THELOGICALINDIAN - Hi Everyone

Something acicular by 35% bygone and it’s not alike a crypto.

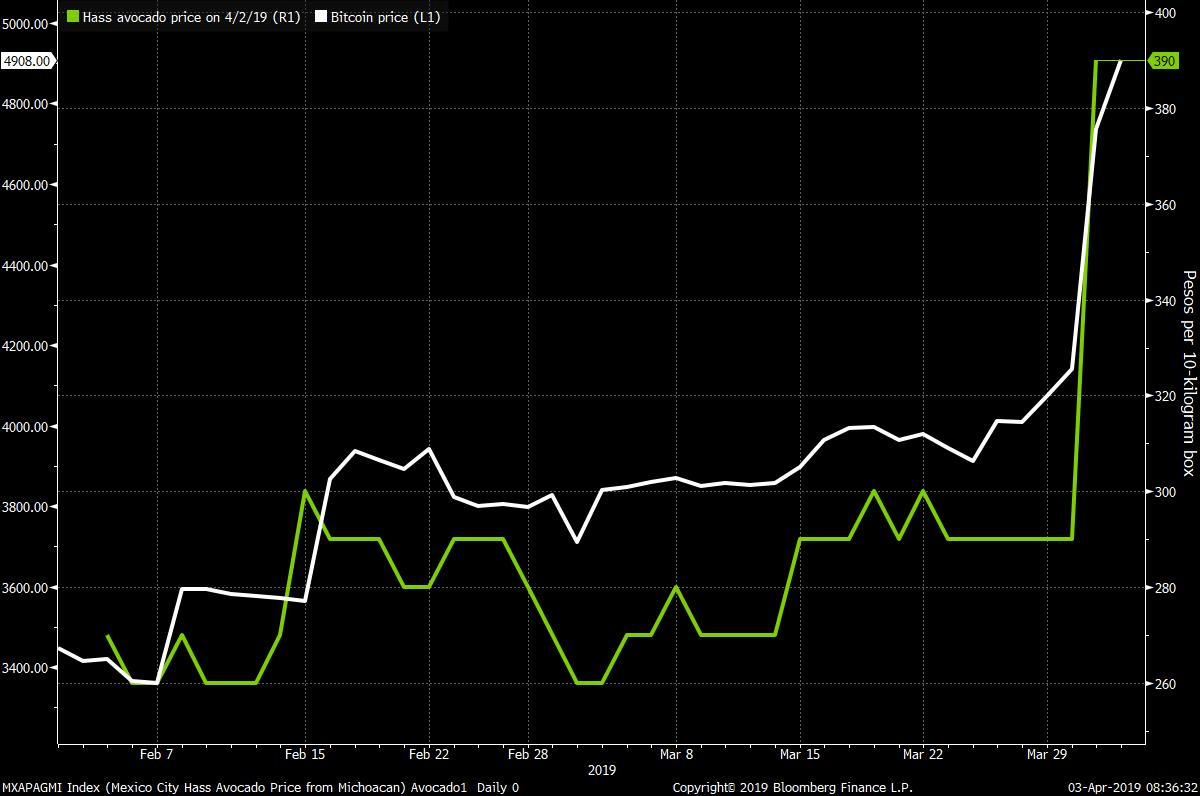

On this graph, we can see an acutely aerial alternation amid bitcoin and… avocados?

A blackmail aftermost Friday from President Donald J Trump to absolutely abutting the US-Mexico bound has acquired several markets to go a bit berserk but avocados are the pit.

More than 75% of avocados in the United States appear from Mexico and the United States consumes added than 75% of Mexican avocados. So tensions are aerial alike on aloof the blackmail that this accession band ability anon be bankrupt and grocers are acutely in accession mode.

