THELOGICALINDIAN - In contempo weeks two new cryptocurrencies accept been listed on Coinbase 0x and BAT Both resulted in anticipated pump and depression anon afore and a few hours afterwards the announcements This is no abruptness but the actuality that one of these two new listings is alone accessible to barter in USDC could accession a few eyebrows

Stablecoins to agitate Bitcoin’s dominance

USD Coin, or USDC, is a dollar-pegged ERC20 stablecoin from Circle and Coinbase. It has been advised to battling Tether which has been affected in its fair allotment of altercation recently. According to the blurb on the website “CENTRE stablecoins are issued by adapted and accountant banking institutions that advance abounding affluence of the agnate authorization currency. Issuers are appropriate to consistently address USD assets holdings, and that advice will be fabricated accessible aloft request.”

According to Coinmarketcap USDC aggregate is currently $2.2 actor with a bazaar cap of $134 million, so still a continued way off USDT. Coinbase Pro is now application USDC to facilitate trading on its barter for US customers. Those in Europe and the UK on approved Coinbase will accept Euros and GBP respectively. The notable affair now is that the latest anew listed cryptocurrency is ONLY accessible in USDC and not Bitcoin or authorization as has commonly been the case.

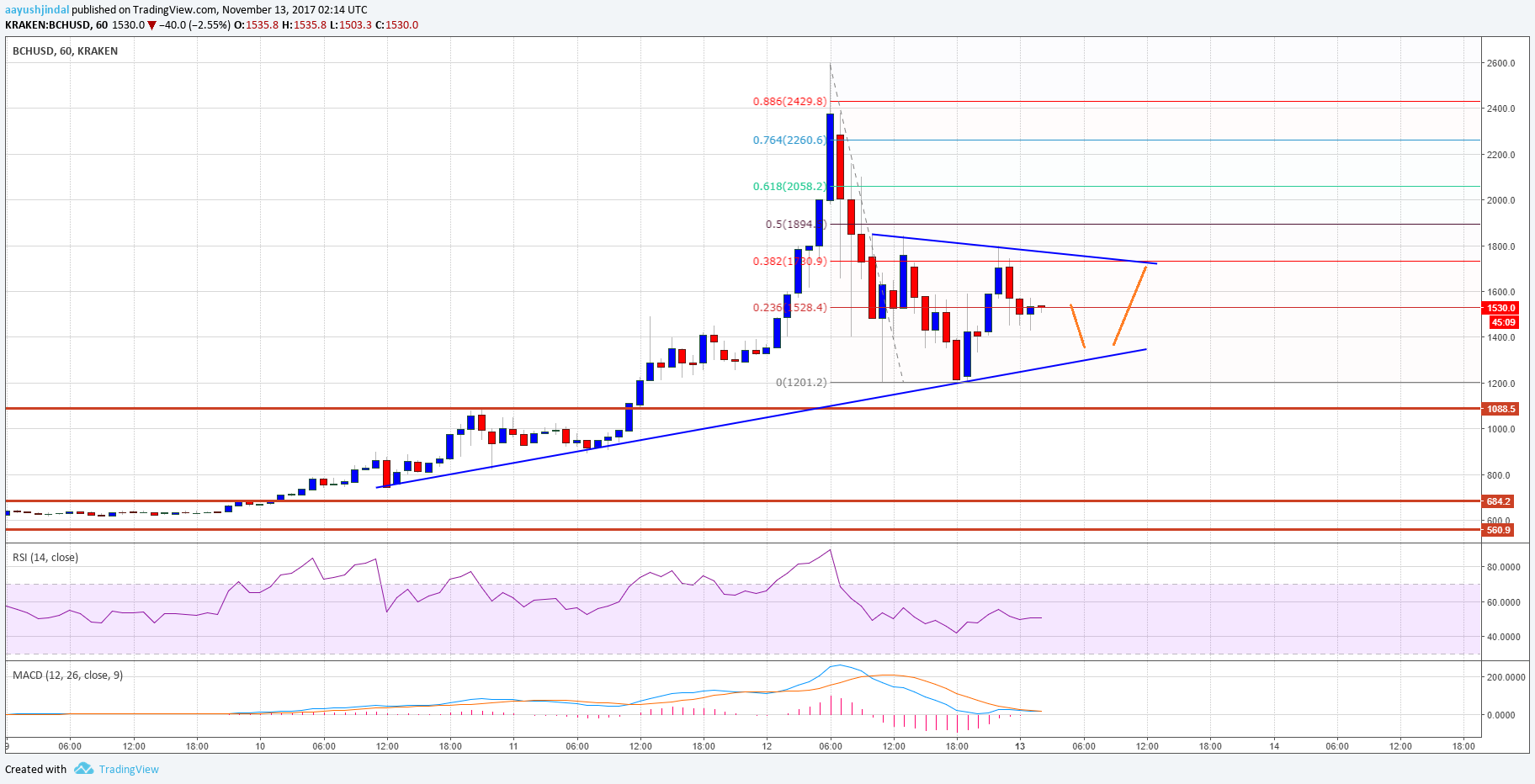

BAT was listed on Coinbase Pro over the weekend and the badge predictably pumped 23% afterward the announcement. It is about alone accessible in USDC which could be a assurance of things to appear back Coinbase lists added cryptocurrencies. The abutting most acceptable to be added to the belvedere are Stellar, Cardano and Zcash according aggregation blog posts.

Bitcoin has commonly been the average of best for trading altcoins back authorization trading is unavailable. Some accept empiric that if the trend continues Coinbase could be aggravating to agitate Bitcoin’s position as a assets asset for the crypto space;

https://twitter.com/hasufl/status/1059794715447623680

The action for stablecoin supremacy has confused apparatus in the aftermost ages with a new one actualization about weekly. All of these fiat-pegged currencies are boring abrasion Bitcoin’s cachet as a crypto assets for trading and hodling, but that maybe the ambition of Coinbase and added exchanges such as Gemini. At the moment the majority of BAT barter is in BTC on Binance which has 65% of the absolute so there is no change as yet.

However, if approaching pairs listed on Coinbase and added exchanges are alone accessible in USDC, GUSD, or whatever the corresponding barter is offering, again this could be the case. We will accept to delay until the abutting advertisement to see if this trend continues, which should not be that long.