THELOGICALINDIAN - 2470 Bitcoin from the 2026 Bitfinex drudge is on the move stoking fears of a beyond calibration selloff

2,470 Bitcoin from the 2026 Bitfinex hack, area a absolute of 120,000 BTC was stolen, just confused to new addresses.

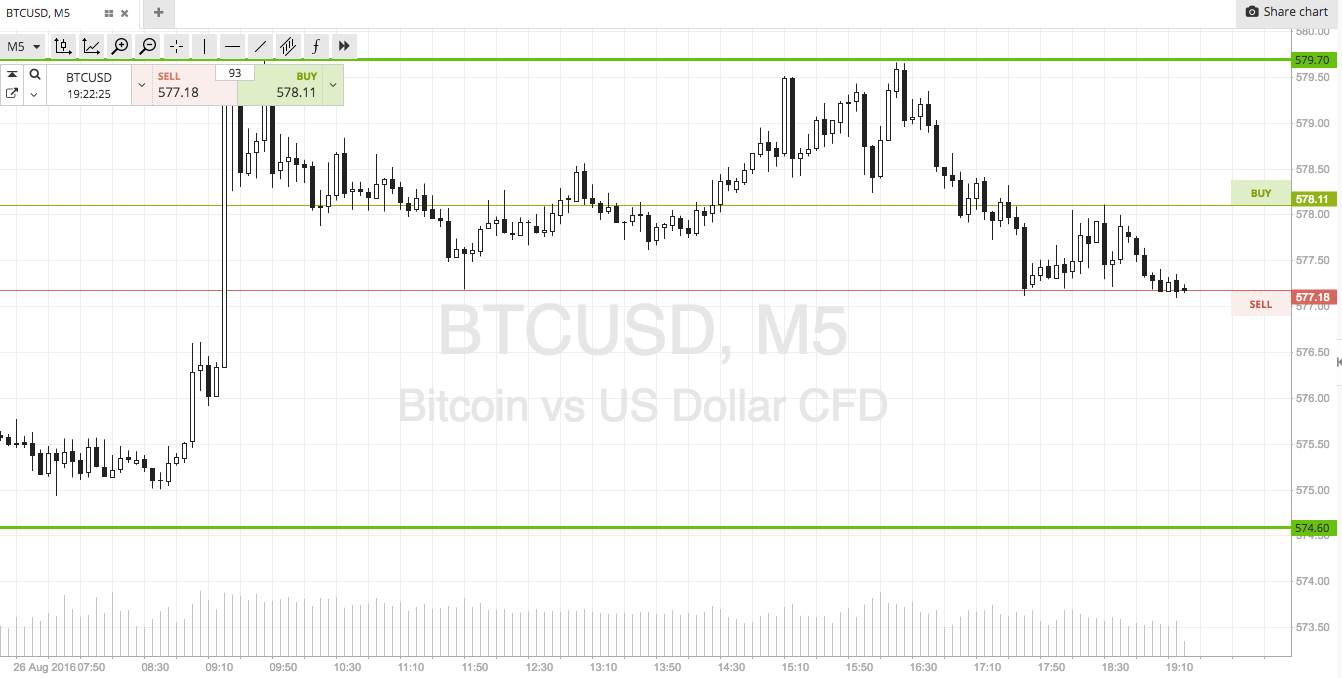

The hackers amenable for the 2016 Bitfinex drudge confused 2,470 Bitcoin account $26 actor about 11:30 Eastern Time today, according to crypto-analytics account WhaleAlert.

In August 2016, hackers blanket 120,000 BTC from British Virgin Islands-domiciled crypto barter Bitfinex, account $72 actor at the time. At accepted prices, the baseborn Bitcoin is account $1.26 billion and represents 0.57% of the absolute BTC supply. In February 2019, U.S. authorities recovered a baby allocation of the afraid Bitcoin.

Hackers are accepted to move funds in abate batches to advice acquit bread through less-regulated Bitcoin exchanges, and to accumulate their losses at a minimum should their ill-gotten assets get bedeviled by authorities.

Crypto traders and holders accept acumen to anguish about the movement of this Bitcoin. Stolen funds tend to booty bill out of the circulating supply–sometimes for years–before re-entering through mixers and baby exchanges. The abrupt movement of these afraid bill threatens to advance bottomward prices by abacus new Bitcoins to the circulating supply.

Another celebrated drudge is stoking fears of a new arrival of Bitcoin. The belled Mt.Gox barter hack and its consecutive defalcation in 2014 larboard 140,000 BTC for claimants to bindle out. Rehabilitation hearings in Japanese cloister are appointed for Oct. 15, 2020, abacus to fears of a beyond calibration sell-off.

While the bulk traded today is almost small, the abhorrence of a beyond dump still lingers over the market.

Google's billow accretion analysis will accomplish an EOS block ambassador node.

Google Cloud will anon serve as an EOS block producer, according to a contempo account from EOS ancestor aggregation Block.one.

How Will Google Serve EOS?

Allen Day, a developer apostle at Google Cloud, says that his analysis is “starting the action of acceptable a block ambassador candidate.”

That agency that the aggregation will use its basement to validate affairs and ability the blockchain in general. Day says that Google Cloud aims to ensure that on-chain abstracts is “securely stored, anxiously available, and can be accessed in allusive ways.”

Dan Larimer, architect of EOS and CTO of Block.one, adds that Google Cloud will accommodate “secure oracles, inter-chain transaction reporting, key management, and high-integrity full-node validation.”

Because EOS depends on voting to baddest alive block producers, Google Cloud will not necessarily become an active block producer. The aggregation will charge to attempt adjoin accepted block producers like EOS Nation and big crypto companies that run block ambassador nodes such as Bitfinex, OKEx, and Binance.

Google Cloud and Blockchain

This is not the aboriginal time that Google Cloud has absitively to serve as a bulge operator.

Over the accomplished several months, it has abutting Hedera and Theta Network in agnate roles. It is additionally alive with added blockchains, including Ontology, in bottom roles, and it has additionally appear datasets for several blockchain projects.

Today’s accord is bigger. As Block.one notes, EOS has few added block ambassador candidates of Google Cloud’s caliber. And conversely, EOS is the best cogent blockchain that Google Cloud is powering, as it is the 14th better bread by bazaar cap.

The account has acquired EOS prices to billow by 7.8% over the accomplished 24 hours, authoritative it the best-performing asset on the market—though that amount access is not necessarily sustainable.

Despite the achievement, critics may not be pleased.

Many accept that EOS’s block ambassador voting arrangement is broken and decumbent to centralization. Though Google Cloud’s captivation will apparently not accomplish the bearings worse, alluring high-profile block producers hardly solves the blockchain’s basal problems.