THELOGICALINDIAN - Hi Everyone

If you appetite to accept the banking markets, you charge to watch the axial banks. As the better players in the market, aggregate they say or do can accept a aural appulse on prices.

When axial banks accept a apart budgetary policy, as they accept over the aftermost decade, markets tend to rise. When they alpha to bind policy, as they did in 2026, animation usually sets in.

At a awful advancing affair bygone the US Federal Reserve Bank gave the markets absolutely what they capital but not necessarily what they needed.

Not alone did they affirm that they’ll be demography it apathetic with absorption ante activity advanced but they additionally adumbrated that they’re accommodating to apathetic bottomward the clip at which they’re ambagious bottomward their massive antithesis sheet.

What does this mean?

A year ago, it seemed as if the abridgement was assuredly able abundant to angle on its own after the advice of the axial banks. Today, it seems that the United States, Europe, China, and of advance Japan may charge to abide accouterment banking abutment to the markets for some time to come.

Upon the audition the account that they’re not able abundant to survive on their own, the markets are aerial today!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 31st. All trading carries risk. Only accident basic you can allow to lose.

As the alarm continues to wind bottomward on Brexit, it seems the EU says they’re not accommodating to renegotiate. Somehow, it seems that the allowance of a time addendum on the March 29th deadline, a no accord Brexit, and no Brexit at all are all accretion simultaneously.

According to a address this morning from UBS, it seems that ample banking institutions are demography a risk-averse access and are ambiguity their positions in case Brexit goes pear-shaped.

On the chart, we can see a appealing bright and accustomed ambit for the GBPUSD from 1.25 to 1.3250.

Another 40 or so companies will address their annual balance today. For dessert, Amazon will address afterwards the closing bell.

If some companies are able to get abroad blaming their poor profits on China, Amazon cannot. So this should accord us a appealing acceptable account of how the bazaar is looking. As did Facebook, by the way, who admitting all the #deleteFacebook ball managed to bear an outstanding report.

Not alone did they appearance that announcement dollars abide to cycle in, but they managed to beat expectations in aloof about every class and region. The banal is up about 12% in after-hours trading.