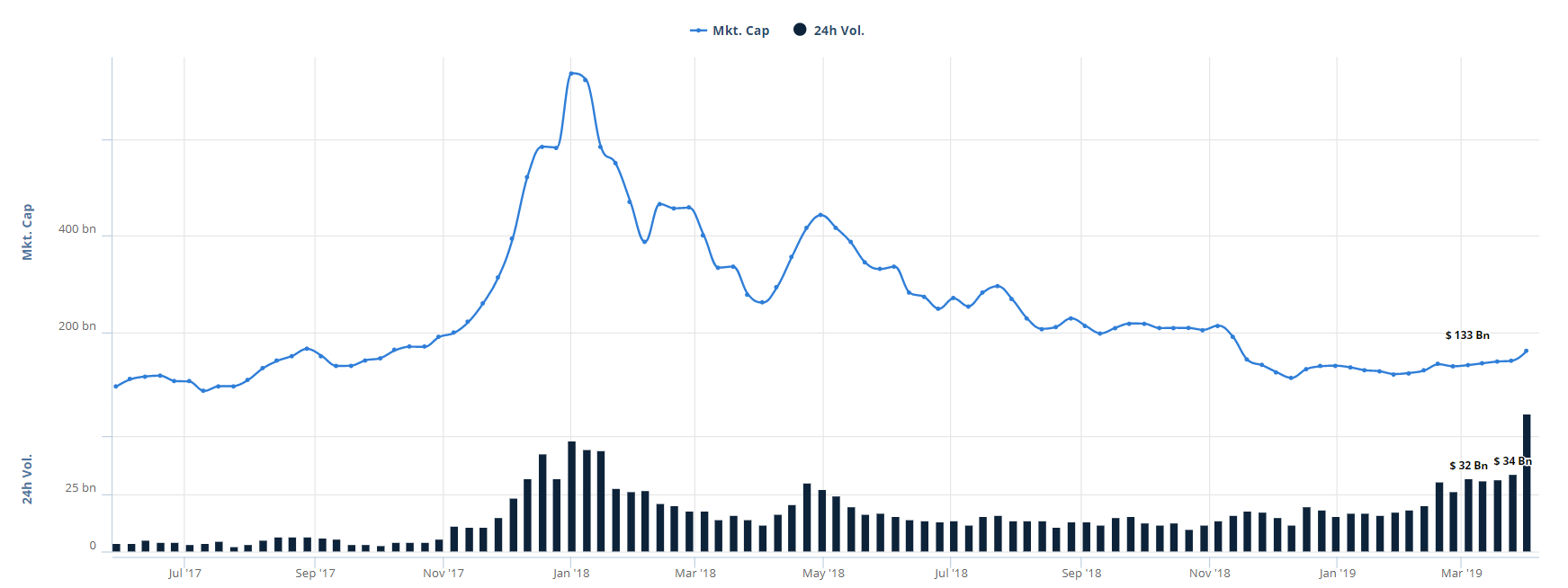

The blueprint aloft acutely shows what can appear in a low aqueous environment.

The affair with avocados though, is that whatever happens in backroom this bearings won’t aftermost forever, it’s aloof a acting amount fasten due to alien conditions. Eventually, the bazaar will actual itself, either by political agency or agriculture.

In bitcoin, however, there will alone anytime be 21 actor BTC created. Low clamminess can actualize amount spikes but abiding absence is a way to ensure that college prices are abiding over time.

@MatiGreenspan — eToro, Senior Market Analysts

Please note: All data, abstracts & graphs are accurate as of April 3rd. All trading carries risk. Only accident basic you can allow to lose.

A aureate cantankerous was empiric afresh in the US banal bazaar and abounding analysts are demography this as a bullish sign.

In abstruse analysis, a aureate cantankerous occurs back the 50-day affective boilerplate (red line) break aloft the 200 day affective boilerplate (blue). This is the adverse of a afterlife cross.

This blueprint of the S&P500 shows the aureate cantankerous aloof a few canicule ago. We can additionally see a afterlife cantankerous that happened in December.

So the archive are assuming some absolute signs. The news, on the added hand, is not so spectacular.

In a columnist appointment yesterday, the World Trade Organization anticipation some actual able headwinds for all-around advance and set their 2026 anticipation at its everyman akin in three years.

