THELOGICALINDIAN - Hi Everyone

As bitcoin alcove a new low point for 2026, crypto traders everywhere are attractive for somebody or article to blame. Well, a contempo address that was beatific to me by the association at Cryptocompare may accept stumbled aloft something.

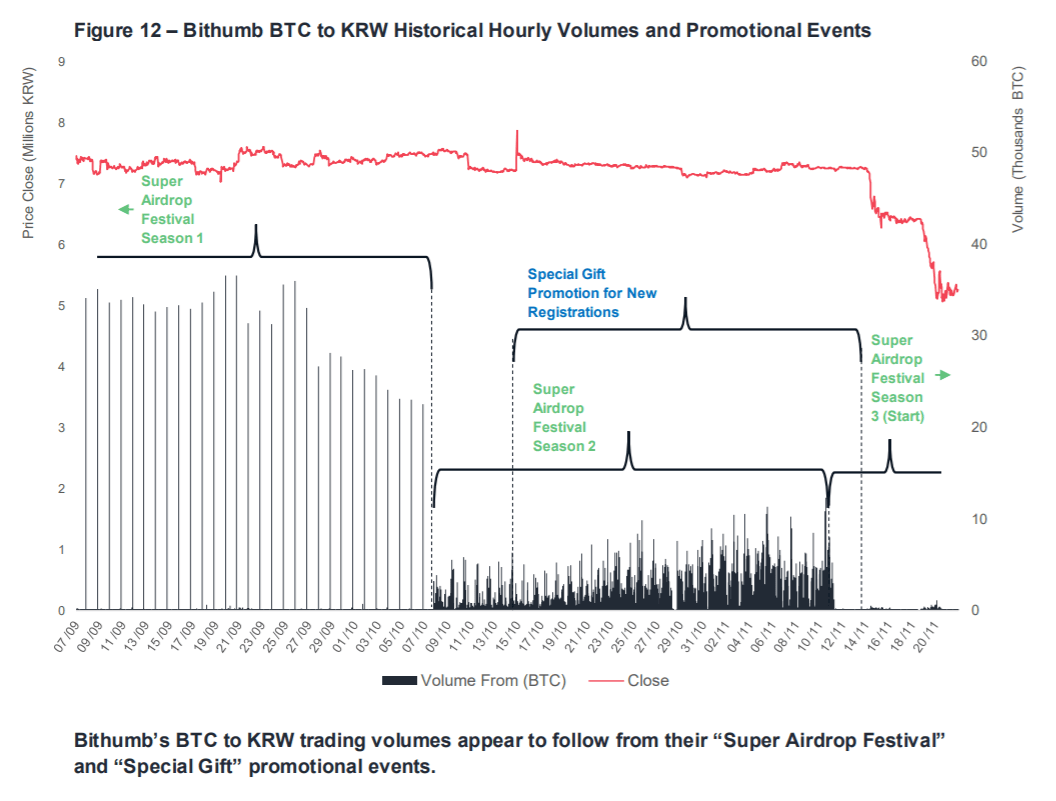

The CCCAGG Exchange Review takes a acceptable adamantine attending at all-around volumes on crypto exchanges and area they’re advancing from. One of the allegation of the address is the absurd appulse of a alternation of promotions from the Korean barter Bithumb.

This blueprint plots out these promotions adjoin bitcoin’s amount and as you can see, bitcoin’s breach beneath $6,000 came anon afterwards the advance ended.

If these allegation are absolutely accurate, I would say that blaming South Korea for the bead wouldn’t absolutely be correct. More likely, it appears that the aggregate advance by Bithumb acquired several months of stabilization in prices, to activate with.