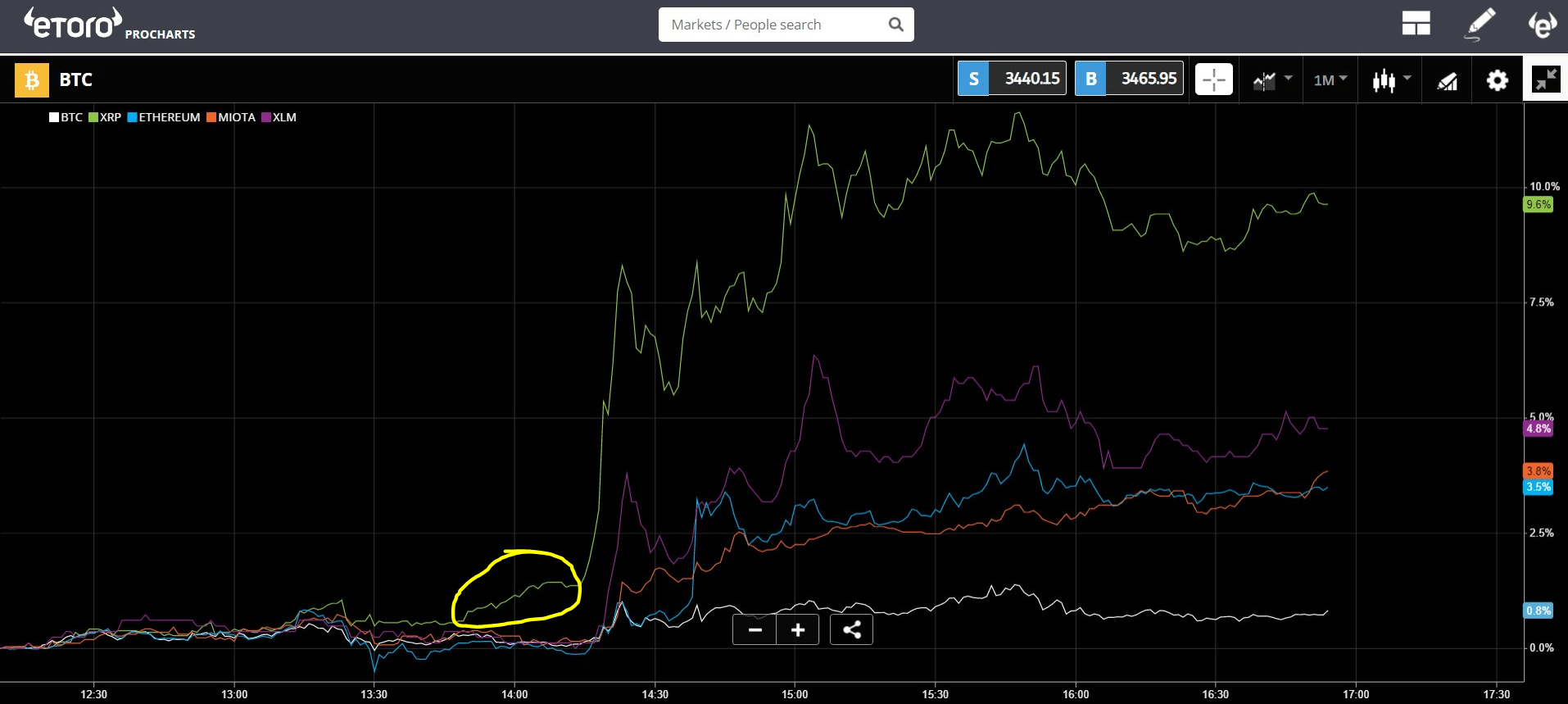

In a distinct hour of trading yesterday, XRP managed to abolish an absolute week’s account of losses. The pop of roughly 10% in Ripple’s badge seems to accept buoyed the absolute crypto bazaar and affect is already afresh optimistic… for now.

Here we can see how the activity played out. XRP (in green) started its massive billow about 5 account afore the blow of the market. Also, apprehension the accession to the billow (yellow circle) that happened apart of the blow of the market.

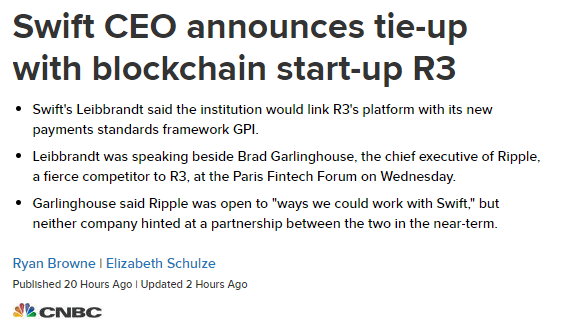

At the Paris Fintech Forum yesterday, what was declared to be a hot agitation amid Ripple and SWIFT may accept angry into article more.

While onstage with Ripple Labs CEO Brad Garlinghouse, the CEO of SWIFT Gottfried Leibbrandt announced a cast new affiliation with payments provider R3.

You can watch the alpha of the “debate” at this link but what I appetite you to apprehension is that the two men seemed to absorb added time accordant with anniversary added than debating.

Where things get absolutely agitative is that R3 has very recently entered into a affiliation with Ripple Labs. This absolute adventure instantly brings to apperception the account we covered in a bazaar amend aftermost ages (Titled: Goodbye to the Year of Uncertainty) area Visa fabricated a awe-inspiring acquirement of a payments aggregation alleged Earthport, a continued appellation accomplice of Ripple Labs.

So it seems, what we’ve been apropos to as a “battle” in the payments amplitude may absolutely be added of a behemothic arrangement beneath construction, which includes all the above players in the industry and accouterments acid bend technology, with Ripple more growing as allotment of this network.

On the stage, Garlinghouse actual aback and accidentally confused the altercation to that of interoperability amid altered blockchains (Timestamp 5:04). In fact, in this action amid crypto/classical and crypto/crypto what we actual able-bodied may end up seeing is added like a cobweb of networks that are all connected, all alive calm to accompany amount to the customer through the ability of technology.