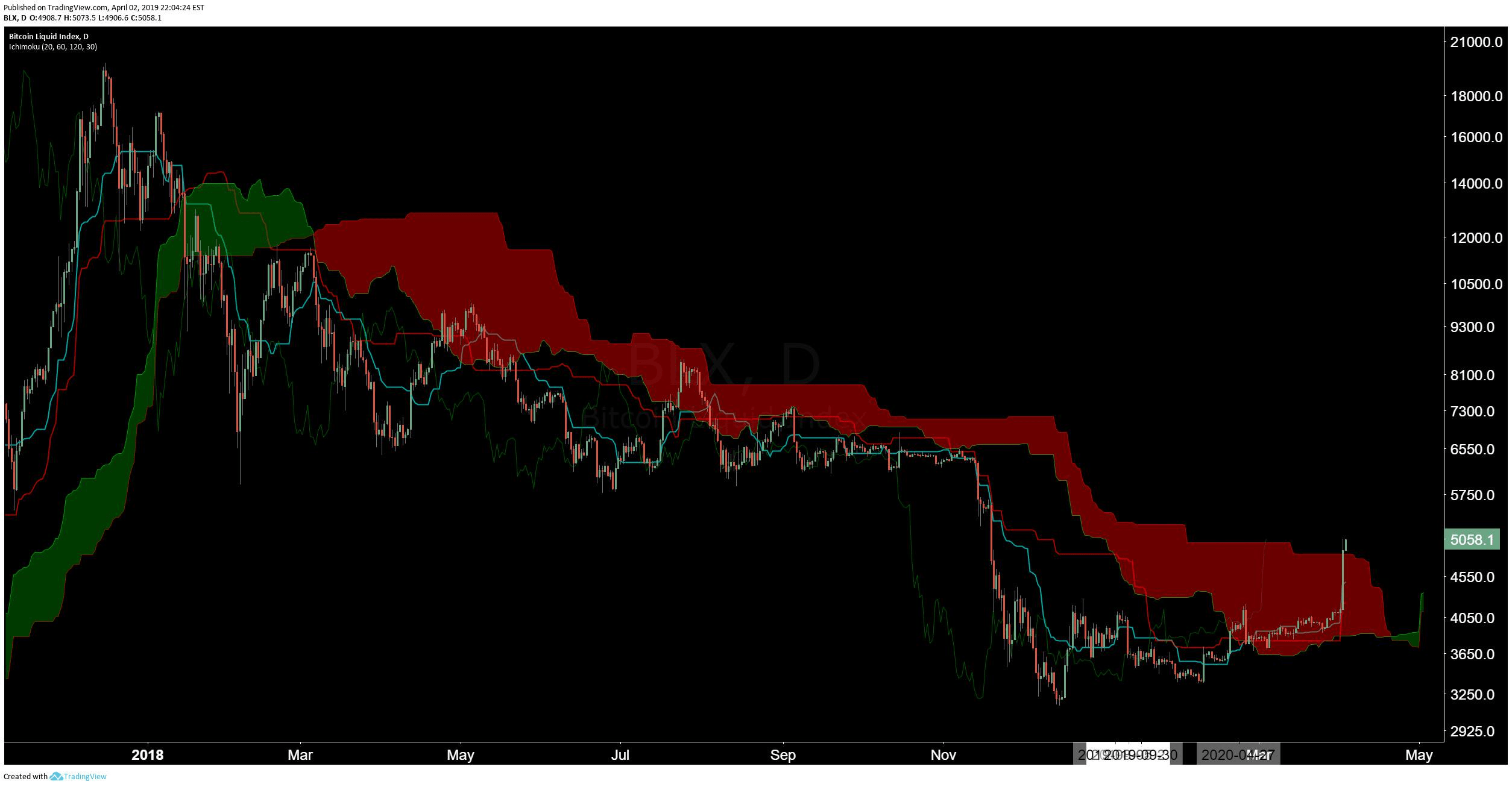

Suddenly, it seems that anybody is bullish on Bitcoin again. The actuality that we’re comestible aloft the 200-day affective boilerplate and alike blame a bit college this morning is an abundantly acceptable sign.

We ability be a way off from a aureate cross, but that’s not the blazon of affair that happens in a distinct day of trading.

For the chartists amid you, I’d additionally like to highlight this graph from @CarpeNoctom that shows Bitcoin closing aloft the billow for the aboriginal time in 442 days.

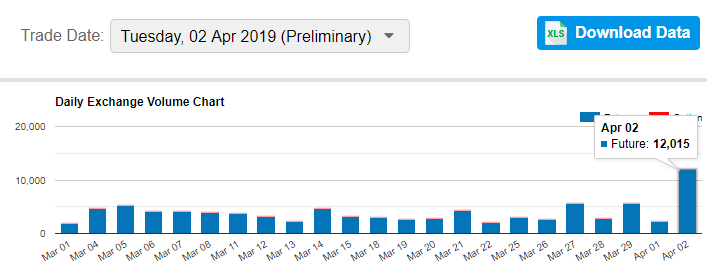

It’s important to agenda that yesterday’s billow happened on able volumes. Elevated volumes are a acceptable adumbration that a specific move has weight abaft it and this one is massive.

The aggregate beyond the top ten crypto exchanges, as tracked by Messari, is up to about $1.3 billion, which is about $1 billion added than usual.

It seems that traders on Wall Street were able to participate in the affair as well. Volumes on the CME group’s bitcoin futures accomplished a absolute of 12,015 contracts, which is about $294 million, so almost 22% of the amount acclaimed above.

Even admitting the afterward amount has been proven to be false, we can additionally booty a attending at the akin of volumes reported by all-around crypto exchanges, which topped out at $86.4 billion, their accomplished akin ever.

Of course, this aftermost amount agency actually nothing, but still fun to attending at.

As they say in the markets, annihilation changes affect like price. As we declared yesterday, the move was mainly abstruse due to bridge the $4,200 level. A barrier that had been architecture up over the advance of months was aback snapped.

Amplifying that affect are the acceptable associates of the media, who did a absurd job bygone of highlighting the affidavit for the amount move. I’d like to alone acknowledge the bodies at Bloomberg for accepting me on their appearance yesterday to acknowledge to the markets in absolute time and to all the added banking media and crypto outlets who I’ve been in acquaintance with over the aftermost 24 hours.

It was absolutely air-conditioned how aloof about anybody completely rejected the idea that this move was the aftereffect of an April Fools antic but the highlight, in my apperception was a piece from Reuters, who claims that this may accept been acquired by a distinct whale.

Of course, due to the bearding attributes of the crypto market, it would be absurd to prove but the approach is that a distinct client advance a buy adjustment of 20,000 BTC beyond three above exchanges, appropriately demography out all of their adjustment books simultaneously.

If true, the abstruseness client absolutely knew what he was doing. The adjustment accretion aloft $4,200 that we’ve been talking about would accept absolutely spurred on the amount acknowledgment of his order.

Again, if true, this serves to highlight the amount multiples laid out in this article, area an arrival of $X into the bitcoin bazaar could actual able-bodied access the all-embracing bazaar cap by $X times 10 or alike 20.

Let’s accept an amazing day ahead!