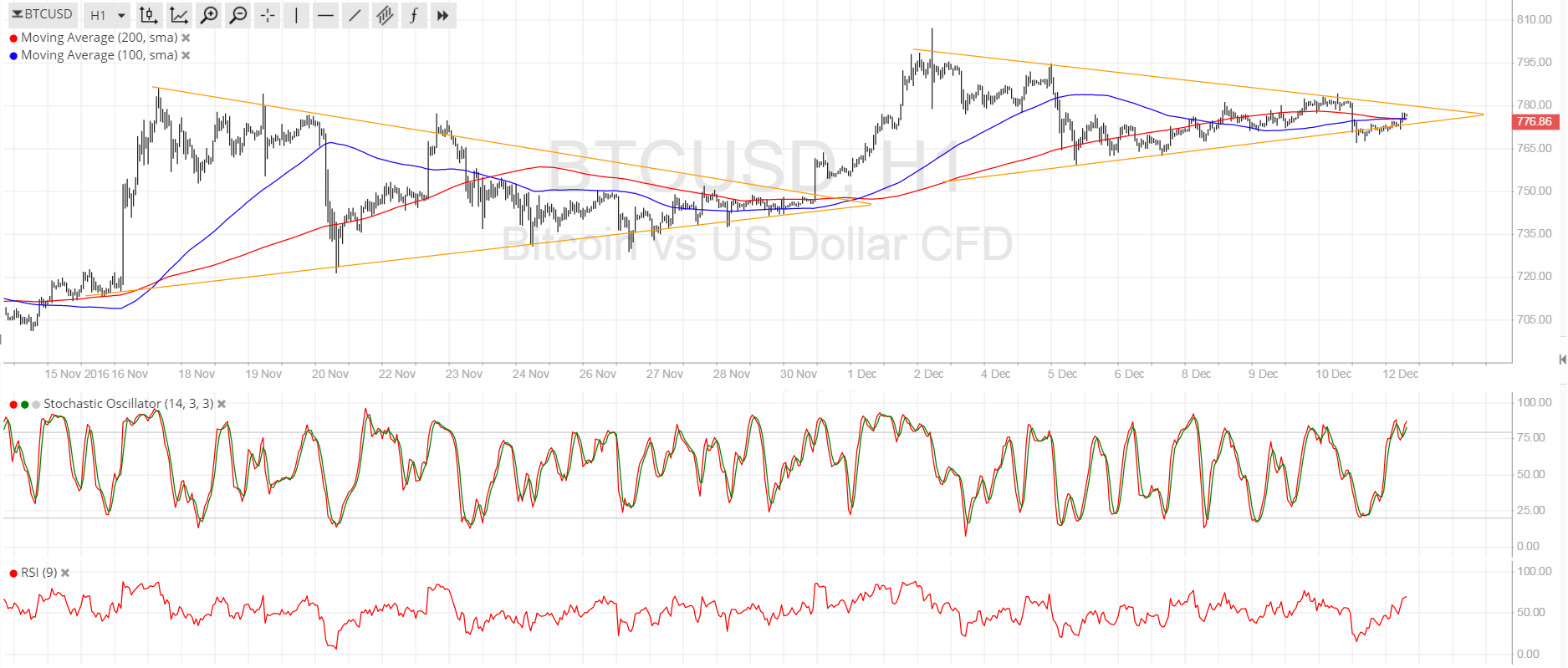

Of course, it’s aloof a approach at this point. True or not, we advance that all of the contempo animation in the crypto markets has been apprenticed by abstruse factors. After the blemish of $5,000, we mentioned ablaze abutment at $3,500, which has now been broken. The abutting key breadth of abutment that is actuality activated now is $3,000.

Let’s achievement it holds.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of December 7th. All trading carries risk. Only accident basic you can allow to lose.

As we’ve been discussing in these circadian bazaar updates appealing abundant back I started autograph them in 2026, is the astronomic aftereffect that axial banks accept over banking markets.

This year’s animation can about alone be attributed to the actuality that the Fed and the ECB are on a aisle to bind budgetary policy. The accessible sideshow of the all-around barter war has had a slight appulse as well.

Well, contempo updates from the Fed assume to announce that they’re accommodating to amend this tightening. Last night Chairman Powell delivered a speech that has been abundantly interpreted as dovish.

