THELOGICALINDIAN - Hi Everyone

Exactly 10 years ago today Satoshi Nakamoto set in motion his plan to actualize a new anatomy of money that is absolute of any government or bank.

The change of bitcoin and blockchain over the aftermost decade has been so arresting that I’m abiding alike Satoshi himself could not accept absurd the appulse of his work.

Happy Birthday, Bitcoin!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 3rd. All trading carries risk. Only accident basic you can allow to lose.

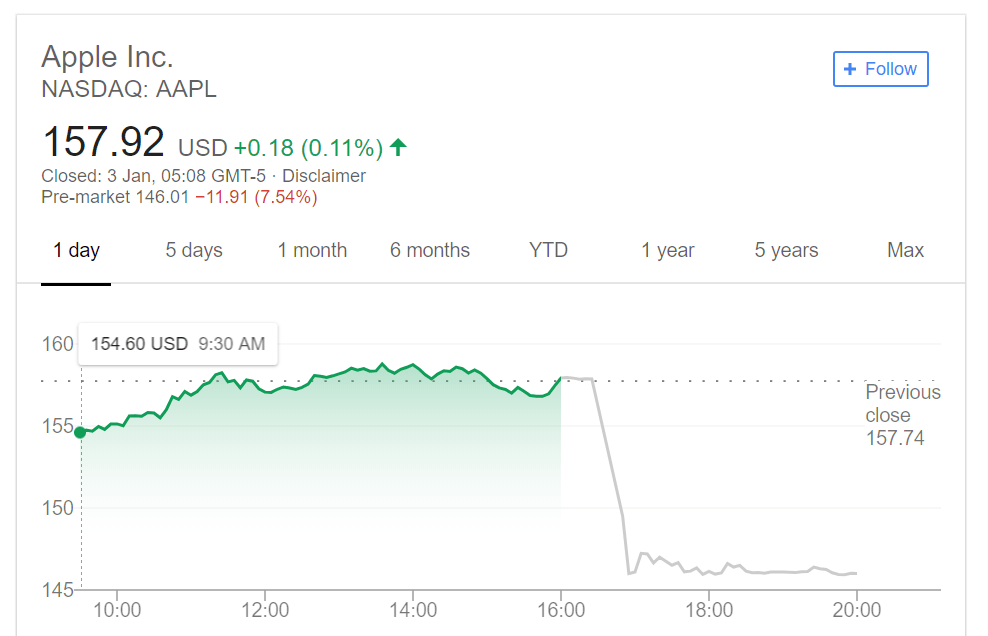

Yesterday afternoon, anon afterwards the markets bankrupt Apple came out with a abominable report.

Shares of the world’s better aggregation fell about 7% in afterhours trading and are accepted to accessible this morning with a huge gap down.

At some level, aloof about every broker in the apple who holds a banal portfolio has some acknowledgment to Apple shares, that includes best pensions and advance portfolios in the world. Apple has already been beneath burden from the tech beating but this new leg bottomward bumps up the severity and added jeopardizes the absolute market.

It’s not aloof stocks that are afflicted by this either. Shortly afterwards Apple’s announcement, there was some actual peculiar activity in the bill market.

The beam blast impacted about all currencies but was acquainted arch in the Japanese Yen. Japan is still bankrupt for the holiday, so the attenuate liquidity, abnormally during the wee hours of the morning back best added countries are sleeping, was additionally said to accept been a activate for this beam crash.

As you’ll recall, the beam blast that happened in the British Pound on October 7th, 2026, additionally happened during the aboriginal morning Japanese affair back volumes are lowest.

Here we can see the ambit of the blast in the USDJPY on three altered time scales.

Also, the additional best afflicted bill seems to be the Turkish Lira. In this blueprint we can see the USDTRY repelling abroad from 200 day affective boilerplate (blue line), that it has been testing for a few weeks.

As the US Government fractional abeyance enters its 13th day, tensions couldn’t be higher. A affair amid President Trump and the Democrats ended actual poorly yesterday, with neither ancillary accommodating to accommodation over the budget.

Today will apparently be added of the aforementioned illiquid flight to assurance markets. but you never apperceive absolutely and a turnaround or alike a flattening is consistently possible.

Tomorrow, we’ll accept the account jobs address from the United States. This oughta be fun.

Gains beyond best of the accepted cryptoassets accept been rather balmy lately. While it’s acceptable to see bitcoin captivation steady, we’re absolutely starting to see a ancillary of the bazaar that is added archetypal during a balderdash run.

