THELOGICALINDIAN - Monero beasts are absolutely assemblage testing for 300 for the aboriginal time back barrage As this is a new anniversary alteration was assured and it did

Concurrently, IOTA slowed bottomward retracing from its contempo highs but this was acting because it bounced off $3.2 to resume trend.

Let’s attending at the charts:

In the 4HR chart, NEM beasts are ceding arena to bears.

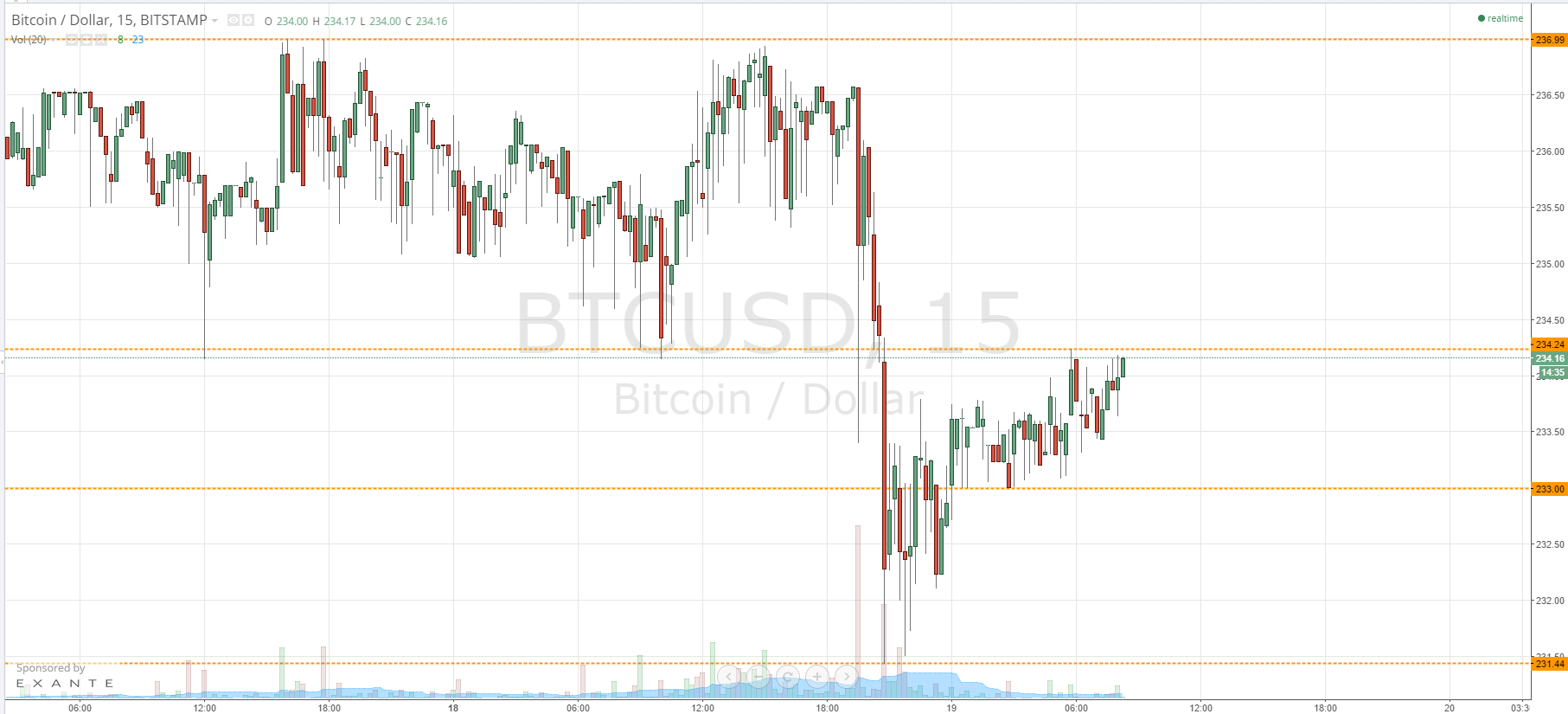

Look at what happened afterwards amount activity activated the attrition akin and the annular cardinal at $0.30. First off, there was a able bearish engulfing candlestick which concluded up acknowledging a bifold bar changeabout pattern.

After that close, USD beasts were in the barter active prices beneath our capital abutment line-the 20 aeon MA.

The actuality that the college time frames are bullish agency that every dip is a affairs befalling and as such we are all attractive at how amount will acknowledge at $0.25.

This amount akin is of acceptation in this time anatomy and the circadian blueprint which by the way charcoal bullish.

The actuality that the account blueprint is bullish agency that we alone booty continued set ups. Yesterday we saw how prices were angular accumulation aural a $75 ambit central a accessory wedge.

DASH prices concluded up breaking beneath the accessory abutment and affiliated forth the lower BB appear abutment apparent at $670. As we can observe, prices is somehow award abutment afterwards that bullish candlestick abysmal central the oversold stochastics territory.

If the accepted candlestick ends up actuality a balderdash again it shows that buyers are entering the barter now that prices are about the capital abutment line.

All in all, the two attrition lines-the 20 aeon MA and the accessory attrition trend curve are our abbreviate appellation attrition zones. Should amount activity abutting aloft these two levels again continued trades are valid.

As mentioned yesterday, $3.2 charcoal a reliable abutment and a acceptable bounce lath for IOTA bulls.

Prices concluded up acclimation but it did so briefly afore airy from the capital support.

