THELOGICALINDIAN - We were appropriate with our IOTA anticipation Theres an accessible IOTA lift off

Well, abounding bodies accept in IOTA accustomed the added than 10X fasten in the aftermost 2 months. NEM is additionally acrimonious up while we are seeing a arrest in LTC, DASH and Monero.

After yesterday, we can say we were on the appropriate ancillary of the barter as prices concluded up rallying. In actuality by close, NEM highs had activated $1.12. That’s about $0.32 from area we had placed our buy stops. It was at our attrition if you bethink well.

I will be accepted today. First, afterward that spike, we shall abide calm and break apprehensive in our “mini victory”. Long appellation trend buyers are late, conceivably affairs in the aftermost stage, the 4th beachcomber of the Elliot wave.

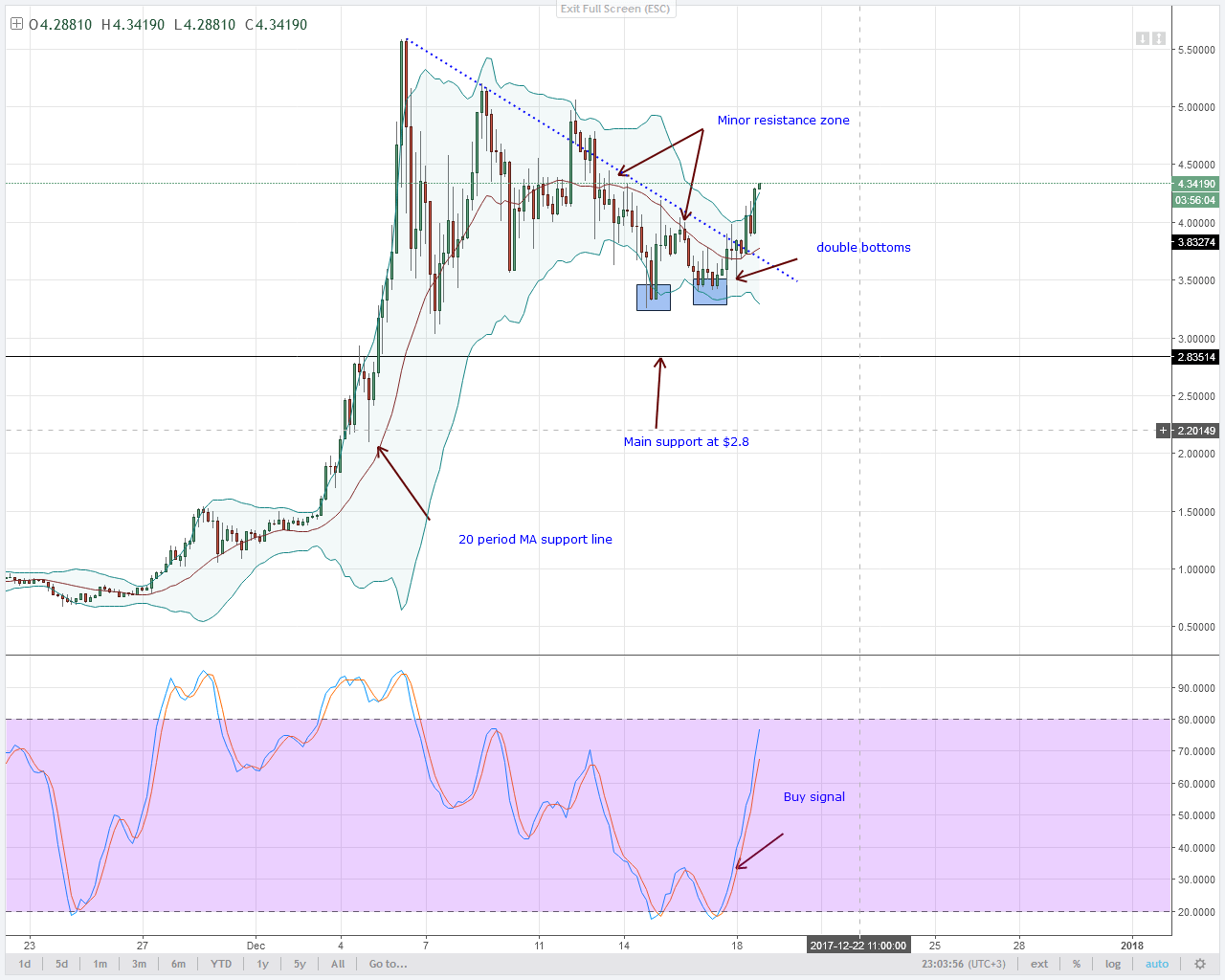

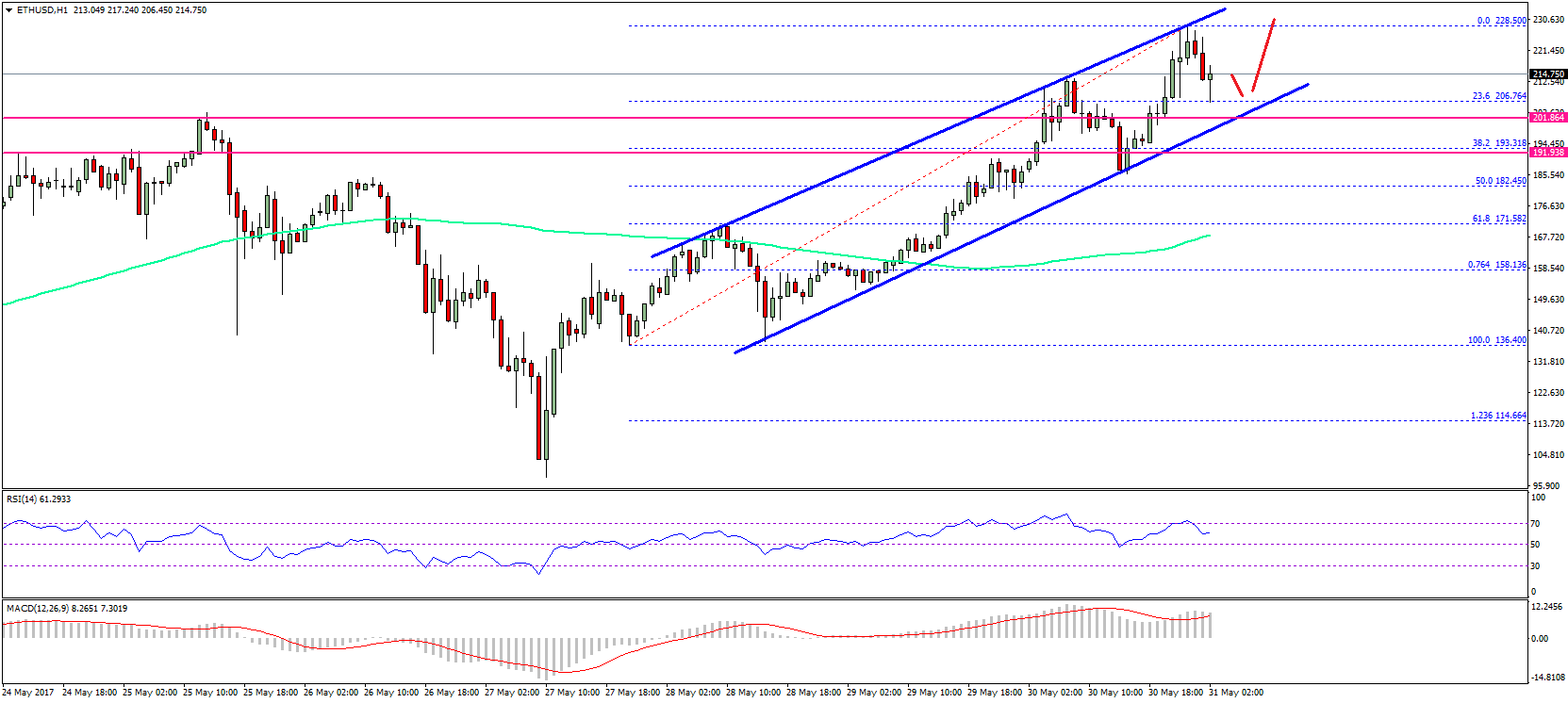

Since I don’t apperceive what the approaching prices are, we shall abject our swings actuality on the 4HR chart. The affair is, the 20 aeon MA has is still reliable and absolute angled acceptation buy drive is still high.

However, we got a little botheration with our stochastics. Bears are jumping in. Remember aloof afore December 19 abutting we had this bearish engulfing candlestick preceded by that astern bang which by the way bankrupt aloft the high BB consistent in a bifold buck changeabout pattern.

In my opinion, NEM prices could calmly amend aback to abutment at $0.80. Once a buy arresting prints at the oversold territory, that is back I ability end up affairs depending on the again prevailing set up.