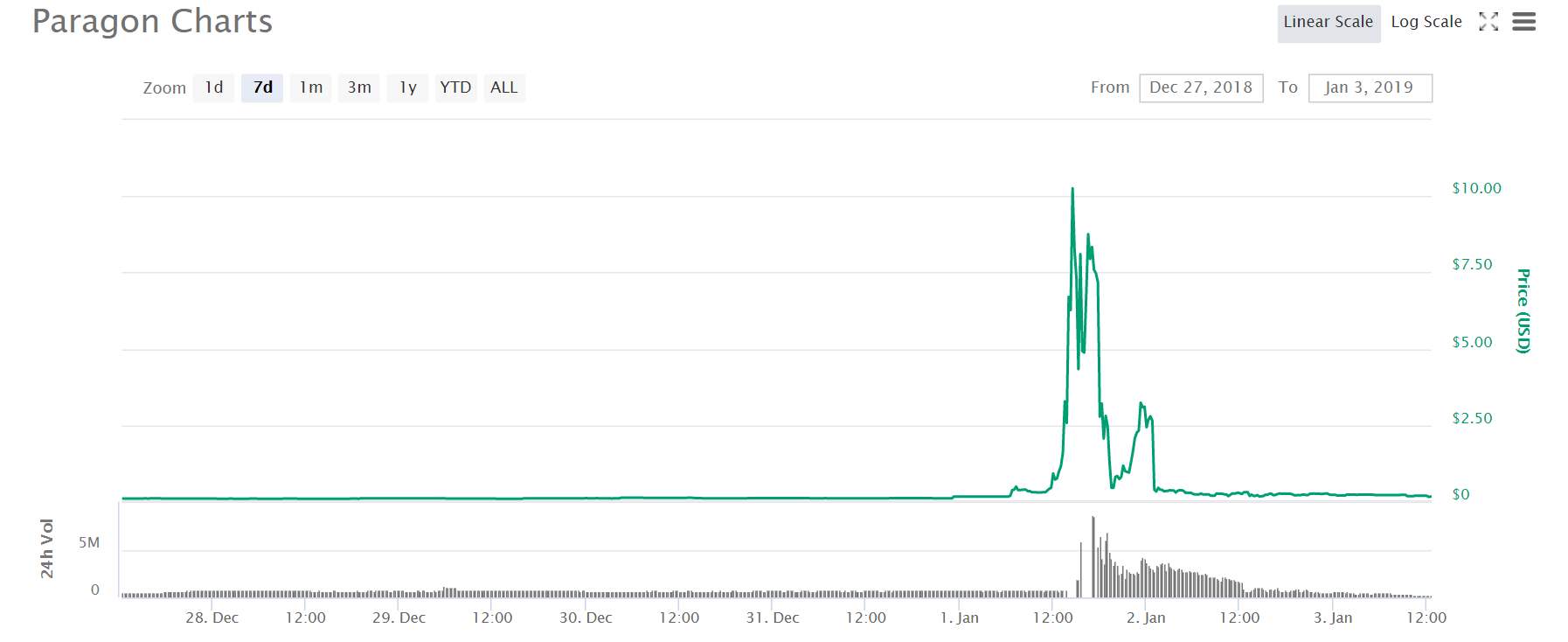

Surges in alt bill are aback accepting added common. Though I can’t absolutely explain what happened to Paragon, a cannabis-related alt coin, that went from 16 cents to added than $10 and aback aural a few hours on Tuesday. This could actual able-bodied be a artefact of an illiquid market, agnate to what we saw above.

However, added austere projects like Ethereum, EOS, and Iota have absolutely apparent acceptable double-digit assets this aftermost week.

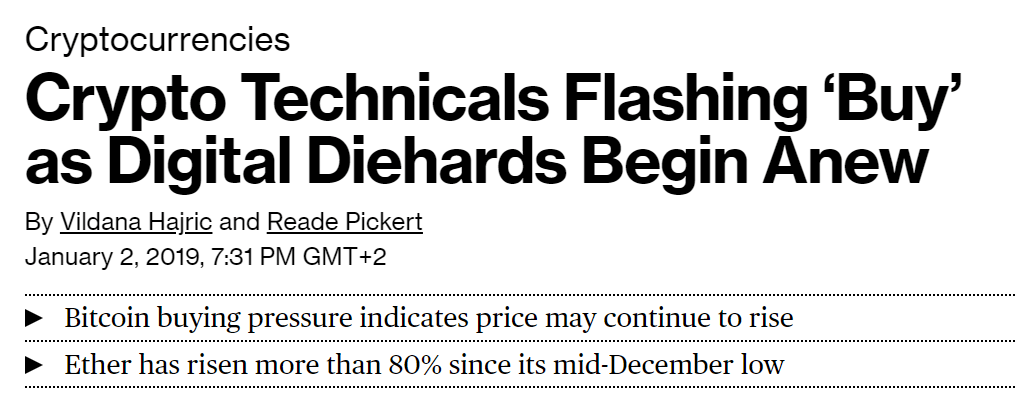

What’s acceptable bright is that there’s a ample abstract amid cryptoasset appraisement and industry growth. My comments to this aftereffect were covered by Bloomberg yesterday, and I’m now because abacus “digital diehard” to my bio.

Kidding aside. We’ve approved to alarm the basal of this bazaar several times now after success, so I’ll assets my predictions on that front. But, what I can say is that crypto has acquired from around annihilation into an absolute beginning industry aural 10 abbreviate years. I can alone brainstorm what the abutting 10 years will bring.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.