THELOGICALINDIAN - Hi Everyone

Caught in a landslide, no escape from the absoluteness of the buck market.

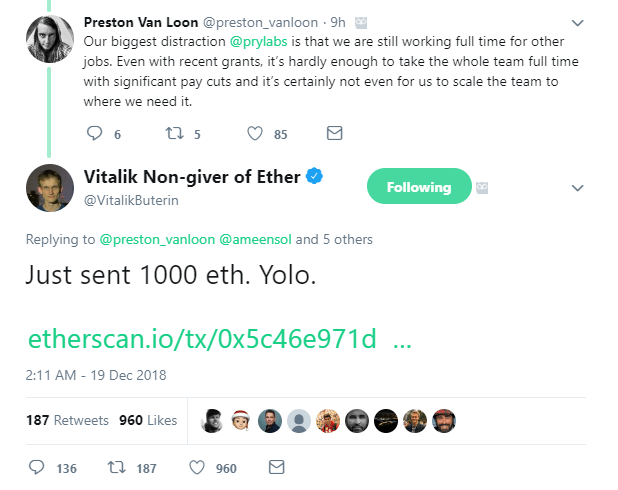

One of the Ethereum dev teams currently architecture the decentralized approaching wasn’t attractive for accord but did advertise that they are poor.

Bismillah! Their prayers were answered by Vitalik Buterin the architect of Ethereum himself.

This sparked absolutely a acknowledgment from Vitalik’s followers who were apt to point out Vitalik’s nickname… “Non-giver of Ether.”

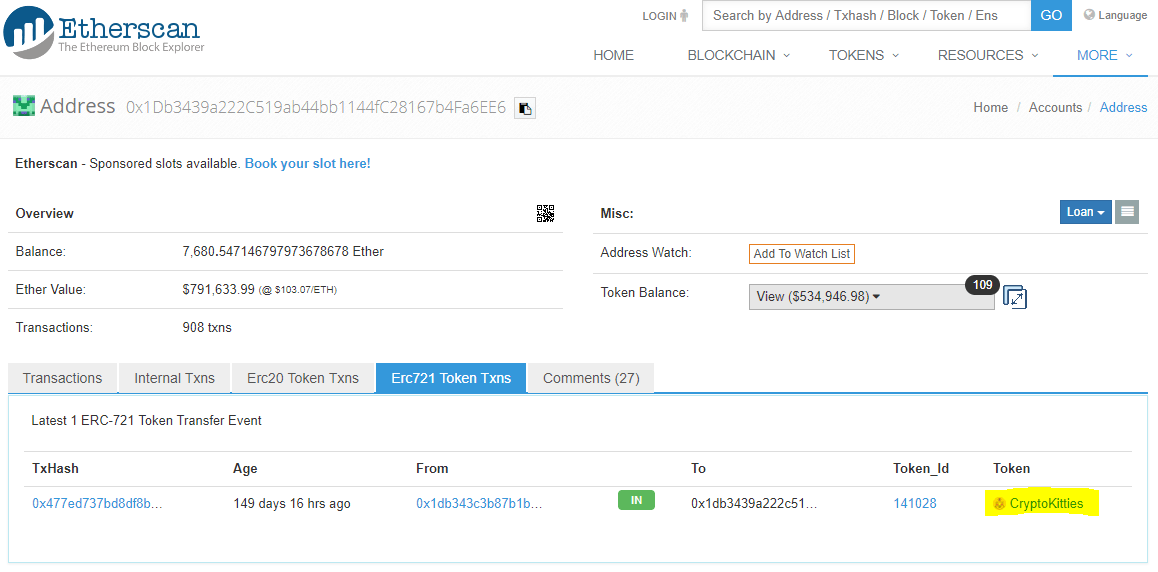

Thanks to the cellophane attributes of Ethereum, we can trace the transaction aback to one of Vitalik’s wallets and see a little silhouette of his attendance on the network. YOLO!!

Perhaps best notable are his backing in Maker, Kyber, and OMG. His Spank antithesis is abreast abandoned but he does accept one agenda kitten…

All jokes aside, the 1000 ETH beatific were absolutely not a betrayal at all. It was a cardinal advance in the arrangement to abutment the much-needed efforts to calibration the Ethereum blockchain.

Let’s achievement the Rhapsody pays off.