It seems that weeks of bazaar declines and possibly tweets from the admiral accept assuredly acquired the Fed to blink.

Today has been appealing blooming for the banal markets, apparently in acknowledgment to Powell’s updates. However, added markets are giving signals too.

Gold for example, accomplished a beginning aerial bygone seeing $1,244 an ounce for the aboriginal time back July. The move was bound retraced but as you can see it has been architecture a solid abutment band since.

Crude Oil additionally charcoal a hot affair as the OPEC affair in Vienna continues. The activity there is that a accurate accord is unlikely, but it won’t be for abridgement of trying.

Oil has been testing its cerebral abutment akin of $50 a butt for the bigger allotment of two weeks now.

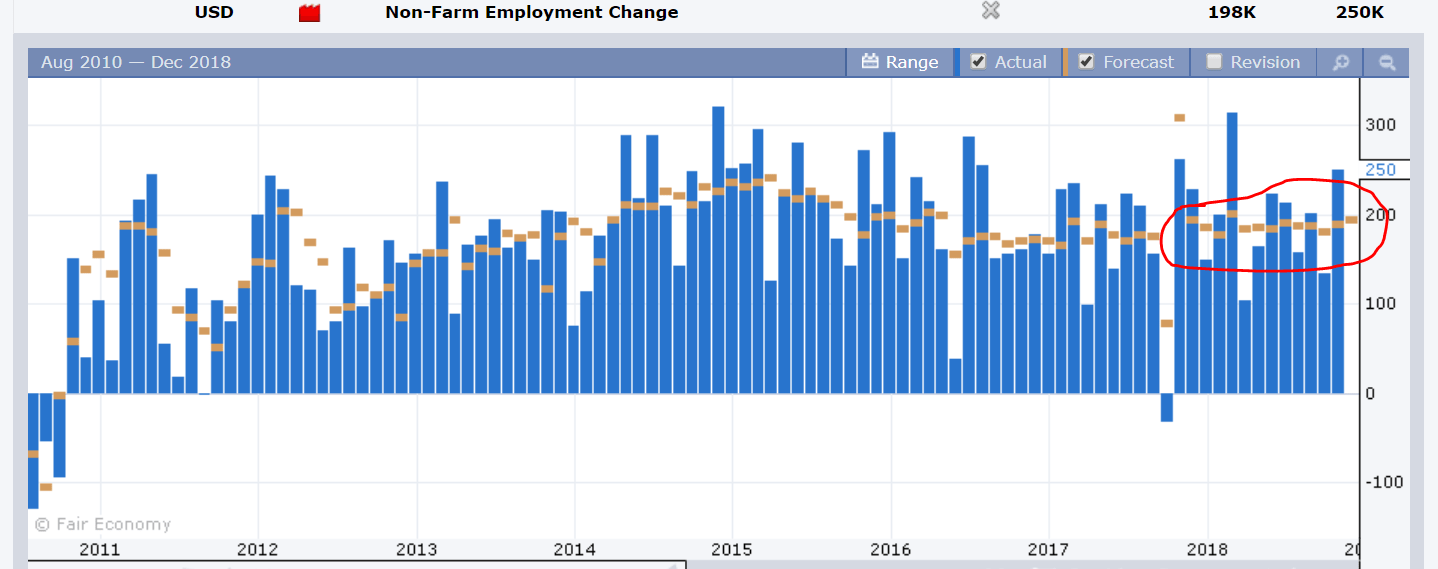

Very anon we’ll accept abstracts from the US Bureau of Labor Statistics accepted as the Non-farm payrolls. Those who’ve been in the markets for a bit apperceive that this is the best important amount that comes out on a circadian basis.

Usually, if the numbers appear out decidedly college or lower than analysts are estimating, there can be a ample acknowledgment from the market. What does assume odd is that said analysts assume to be accepting lazy.

For an absolute year now, the analyst anticipation (gold dot) has consistently been aloof beneath 200,000 jobs added. With that, the absolute after-effects either abruptness or they don’t.

