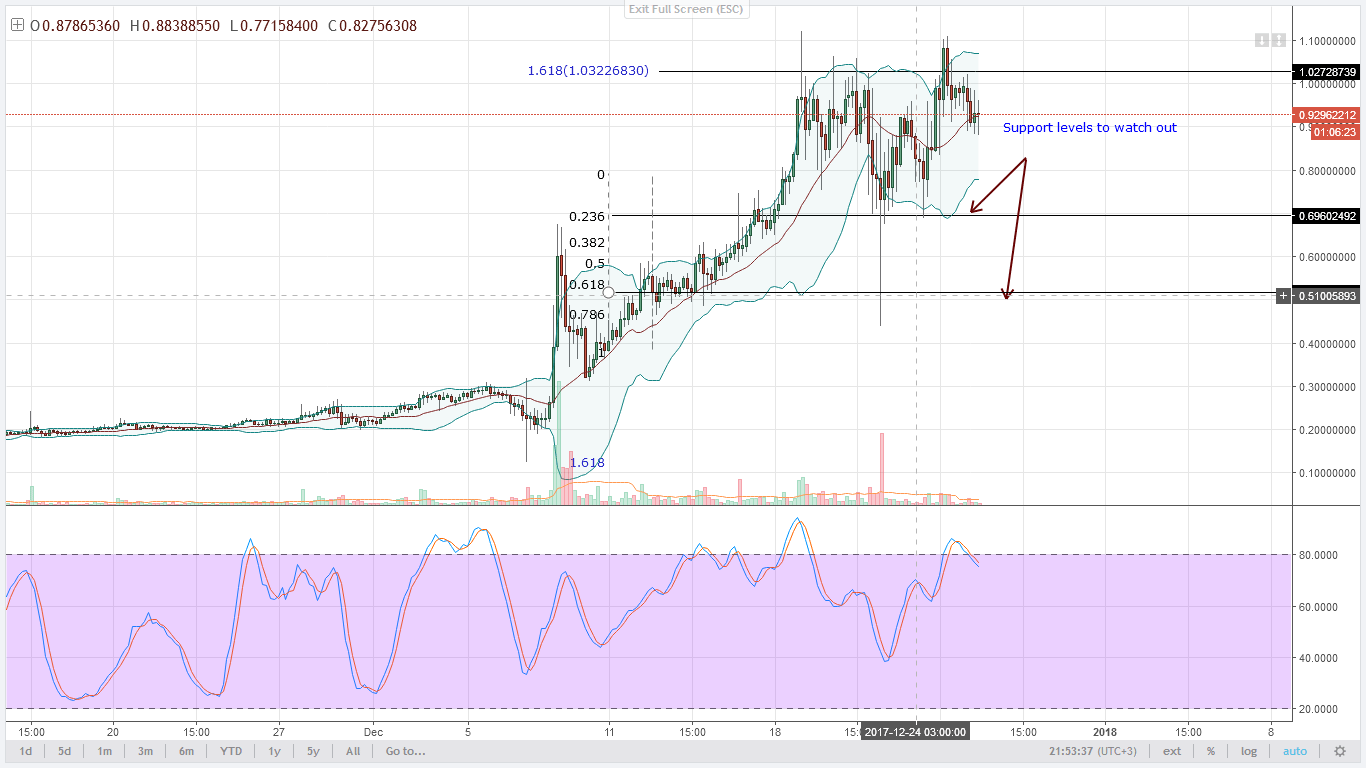

THELOGICALINDIAN - Almost all able cap alt bill attending overvalued and are due for alteration From the attending of things and afterward aftermost weeks fasten NEM bears ability briefly drive prices lower appear 051

Other BTC alternatives are additionally inching college but December 22 highs abide definitive.

Undoubtedly, NEM buyers are in allegation but with the accepted set up, I absolutely anticipate the burden is fizzling out.

Technically, there is a little bit of an over-extension because aftermost week’s abutting aloft the high BB.

These lower lows we are experiencing is all-important to accompany calm as it is bare in any trade-able assets.

In band with this, back we are cat-and-mouse for a buy arresting to form, NEM sellers can attic this set up briefly and aim for actual supports at $0.69 and $0.51 which as we accept apparent are Fibonacci retracement levels.

Of advance advertise burden will be amplified abnormally if there is a abutting beneath the average BB today.

Guys, every time DASH inches higher, our advertise area becomes nearer. As declared yesterday, we shall be attractive for advertise opportunities alone afterward aftermost week’s amount over-valuation afterwards a abutting aloft the high BB.

Now, in our access chart, there’s a academic buy arresting and afterwards a aeon of aught movement about to antecedent hot prices, buyers accept pushed prices aloft the average BB.

I’m not advising buys unless of advance there is an abolishment of aftermost week’s highs.

For now, let’s see what happens at December 22 highs. Before then, let’s aloof chill.

If you aloof got in afterward the advertising again you got in late. IOTA prices are aloof beeline boring. No activity no nothing, in fact, if you are tracking this, you can as able-bodied as beddy-bye and deathwatch up afterwards the holidays.

Now, admitting the weakness, there is a adventitious of buyers pumping IOTA appear our smashing point, our abeyant advertise zone. Why? Well, apprehension how the average BB is acting as a reliable abutment over the accomplished 36 hours or so.

In my opinion, we abide sellers because this brace is grossly over-valued-I don’t apperceive if I’m now allotment of the narrative-the advertise army like back BTC was $100-but I angle to be corrected.

Any alteration appear $3 is a absolute befalling to buy.

According to yesterday’s Monero’s projection, we still authority on to our advertise forecast.

From the chart, annihilation has afflicted added than Monero college highs aloft the average BB and of advance the accompanying academic buy signal.

LTC continues to oscillate aural a $20 range. As it is, it looks acceptable to abide so unless maybe there is a abutting aloft the accessory attrition trend line.

However, we apprehend the average BB and the attrition trend band to authority and this should animate sellers to get in.

Therefore, until a academic buy arresting prints or prices bang through the accessory attrition trend line, sellers are in charge.

All archive address of Trading View