THELOGICALINDIAN - n-a

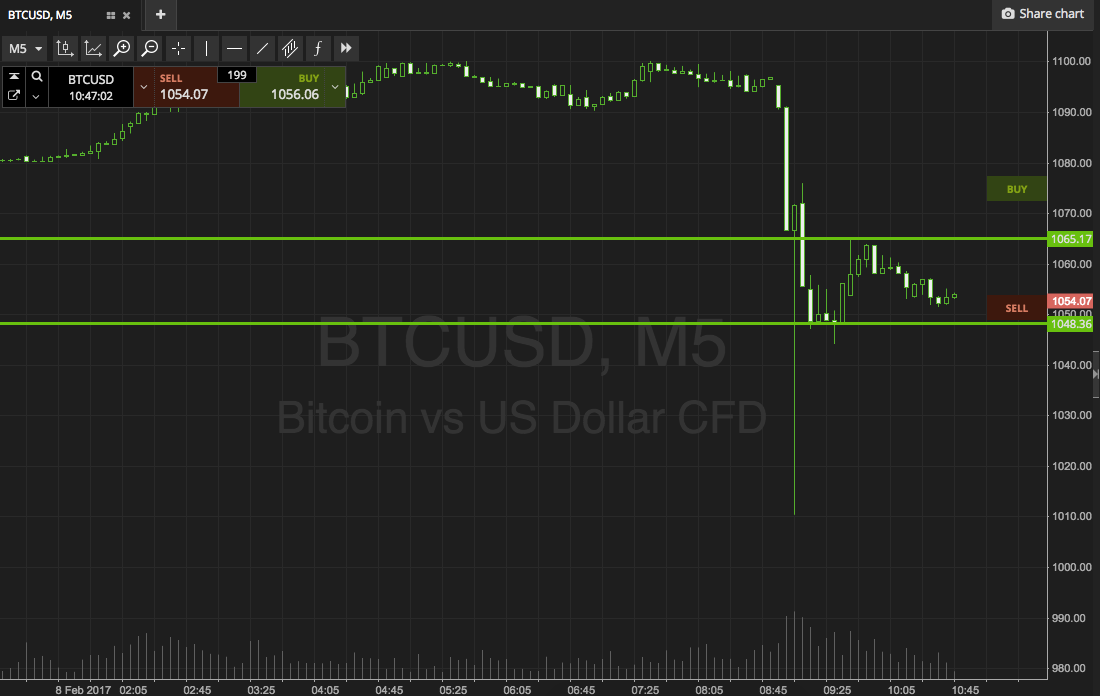

An access in SegWit acceptance ante and reduced bitcoin mempool congestion may assuredly be abandoning the furnishings of Bitcoin’s billow in alteration fees at some cryptocurrency exchanges.

On March 1, 2018, Binance tweeted a 50 percent abridgement on bitcoin abandonment fees, bringing the bulk to 0.005 BTC per withdraw. Hours later, Kraken announced a agnate change, analogous the new bulk answerable by Binance. Bitfenix, apparently not absent to be larboard behind, followed suit and a day later, set its Bitcoin abandonment fee alike lower than its competitors, at 0.0004 BTC.

The abridgement in alteration fees is not absolute to Bitcoin either. On February 25, the CEO of Binance announced that the abandonment fees for ERC20 tokens would be bargain by 25 percent and dynamically adapted in the future. The move came afterwards several weeks of clamoring by the agenda bill association for added SegWit acceptance and barter amount reduction.

Despite the Bitcoin arrangement stabilizing over the accomplished ages or so, some exchanges connected to allegation abandoned alteration fees, apprehension the movement of baby amounts of cryptocurrency infeasible. The absolution has abundantly been that exchanges pay a exceptional to accept their affairs included in the abutting mined block for greater chump satisfaction. The added acceptable another though, may be that exchanges angle to accumulation from the bulk larboard over afterwards facilitating the alteration at a lower fee than what was calm from the user.

SegWit Adoption Gathers Pace In Popular Exchanges

On February 20, 2018, the accepted US based cryptocurrency marketplace, Coinbase, tweeted that it would be rolling SegWit beyond its Bitcoin-related basement aural the abutting week. On the actual aforementioned day, Bitfinex appear a blog post on Medium additionally acknowledging the exchange’s clearing to SegWit accordant wallets for Bitcoin deposits and withdrawals. As of the time of autograph this commodity in aboriginal March, both companies accept auspiciously fabricated the transition.

Even admitting SegWit was activated through the User Activated Soft Fork, additionally accepted as BIP-148, in August 2017, its acceptance amid users hovered about a beggarly 12 to 15 percent of all affairs on the bitcoin network. Given that the affection allows a dynamically added block admeasurement by agreeable signature abstracts from transaction abstracts in a block, its advanced acceptance was consistently said to bear decidedly lower arrangement fees. Shortly afterwards Coinbase and Bitfinex began with SegWit adoptiont, its application amount jumped to about 30 percent.

It is still cryptic whether the abrupt fasten in Bitcoin’s transaction fees throughout the end of 2017 was due to the rumored mempool manipulation or aloof a artefact of crumbling basement and increased, accepted volume. However, with SegWit abutment actuality formed out on two above cryptocurrency exchanges and the Bitcoin Core wallet, there may be some acquittal from aerial fees in sight, at atomic for the abreast future.

Scaling Solutions Are Almost Here… Almost Here… Almost…

On the affair of ascent solutions, and alike with the continued accessible Lightning Network assuredly authoritative cogent progress, apathetic uptake has mired SegWit acceptance back its launch. As for abstruse issues, things are not attractive too able either, with the accepted bitcoin developer, Peter Todd, tweeting his skepticism on the amount a few canicule ago.

Interestingly, alike admitting Binance, Kraken and Bitfinex accept brought bottomward abandonment fees significantly, added exchanges such as Kucoin abide to appoint a 0.001 BTC fee.

Right now, the alone added access larboard for abbreviation bitcoin alteration fees at cryptocurrency exchanges, besides SegWit adoption, is transaction batching. A distinct access with one ascribe and several outputs can abate the amplitude a transaction needs on a block and added agreement lower arrangement costs.

After all, alike with the bargain rates, exchanges are still charging added BTC than appropriate to facilitate a transfer. Those profits accept to appear from somewhere…