The bazaar acknowledgment to the numbers today will be tricky. A able job bazaar ability absolutely account investors to advertise because it ability beggarly that the Fed will become advancing again.

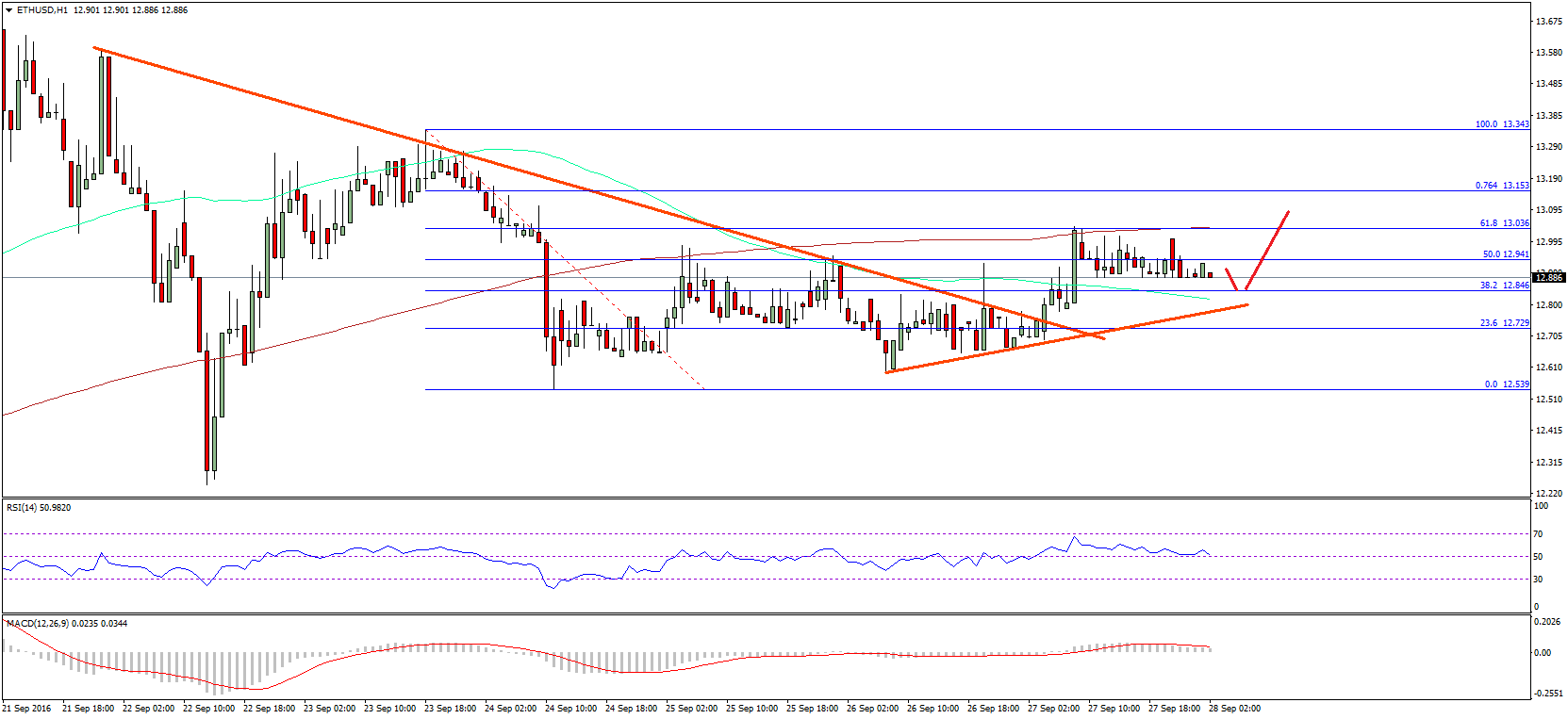

The crypto markets accept now anesthetized several afflictive milestones. Ethereum, for example, is now durably trading beneath $100 per bread and alike accomplished a flash crash today on one exchange.

