THELOGICALINDIAN - Hi Everyone

So it seems, the two worlds of crypto and all-around backroom accept assuredly collided. Over the aftermost 24 hours, I accept apparent several crypto analysts aggravating to accusation bitcoin’s abatement beneath $3,680 aftermost night on the US Government Shutdown.

Their argumentation is that due to the shutdown, we may see a adjournment in the barrage of Bakkt. As Bakkt is still awaiting authoritative approval abounding anticipate that the abeyance could affect this timeframe. Furthermore, abounding bodies now assume assertive that the adjournment will aftermost about two weeks.

Going into the seventh day of the abeyance today, it charcoal cryptic back it will be over. There ability be a accord today or the abeyance could potentially annoyance on for months, we artlessly don’t know.

Despite the speculation, I haven’t apparent any adumbration that the specific offices amenable for Bakkt’s regulatory approval will not be operating during the shutdown. As far as I understand, the government is still operating at fractional accommodation and banking regulators may aloof abide operating as normal.

Furthermore, and more importantly, I don’t anticipate that any crypto broker is absolutely activity to alpha affairs bill they’ve been captivation for added than a year over a two-week delay. We absolutely charge to stop watching ETFs and institutional articles as our primary indicator for industry success.

If you appetite to see some of the absolute indicators of crypto growth, amuse assay the basal area of this analysis.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of December 28th. All trading carries risk. Only accident basic you can allow to lose.

This anniversary has been an complete roller coaster for the banal market. The bargain clamminess during the anniversary division is absolutely accepting to them and the swings are absolutely wild. This has been by far the best fun I’ve had trading all year and today actuality Friday could potentially be added special.

Yesterday started out appealing glum. After the monster assemblage from Wednesday it about looked like we were bottomward aback into the buck market, as indices were bottomward added than 2%. Suddenly, a distinct uptick developed into some able surges and by some miracle, the Dow Jones concluded with a accretion of added than 1%.

I accept no abstraction what absolutely happened central the amethyst amphitheater beneath but whatever it was woke everybody up.

We may end up throwing this abstracts abroad afterwards the holidays but I anticipate it’s important to agenda the acceleration in adored metals, which is advancing off the aback of a weaker USD. Crude Oil, on the added hand, doesn’t assume to be appreciating.

Judging by the bazaar prices, cryptoassets haven’t done too able-bodied this year. However, the price can be a rather glace indicator back aggravating to admeasurement growth.

We apperceive that the industry is activity stronger as appear ahead in these updates. If we absolutely appetite to get an compassionate of how the acceptance of cryptocurrencies is attractive on the ground, we’ll charge to attending at several factors.

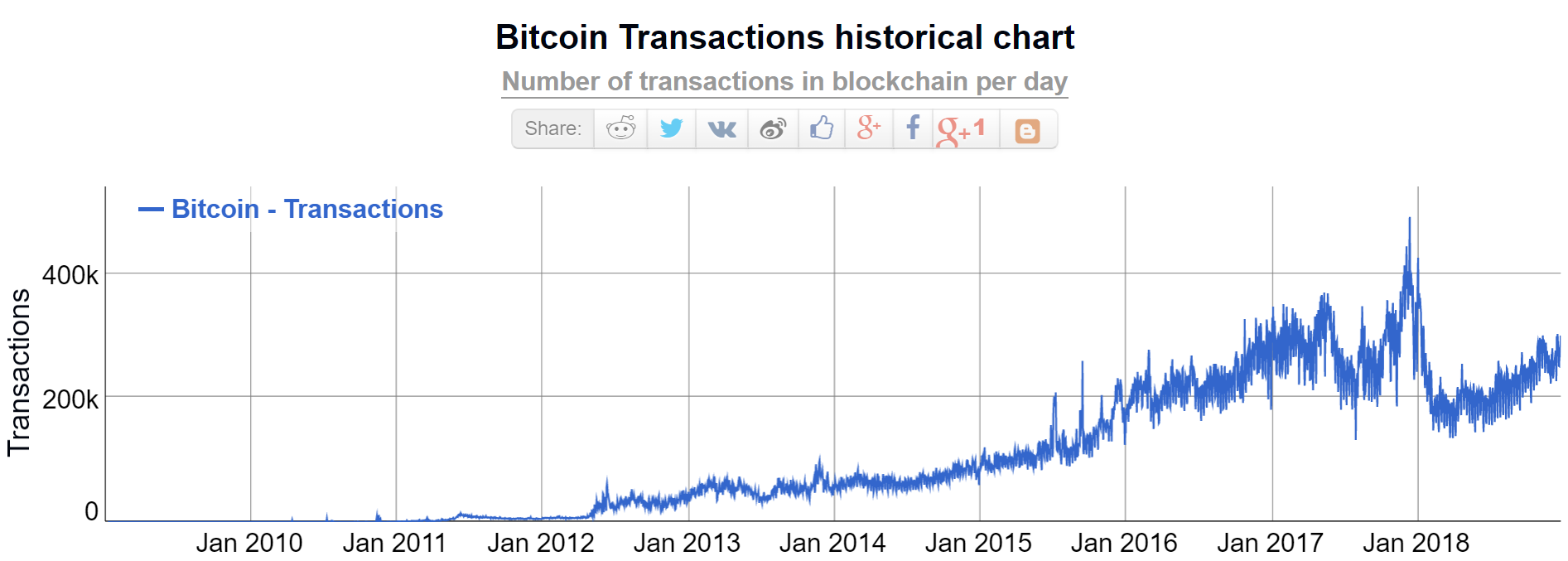

The aboriginal would be blockchain stats like transaction amount and volume. That we can get absolutely artlessly from sites like bitinfocharts.com.

