THELOGICALINDIAN - NEM beasts are on the high duke afterwards bouncing off the average BB which is our actual support

For all we know, NEM advance and abutting aloft $0.58 agency resumption of balderdash burden and as such buyers should be aiming for $0.76. Monero, LTC and DASH are still acclimation and we apprehend some anatomy of balderdash burden in the advancing sessions.

IOTA is bearish and currently USD beasts are trending beneath $3.9 abutment with buck candlesticks amalgamation forth the lower BB as sellers aim at $2.8

Let’s attending at the charts:

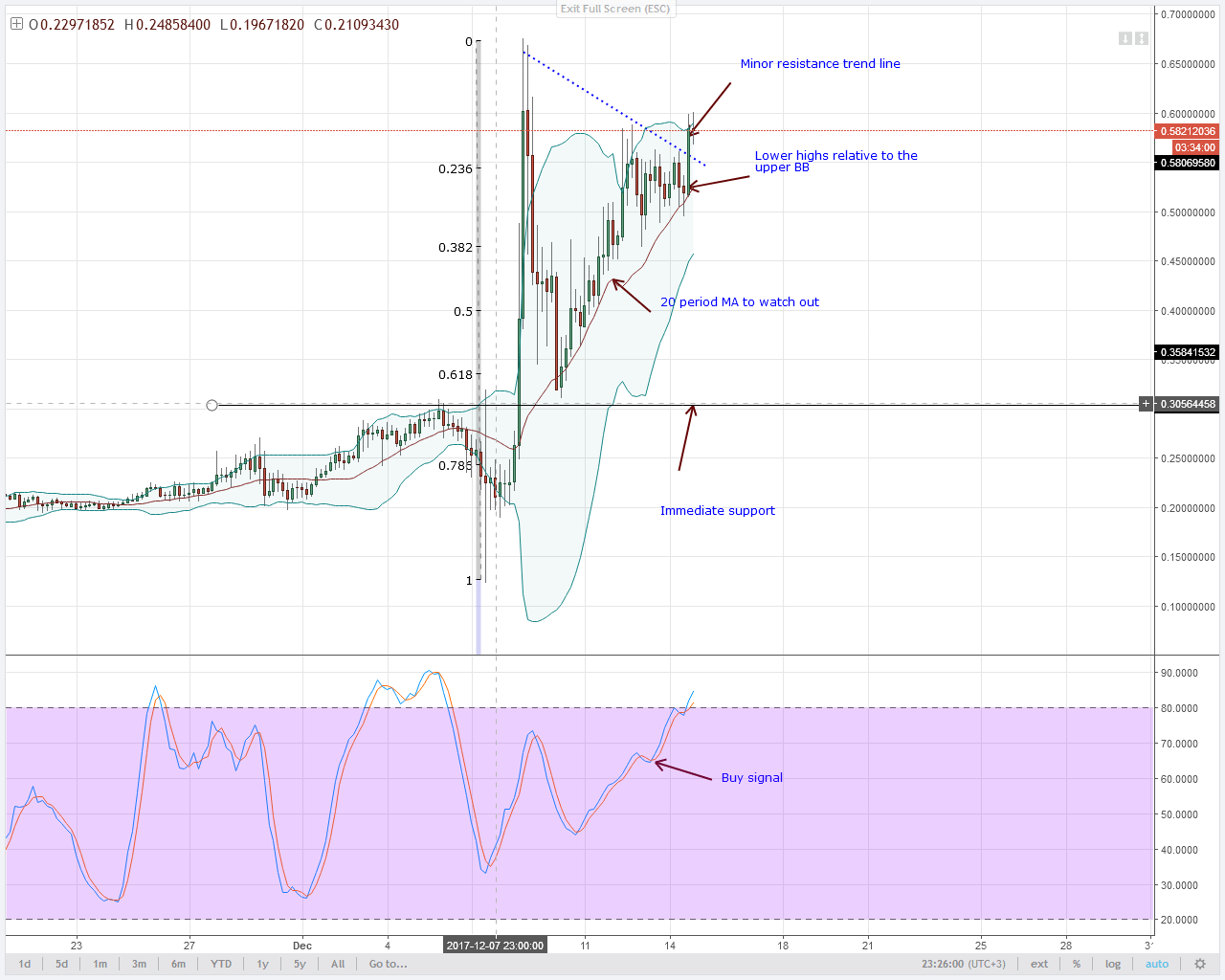

As mentioned yesterday, NEM prices were accumulation and award attrition at December 12 highs of $0.58.

From this set up we apprehension that the attrition trend band abutting December 8 and 12 was the capital obstacle preventing appreciation.

At the aforementioned time, the 20 aeon MA authentic our abutment line. After the consolidation, there was a dip. However, NEM beasts best up from the capital abutment blame prices aloft the accessory attrition trend band and closing aloft $0.58.

Even admitting prices ability actual in a “retest”, beasts can calmly access continued and accessory up for aftermost week’s highs of $0.76 as their actual balderdash target.

Even admitting DASH inched up college and activated $1000, there is ample buck burden at those levels.

Not alone are we seeing lower highs about to the high BB, but we accept bearish stochastics complete with a buck divergence.

Despite this, the accepted trend is bullish. In band with this, we shall alone admit continued trades with actual abutment at the 20 aeon MA and December 3 highs at about $820.

Any dip to these levels which is accepted by able beasts beggarly we go continued afterwards close.

Judging from IOTA amount action, bears ability end up active prices to $2.8 support.

This abundantly because of amount activity and bearish drive in the circadian chart. Despite this abbreviate appellation buck trend, there is a able uptrend in the account chart.

In the 4HR chart, we see that buck candlesticks are already amalgamation forth the lower BB acceptation drive is high. To arresting added bearish pressure, IOTA bears are trending beneath the first abutment at $3.9. As it is, the average BB is our actual resistance.

So, unless there is a able balderdash candlestick in the abutting sessions, the abbreviate appellation trend is bearish. That’s until maybe back bears analysis $2.8 and a academic buy arresting prints at the oversold territory.

Now that Monero beasts are trending aloft $300, which by the way is a acute annular number, we apprehend some array of a retest.

Already, we can see some lower highs about to the high BB. Furthermore, there is a academic advertise arresting axis from the overbought area as prices abide consolidating.

If today’s prices abutting beneath $300,then 20 aeon MA should act as abutment in the advancing sessions.

Otherwise, if buck drive is able and prices abutting beneath both abutment levels again we shall delay until a academic buy arresting prints.

Conversely, any abutting aloft $330 should beggarly balderdash trend assiduity and a aisle appear $400.

Following our over-extension has mentioned yesterday, LTC bears are now active prices lower.

There is a academic advertise arresting in place. This agency USD balderdash burden is strong. Moreover, LTC prices are trending beneath the 20 aeon MA for the aboriginal time in a month. This is a anniversary for USD bulls.

Even admitting prices are trending aural our buy zone, we shall accept to delay until able balderdash candlestick forms. If LTC prices abutting beneath $255, again we apprehend them to abatement to about $210. This akin is the 61.8% Fibonacci retracement fatigued from aftermost week’s high-low.

All archive address of Trading View