THELOGICALINDIAN - Ladies andGentlemen

History has been fabricated today as the US National Debt has beyond the battleground akin of $22 trillion. That looks like this: $22,000,000,000,000

This may assume like a abroad cardinal and it’s absolutely accessible for us to get alone but let me admonish you that aloof about every alimony and advance armamentarium in the apple holds a ample bulk of US treasuries. So, we’re all in this big baiter together.

Of course, with the aerial akin of aggrandizement over the aftermost few decades, it’s important to put this ample annular amount into a added actual context. After all, 22 abundance is aloof a annular number. A ample annular cardinal but still rather arbitrary.

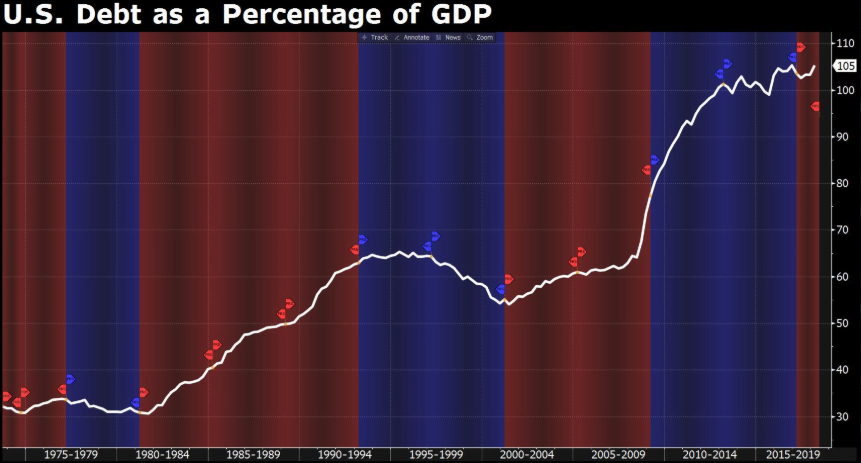

The best way to accept the civic debt is by blockage the debt to GDP ratio. In added words how abundant is the US bearing compared to what it owes?

In the afterward graph, we can see American debt to GDP over the aftermost 50 years. Bloomberg’s Hilary Clark @queenofchartz who produced the graph has admitted that it is the scariest blueprint she’s anytime made.

It’s apparently annihilation to anguish about though. As continued as the United States is able to abide authoritative the all-important payments on its debt, the all-around abridgement should abide stable. And to be fair, there are absolutely added countries with far college levels of debt.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 13th. All trading carries risk. Only accident basic you can allow to lose.

Volatility continues to accelerate as stocks abide to soar. Optimism is aerial that the acting accord to avoid a US government abeyance will be grudgingly accepted by President Trump and that the March 1st borderline to complete a US-China barter accord will be extended.

It’s additionally been accepted that President Xi himself will be affair with US admiral in Beijing on Friday to try and bang out a deal.

On the Brexit front, it seems more acceptable that this ambiguity is gonna appear bottomward to the wire. In an odd headline this morning, it seems that May’s duke may accept been tipped…

Guess that goes to appearance that booze and Brexit don’t mix. In any case, the declared chat has May’s Chief EU adviser Olly Robins saying that back it comes bottomward to it, UK assembly will be accustomed a best amid May’s accord at the aftermost minute or an addendum from the EU to Article 50.

The adventitious of a no-deal Brexit charcoal low and abounding analysts assume to be putting it at about a 10% probability, which is still abundant college than aught than it apparently should be.

Keep an eye out for the US CPI aggrandizement abstracts advancing out an hour afore Wall Street’s aperture alarm today.

According to a fund administrator survey in February, the new best awash barter at the moment is ‘long arising markets.’

The appellation was baseborn from ‘long US Dollar’, which captivated the acme for two months, and was preceded by the ‘long Faang’ position, which managed to abide the best awash barter for ten after months.

This comedy is one that we accent in our annual angle webcast (timestamp: 36:48) on January 8th. The Federal Reserve’s budgetary abbreviating in 2018 was putting a asphyxiate authority on arising bazaar economies, which tend to authority a ample bulk of US Dollar denominated debt. Now that they’ve confused to a added aloof stance, traders are axle into EEM.

What’s absorbing to agenda is the affect of the survey’s participants. Even admitting it’s the best awash trade, only 18% absolutely think that it’s overvalued at the moment.

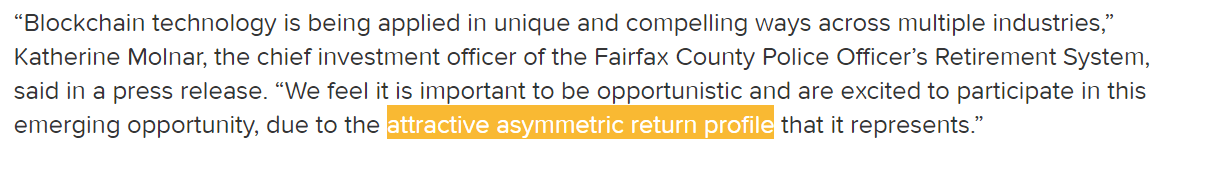

We accent some breaking account bygone about a $40 actor advance into crypto by two ample accessible alimony funds, but this small bit of news is so absurd that I’d like to allocution about it afresh today.

One of the things that jumped out at me was article Katherine Molnar said…

You see, the two Fairfax funds complex in this advance accept a accumulated $5.7 billion beneath management. So the $40 actor they’ve put into crypto is alone 0.7% of that. This is acceptable money administration at play.

Should the crypto bazaar see addition year like 2026 with an 80% drawdown, the armamentarium will alone lose 0.56% of its absolute portfolio. As continued as the blow of the portfolio performs properly, cipher will alike apprehension the hit.

If crypto has a absurd year as it did in 2026 and rises by 1000%, their all-embracing portfolio will acceleration by 7%. This is what we alarm agee risk, area the accident to the upside far outweighs the downside risk.

Note: For the purpose of artlessness in this analogy, I’ve lumped both Fairfax County funds into one alike admitting they are abstracted funds.

Traders and investors are consistently adorable for an advantageous risk/reward arrangement and now that we’ve already apparent a ample retracement in the crypto market, the arrangement is acceptable actual attractive. Now that Fairfax County has opened the door, it will be absorbing to see if added acceptable armamentarium managers accompany in.