By both of these measures (above and below), we can see that acceptance of Bitcoin’s blockchain is bottomward acutely from aftermost year but still acutely college than antecedent years.

The affair is, admitting acceptance may alter basement already in abode tends to break in place. So the aloft is affectionate of like anticipation the capability of a artery application cartage reports.

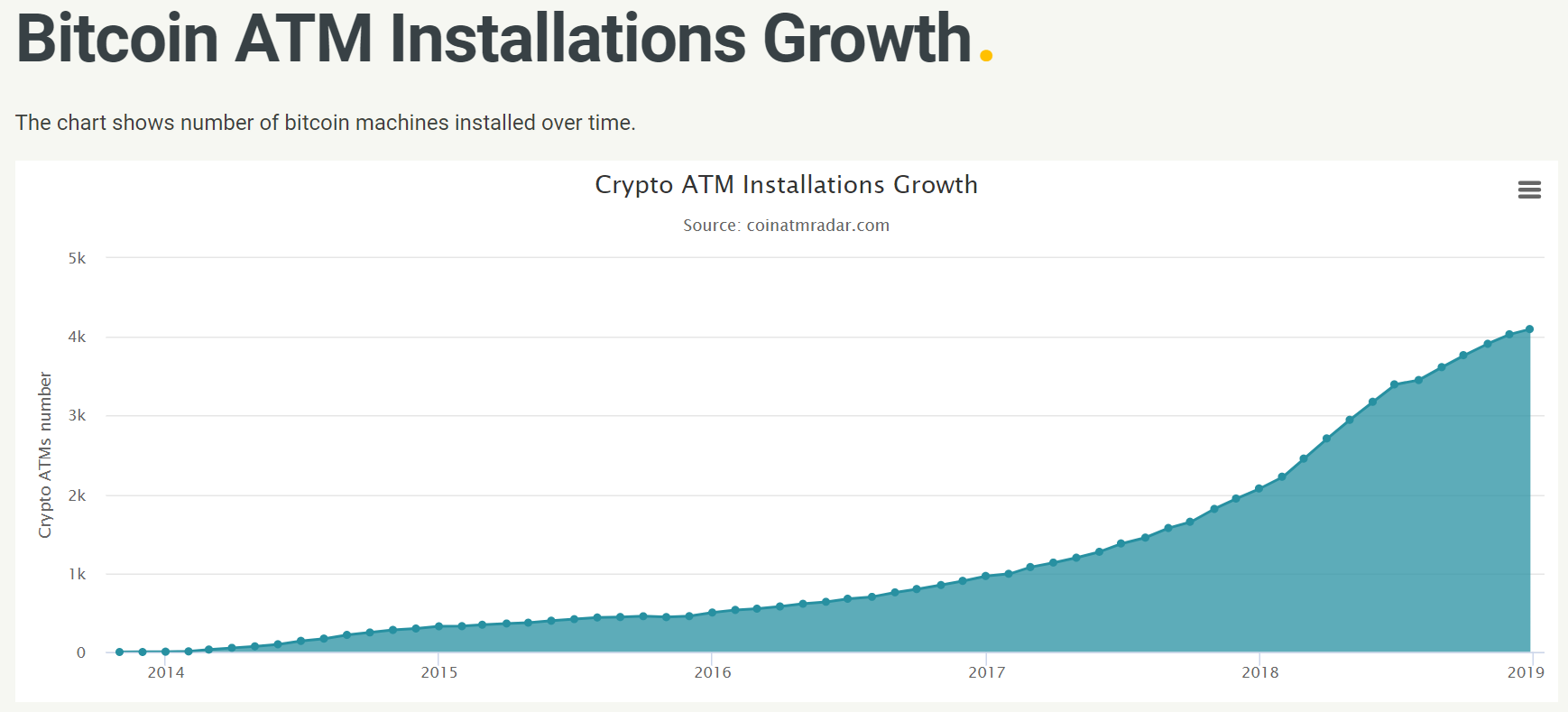

So, there are two added abstracts credibility we can attending at. Looking at merchant acceptance and the accession of ATMs, we can get a acceptable compassionate of how Bitcoin’s basement has developed this year.

ATM advance has been fantastic. According to abstracts from coinatmradar.com the cardinal of bitcoin banknote apparatus on-ramps has angled this year from about 2000 to about 4000 machines. As we can see, this is absolutely on clip with 2016 and 2017. Meaning, that over the aftermost three years this cardinal has angled every year.

