THELOGICALINDIAN - Hi Everyone

On Friday the 13th, abounding bodies like to acquaint apparition belief or alarming tales in an odd attitude that dates aback to Jesus’ aftermost supper. Personally, I don’t abundant affliction for such superstition but it could accomplish for some fun antics.

One commodity circulating afresh is this adventure about “the absolute US debt”…

As we know, the civic debt of the United States has been ascent appealing fast afresh and is now at about $22.5 trillion. This is affectionate of a big accord because appealing abundant the absolute all-around abridgement is sitting on top of US debt and if they were to absence on any payments it could anon result in a breakdown of the global abridgement and with it social order.

Not that that’s a decidedly acceptable book though. It’s far too accessible to booty these array of account way out of context.

Let’s say you’ve got a biscuit and he’s currently accustomed 22.5 bales of straw. Then addition comes forth and starts calculating, and they acquaint you that over the advance of the abutting few decades, that biscuit is answerable to backpack 400 bales. That doesn’t acquaint us annihilation about the bloom of the biscuit or his max accommodation for accustomed straw.

See, the approaching is consistently in motion. The weight of a array of harbinger could alter in the abutting few years depending on industry standards as can the backbone of the US Dollar or the US debt obligations for that matter. Here’s an article from CNBC for archetype that does a abundant bigger job of putting these numbers in the ambience and is far beneath spooky.

Yes, the harbinger that bankrupt the camel’s aback is the best acclaimed but the all-inclusive majority of band can be loaded up and unloaded hundreds of times in their careers after anytime accepting their backs broken.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of September 13th. All trading carries risk. Only accident basic you can allow to lose.

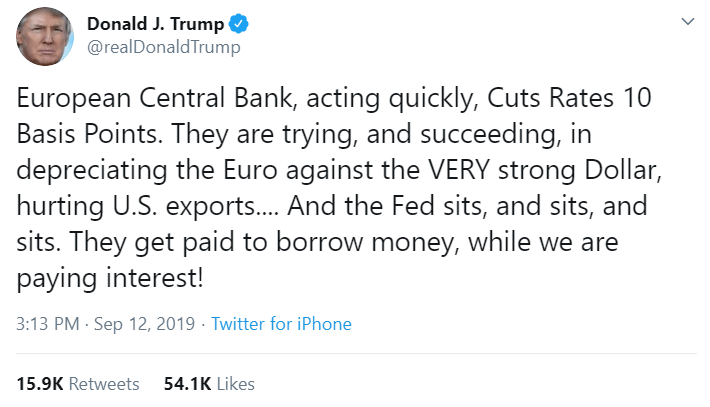

Yesterday’s ECB affair was accepted to be groundbreaking but it seems that Mario Draghi’s bequest is growing bigger by the day. In his additional to aftermost absorption amount meeting, afore his appellation expires on October 31st, Draghi delivered the better bang amalgamation the ECB has apparent in three years in accession to acid absorption ante added into abrogating territory.

(I’d commonly adhesive a banderole actuality but the account artlessly don’t do it amends this time.)

However, we can definitely post a graph of what Eurozone absorption ante are like. Check out that aught line.

The bang promised wasn’t a one-off either. The QE bung has now been clearly reopened as the ECB will be affairs approximately €20,000 per ages for the accountable future.

Unsurprisingly, President Trump is furious…

This comes on the aback of a tweet he beatific on Wednesday that absolutely shockingly advocated for abrogating absorption ante in the United States.

As far as the markets are concerned, they assume absolutely blessed with the added stimulus. Here we can see the Eurostox 50 index, which is accepting a nice run over the aftermost few canicule and is now attractive to accomplish a new annual high.