I was ambiguous of this reversal and now you see why. As it is generally the case, reliable changeabout appear at levels mentioned from December 19 Analysis-around 38.2% and 61.8% or alike lower.

If we assay this “rally” again you apprehension that there are no buys to pump prices. Stochastics are alike axis lower from abysmal the overbought area accompanied by those buck candles.

Look, in the continued appellation we abide bullish. DASH, the activity is alarming but for intra-week traders, break on the sidelines and observe.

I ahead some anatomy of acknowledgment at the average BB but a dip beneath aftermost week’s aerial will be ideal for affairs at dips.

For this reason, my abeyant breadth area buyers ability jump in is about $830 and $900.

It looks like our anticipation on December 19 is axis is axis out to be a USD minter.

Well guys, I recommended already prices analysis $5.5, we should move our stop losses to $3.5. Now let’s do that and lock in some profits.

Confident of college highs? Yep! Reason? These strings of IOTA soldiers are a breach out in the circadian chart. It’s basically an IOTA lift off. IOTA prices ability apathetic bottomward today but affairs of it closing aloft $5.5 is additionally high.

Of advance attention should prevail. If IOTA prices tank, again our stop losses at breakeven would be hit and we avenue the barter gracefully.

Is Monero assuming cracks? Short term? likely….long term? Definitely not.

