THELOGICALINDIAN - n-a

The temperatures may be aloof alpha to drop, but cryptocurrencies accept been ashore in winter for what seems an ice age. For months blockchain leaders accept insisted that the bead in bazaar amount has not afflicted projects abnormally and if anything, has aloof accustomed developers a adventitious to focus on building.

The absoluteness is, however, that $700 billion has been baldheaded off the amount of the bazaar and the crypto recession has taken its assessment on abounding arch projects, the affirmation of which is now acceptable apparent.

If there was any catechism about the appulse of the buck bazaar on the space, it was answered back Ethereum startup incubator ConsenSys appear an check of its business in a action about-face that’s been branded as ConsenSys 2.0. If amount wasn’t the motivator, again conceivably it’s a assurance of a crumbling industry.

“Certainly we are seeing some conflation with the bazaar and continued appellation success of ConsenSys,” a spokesman for the aggregation told Crypto Briefing. “We don’t see it that way.”

Nonetheless, the restructuring reaches beyond the ConsenSys Brooklyn address and will additionally appulse the several dozen projects, or spokes, that the company’s adventure arm has been supporting. But the agent credibility out that admitting the changes, ConsenSys hasn’t chock-full abetment projects, as apparent by its contempo advance in “AZTEC, a agreement for privacy-preserving affairs on the Ethereum mainnet.”

Crypto Recession: ConsenSys Is Becoming Leaner and Meaner

ConsenSys Founder Joseph Lubin bound a letter to agents analogue the overhaul, which includes transforming ConsenSys Labs, the adventure basic arm that supports Ethereum projects, to resemble a “traditional startup accelerator,” according to Breaker.

Spokes that got by on their abeyant will now accept to appearance added substance. This time around, ConsenSys will appraise projects application on a leash of added assessable metrics beyond revenue/ROI, “benefit to Ethereum” and amusing good, the closing of which has been the action cry of blockchain pioneers.

“We’re activity to get a lot added accurate in agreement of milestones and timetables,” Lubin reportedly said, abacus that projects could be “dissolved,” and layoffs are possible.

Some of the safe bets are those that accept been the most successful, such as MetaMask and Truffle, anniversary of which boasts added than 1 actor downloads, in accession to blockchain startup Adhara, which is advancing zero-knowledge proofs and which aloof completed a $2.1 actor allotment annular led by ConsenSys. And it’s accessible to accumulate in apperception that the ConsenSys ecosystem boasts added than 400,000 developers.

Some of the beneath acknowledged projects, however, could face a approaching after the business muscle, technology and banking abetment that ConsenSys brings to bear, not to acknowledgment the brotherhood that is alloyed into the bolt of the Ethereum startup incubator.

Among the projects that could be adverse the chopping block:

While ConsenSys layoffs could be a byproduct of the restructuring, added projects accept beneath of a war chest to accumulate them afloat during the crypto recession. Steemit, a decentralized belvedere for blogging, has gone into adaptation approach and is reportedly slashing its workforce by about three-quarters amid “the weakness of the cryptocurrency market, the authorization allotment on our automatic affairs of STEEM diminishing, and the growing costs of active abounding Steem nodes,” the aggregation said, according to TechCrunch.

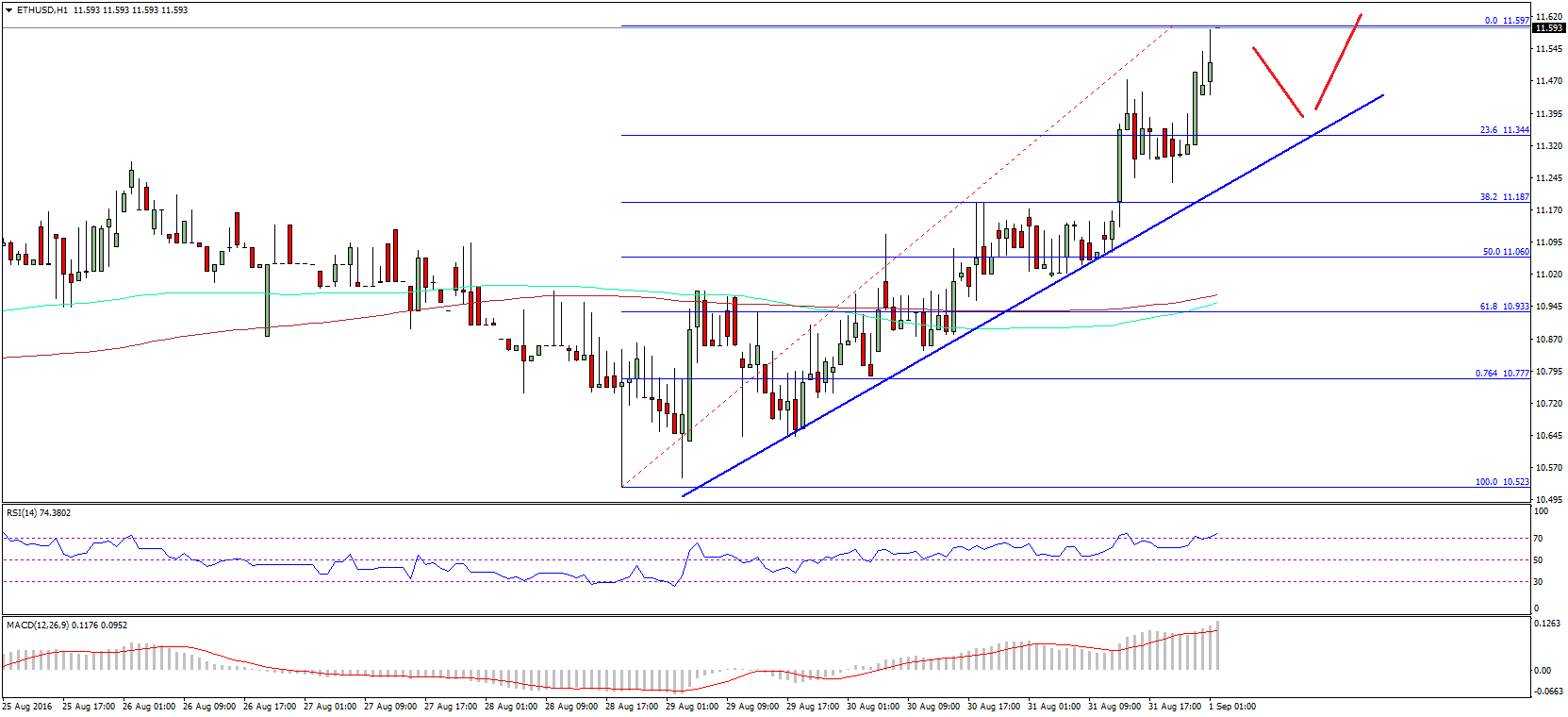

Meanwhile, the weakness in cryptocurrency prices has ETH aerial abreast the $100 level. While Lubin isn’t bedeviled on price, he has appropriate before that if the amount alone to $1 it would be a assurance that there’s a problem. Let’s achievement it doesn’t appear to that.

And while investments may accept shifted, they haven’t appear to a standstill. There are added in the pipeline, and James Beck, ConsenSys’ arch of Global PR, tantalizingly hinted to Crypto Briefing: “Next week, we will advertise an abundantly impactful advance in analytical infrastructure.”

The columnist is currently invested in ETH.