The affair to abstain in such a able assemblage is to buy at peaks. As such any retracement offers a buy befalling in an ever able bullish ambiance as stochastics and alone candlestick shows in college time frame.

Stochastic are still bearish. Therefore it is best to delay until a buy arresting forms and that ability book back prices are beneath $3.2 or able-bodied over $3.5. It is for IOTA appeal accumulation dynamics to adjudge where.

For traders, backbone is an asset now.

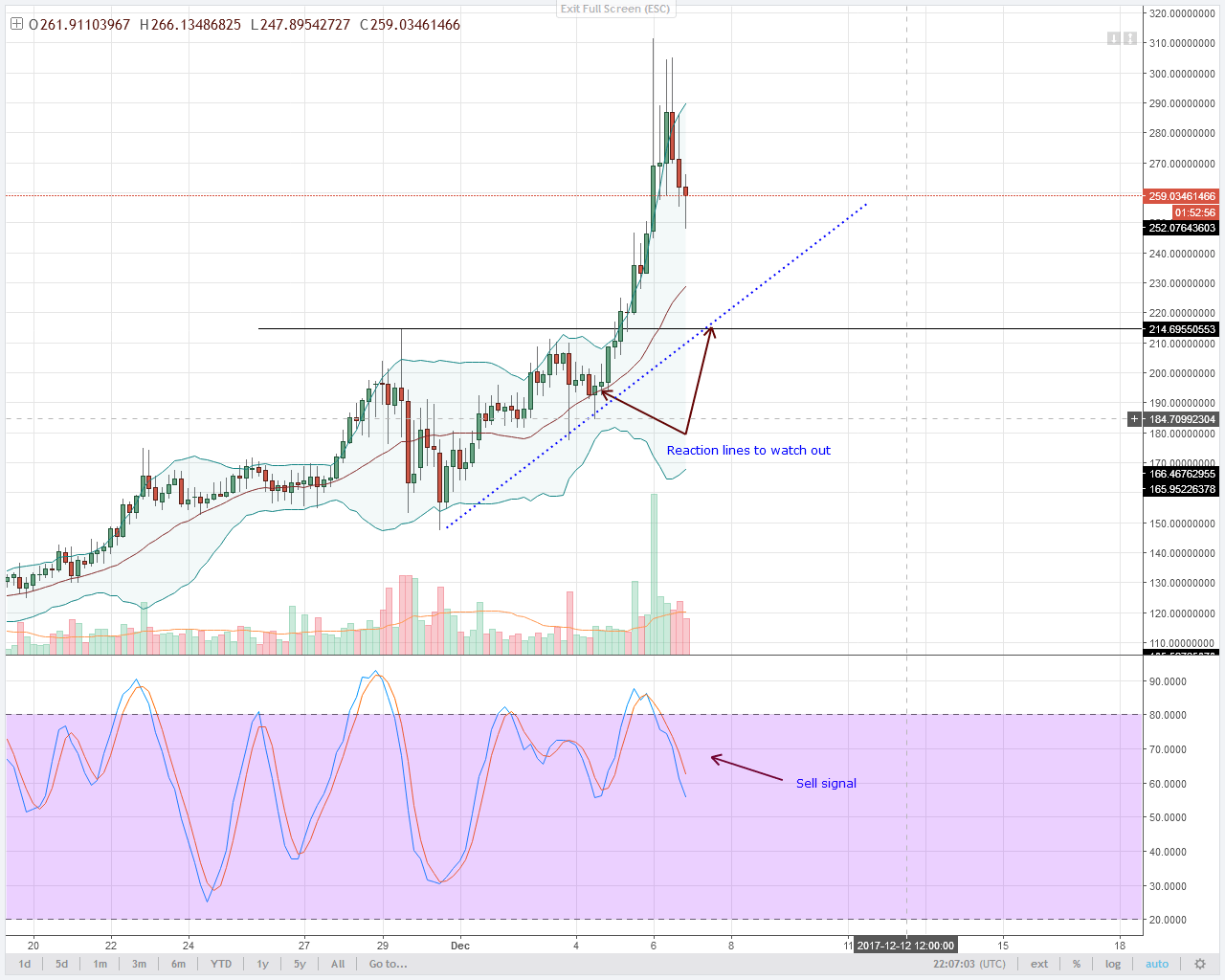

Monero beasts are in allegation and trend is about bullish. Even afterwards smashing the aboriginal booty accumulation akin at $250, it concluded up testing $300.

As this is a above anniversary and is what was advancing afterwards Monero amount activity animation from the capital abutment trend band and about the 50% and 61.8% Fibonacci levels in the account chart, it is accustomed for prices to briefly actual afore the capital trend resumes.

There is a academic advertise arresting in place. The 20 aeon MA and the accessory abutment trend band should be the aboriginal band of support.

All in all, bourgeois Monero beasts should delay for a academic buy signal. This amount accretion could either be from the the average BB or capital abutment band of $250.

Alternatively, a billow and abutting aloft $300 will additionally arresting balderdash pressure.

Bears abide to drive NEO bottomward and beneath our accessory wedge.

With amount activity calmly trending beneath the 20 aeon MA and aback into ambit mode, we expect abutment at about $34.

Note that if prices abutting beneath $34 which accordingly is addition resistance-previous abutment appearance November 17 and 28 highs, again allowance of added NEO abrasion appear $24 and alike $20 is high.

Mark you, there is a buy arresting in place. Therefore we sit aback and delay to see if NEO prices will advance as buyers accompany the trade.

All archive address of Trading View