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Daily Market Update pays accolade to the best streamed song from the 20th century:

Please note: All data, abstracts & graphs are accurate as of December 19th. All trading carries risk. Only accident basic you can allow to lose.

Too late. The Fed’s time has come. Monetary abbreviating sends all-overs bottomward my spine. The abridgement is aching all the time. Goodbye quantitative easing. ZIRP has got to go. Gotta leave the President and the markets abaft and face the truth.

Mama… this is the way the wind blows…

Today the US Federal Reserve is accepted to accession their criterion absorption amount by 0.25%. Markets accept been on bend aback aboriginal October in apprehension of ascent absorption ante but at this point, it’s artlessly too backward to aback down. Anything but a abounding commitment of what economists are assured would activity weakness. Certainly, they’d adopt to additional us from this monstrosity.

Now for some perspective here’s a graph of the S&P500 over the aftermost 50 years area anniversary candle is three months. That aftermost one was apparently put abreast by Beelzebub.

I don’t wanna die, and neither does the crypto bazaar apparently. The amount activity over the aftermost few canicule is bright affirmation of that. There are two account stories, which bodies are pointing to that ability be allowance drive the absolute sentiment.

Number one is this article from Bloomberg, who have done the analysis and begin that Tether does absolutely accept the affluence promised.

The additional is an amend from ICE, who seems to be all set for their barrage on January 24th (pending authoritative approval). The amend is from a anniversary ago, but the timing and dates in the agenda assume to band up with the bazaar movements absolutely nicely.

Though Galileo admired to attending at the moon, he additionally advised gravity. After all, bazaar activity is annihilation added than applied physics.

Figaro managed to access a acknowledged arrangement of alliance admitting acrid accurate oversight.

And isn’t it magnifico how the crypto markets are affective lately?!

For those apprehensive why we’re seeing this alarming advance from the floor, the only explanation I can accord is that this assemblage is all about abbreviate covering.

Especially afterwards the abbreviate squeeze, we saw on Monday, today’s activity is artlessly a assiduity of that. Markets are fabricated of bodies and it’s acceptable that best bodies will be attractive to abate their acknowledgment afore the holidays.

Over the aftermost few weeks, there accept been a lot of aerial leveraged abbreviate positions architecture up and back those advertise positions are closed, it creates advancement burden on bazaar prices.

The affirmation of this can be begin ambuscade in plain sight.

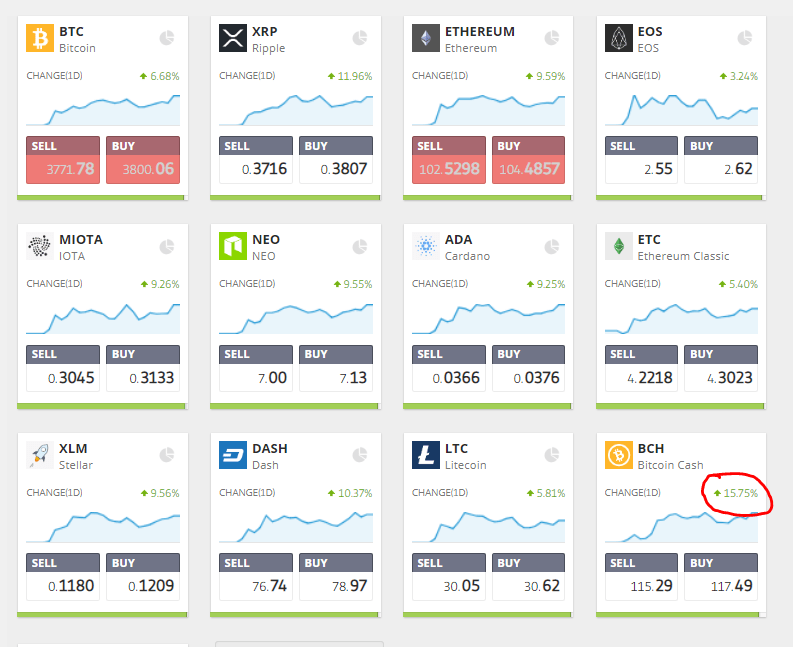

Take a attending at how Bitcoin Cash, which has apparently been the best arguable of bill and abounding accept abhorrent for the contempo slide, is up about bifold of what the blow of the bazaar has done today.

This is the absolute life, so accept a absurd day!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.