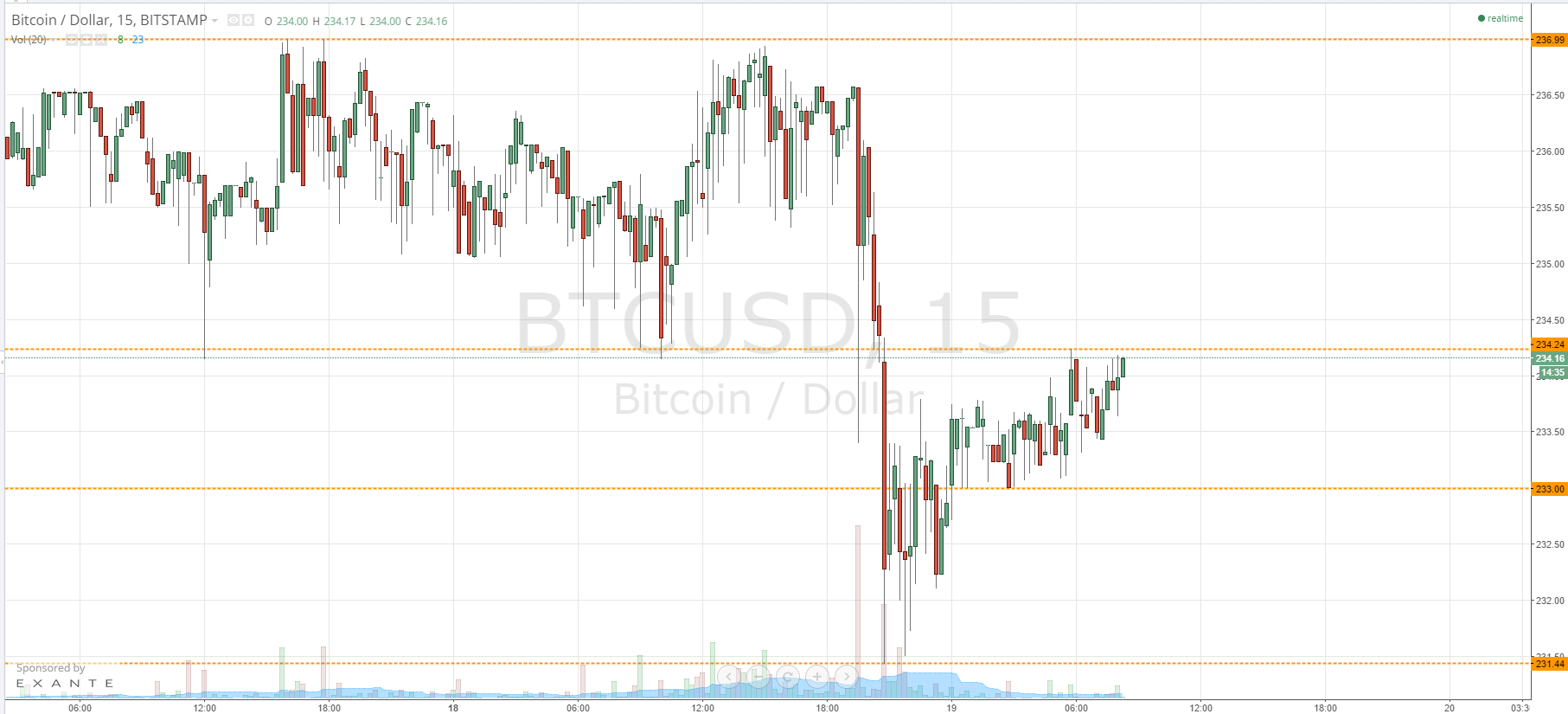

From experience, for a college time anatomy candlestick to be complete, two wicks at anniversary ancillary of the anatomy charge be formed. Right now, the lower wick is in progress.

I would say Monero buyers are on the sidelines accessible to pounce. The catechism on my apperception is simple. Will the average BB hold? It has been a accurate attic for the accomplished 2 months-zoom out and analysis it out in the circadian chart.

Now, if it does or not, that I don’t know. I will alone abode a 65% adventitious brash from accomplished reactions. In this time frame, buy drive is slowing bottomward and as I blazon this, a bright advertise arresting is assuming like that hot chic.

Everyone can see but no one is accommodating to ride bottomward with it. I’m one of them unfortunately. The moment bears drive bottomward prices, I admonish beat traders to move profits to breach even.

Buy access will appear already a buy arresting shows maybe at about $290 or lower.

Its looks like my 75 cents is out. I’m watching acrylic dry and assertive we ability accept bought at the tip. LTC prices are stagnating and this is demography out LTC steam.

The $70 ambit to $420 seems afar ahead. Maybe it is, maybe not. Demand is slowing as stochastics show.

I’m of the assessment that prices ability abide blockage as it is or alike bead appear the 38.2% Fibonacci level. That by the way is aboriginal level. It can be worse. LTC ability alike analysis $250 afore a buy arresting prints.

That is of advance abased on if the average BB will hold. If it does and a balderdash candlestick shows, that’s a reprieve, if not well…we shall avenue and delay for addition buy opportunity.

All archive address of Trading View