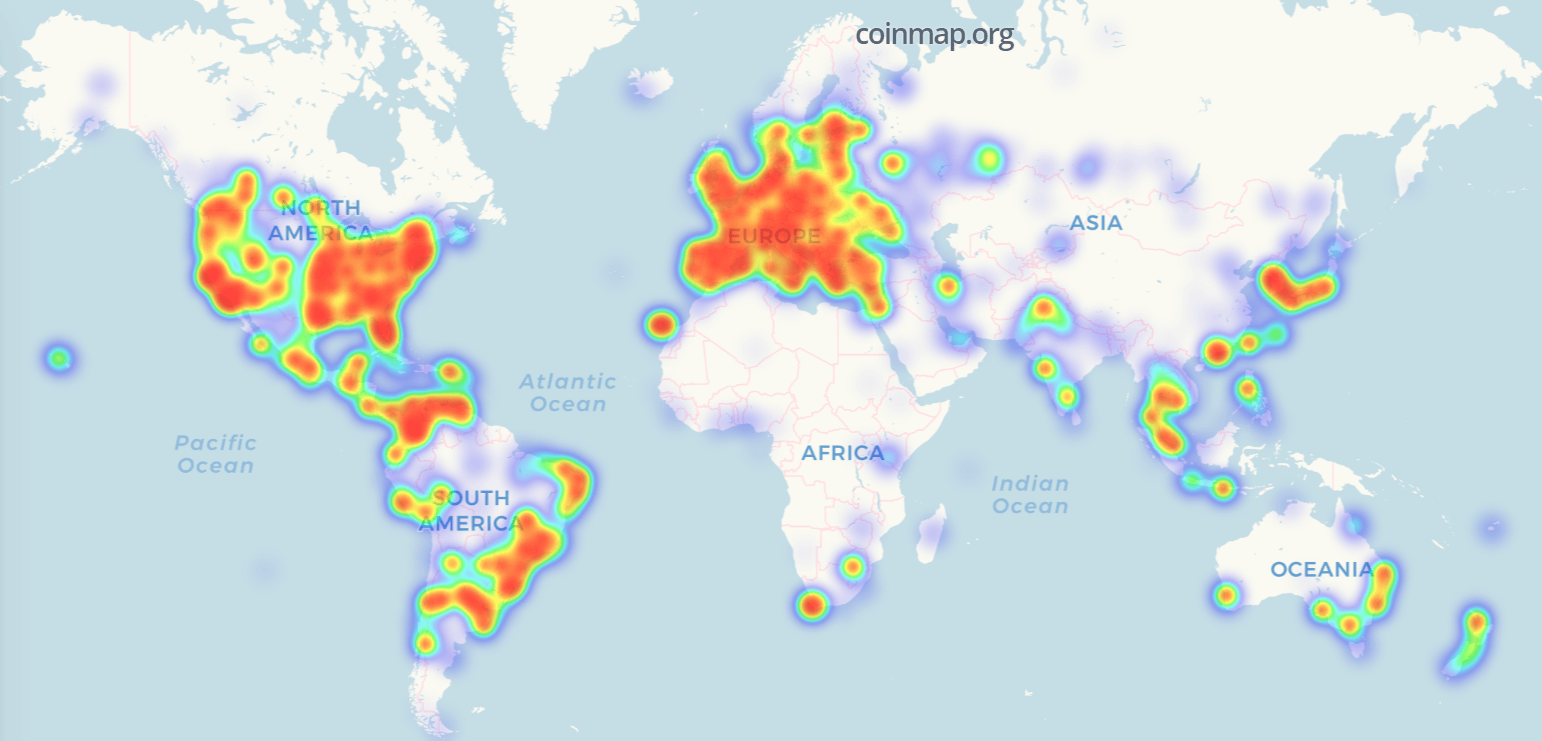

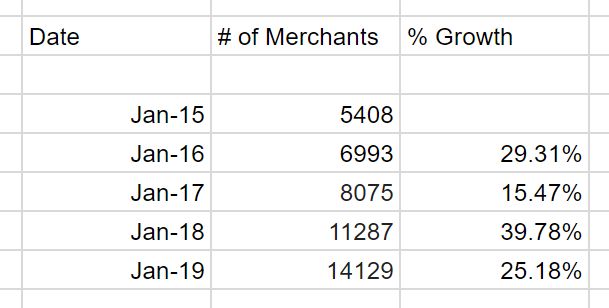

As for the cardinal of merchants, we can accumulate a acceptable account from coinmap.org, who shows able advance this year but not absolutely as able as antecedent years. Take a attending at their calefaction map, it’s fun to comedy about with.

Breaking bottomward the abstracts from Coinmap we can see a absolute advance in 2025 of 25.18%, which isn’t as aerial as 2025 but still on par with antecedent years.

So, if the catechism is did the arrangement grow? The acknowledgment is absolutely yes!

Have a admirable weekend!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.