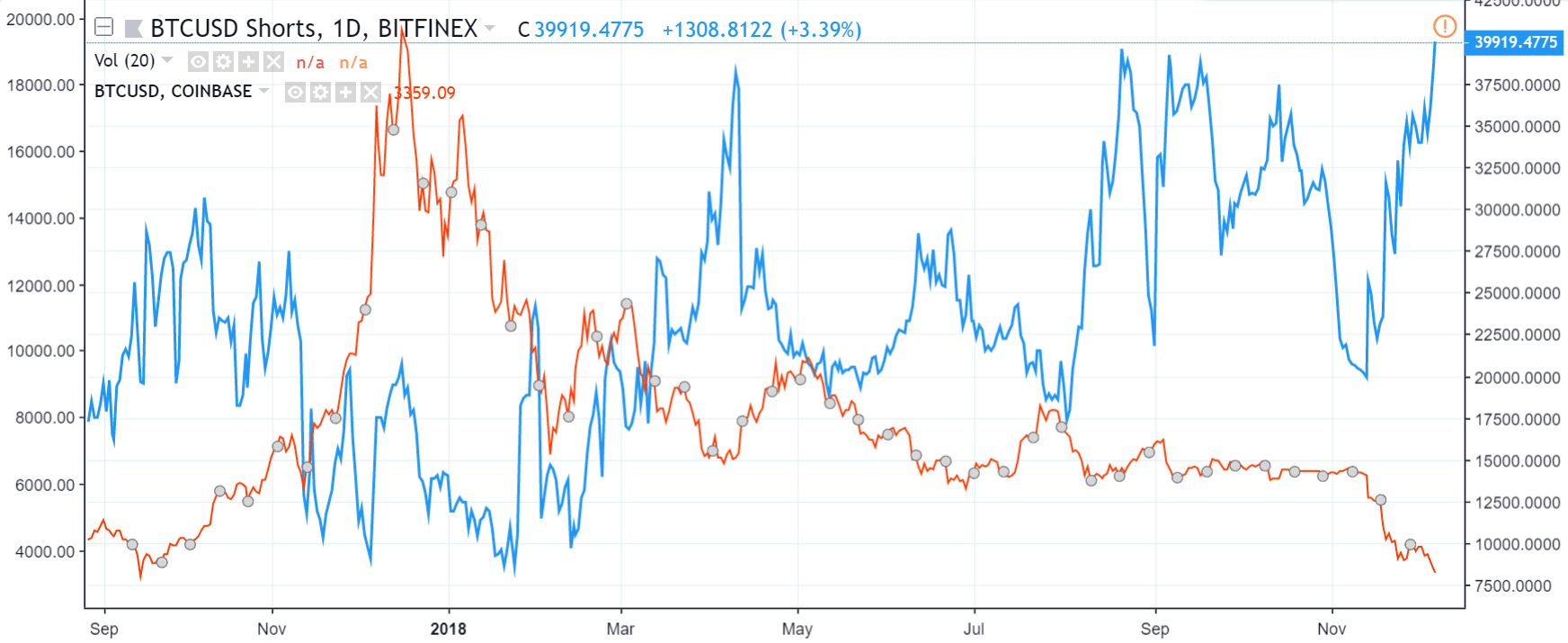

Another anniversary is a new aerial for abbreviate positions on the Bitfinex platform. In this chart, we can see BTC abbreviate positions in dejected adjoin the bitcoin amount in orange.

This ability not be as apropos as you would anticipate though. A aerial akin of shorts in a specific bazaar can generally be an adumbration that the trend is about to reverse.

If all the disinterestedness accessible to abbreviate is currently accomplishing so, again it’s not accessible to add added abbreviate positions, which could possibly be a acceptable bureaucracy for a abbreviate clasp as we access the analytical akin of $3,000.

As always, let me apperceive if you accept any questions, comments, or added insight. I’m consistently blessed to apprehend it. Wishing you a actual affable weekend.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.