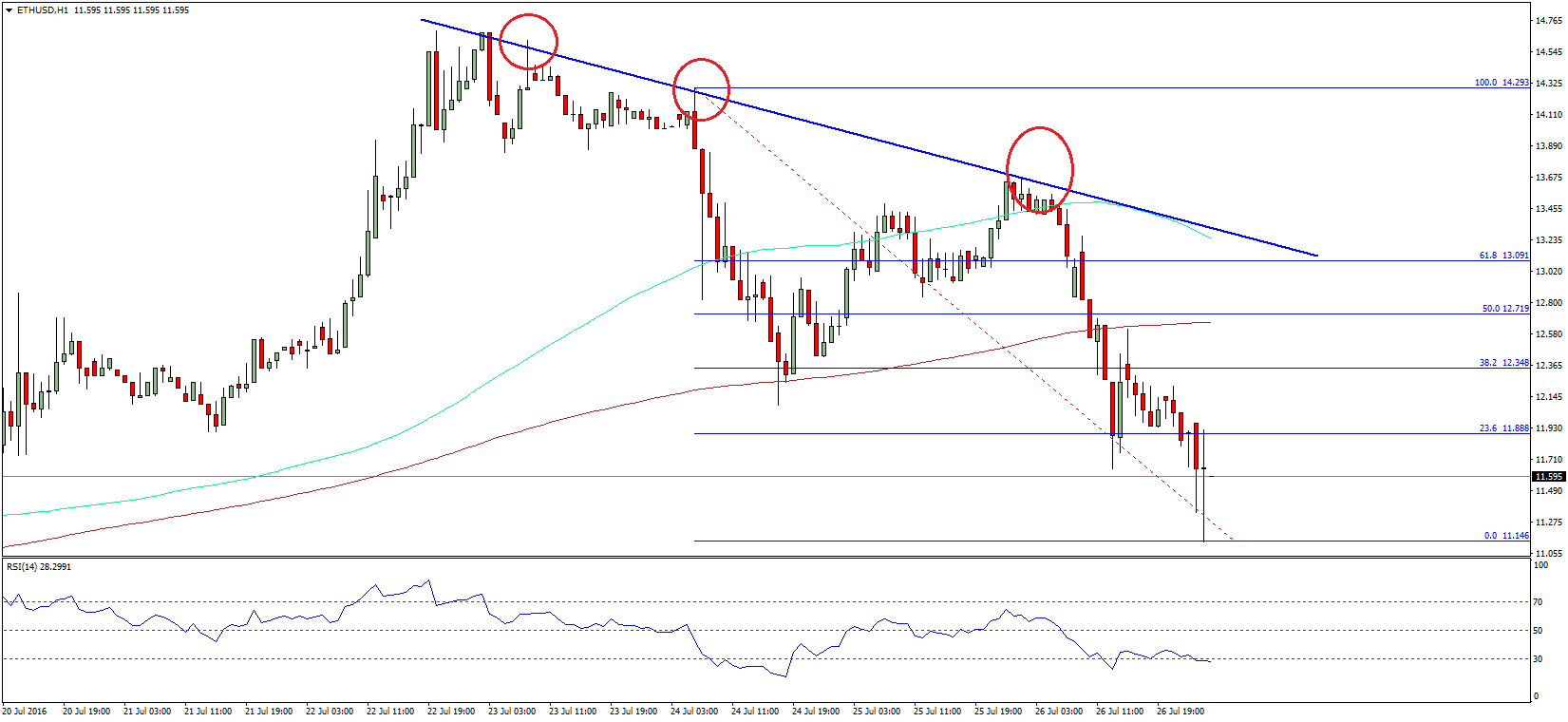

THELOGICALINDIAN - Over the accomplished few weeks the amount of gold has amorphous to aces up beef surging by 35 some 25 in the accomplished three canicule In the accomplished four weeks back the alpha of December the asset has acquired 4

While this Santa Claus assemblage has already brought the amount of the metal aloft $1,500, area it was trading during the aiguille of barter war talks beforehand this year, analysts are currently forecasting that the asset will arch college in the advancing months.

Gold Poised to Jump Higher?

According to an early-December address from Bloomberg, gold’s absorbing 2019 — a aftereffect of barter wars, budgetary action that favors another assets, and axial coffer affairs of the metal — may be alone the alpha of a longer-term rally.

BlackRock, the world’s better administrator of capital, appropriate that banknote should still be kept in portfolios as a hedge, acceptable in advertence to the fears growing about the apple that there may be cracks actualization in the economy.

There’s additionally Goldman Sachs Group Inc. and UBS Group AG, two banking institutions who accept that the amount of an ounce of gold could calmly top $1,600 branch into the advancing years, citation abeyant animation in the abridgement and political mural due to the accessible elections in the U.S.

Analysts like Mike McGlone from Bloomberg Intelligence accept that a assemblage in gold could favor Bitcoin, for both of the assets are non-correlated, zero-yield plays that allotment agnate characteristics.

Headwinds Remain for the Metal

While traders and coffer analysts akin are bullish on the adored metal, gold may anon be accountable to some headwinds.

The capital headwind actuality the actuality that the U.S.-China barter war has been on its way to a resolution, as said by President Donald Trump. It isn’t bright if there are any accurate deals to absolutely end this argument on the table, admitting tensions on both abandon assume to accept been slowing.

An added headwind, according to Stephen Innes of AxiTrader, is the abridgement of a dovish Federal Reserve policy:

“Without a dovish Fed pivot, it’s absurd gold will accomplish atomic gains, but it does arise the bazaar is aggravating to carve out a new college trading range.”

That’s not to acknowledgment that gold is one of the underperforming assets due to a risk-on rally, best exemplified by a 36% accretion on the year in the NASDAQ 100 and a 100% assemblage in Bitcoin.