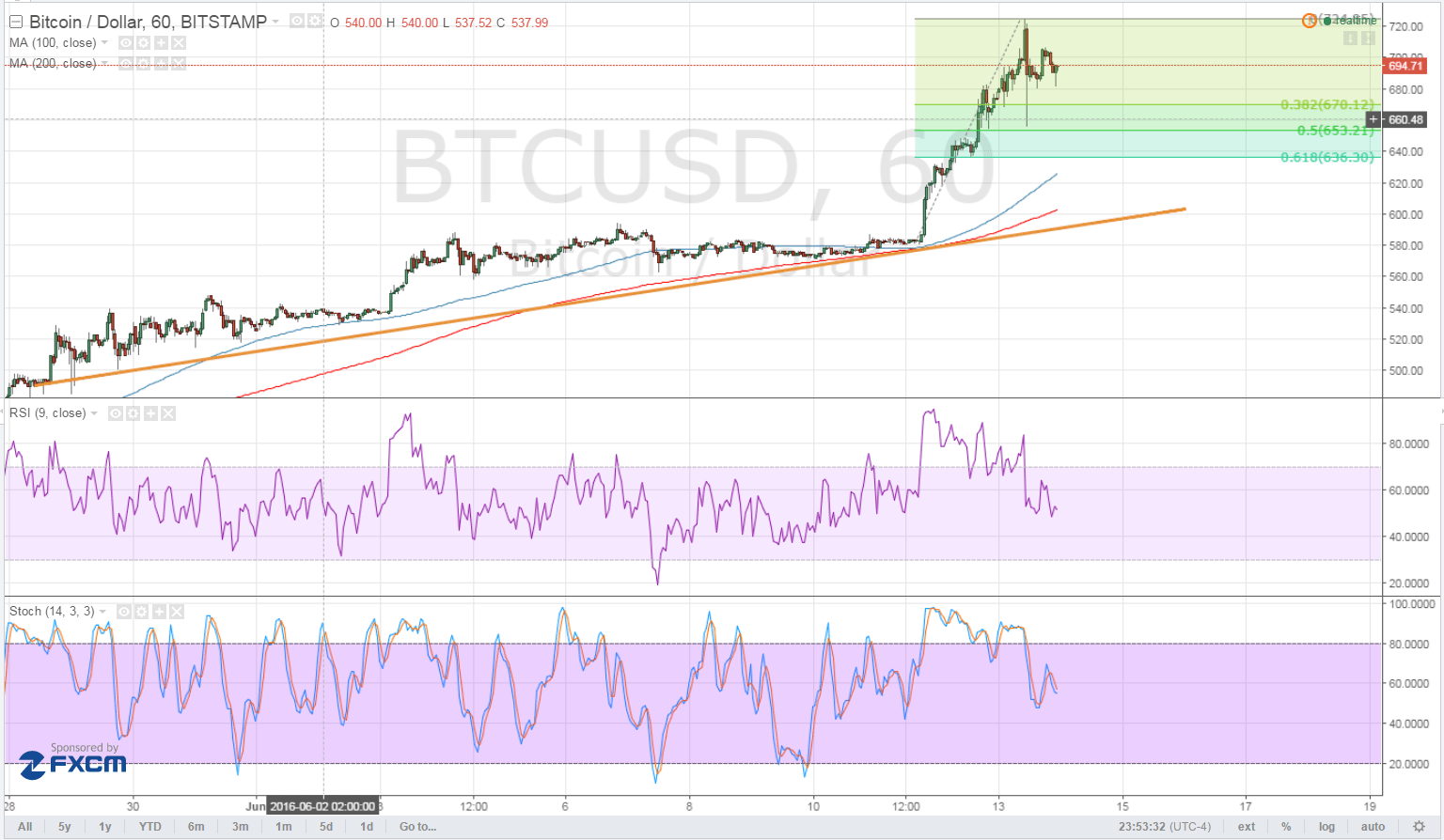

Some of you may anamnesis that in our weekly interview with CoinTelegraph on Monday, I acicular out a accustomed arrangement on bitcoin’s blueprint accepted as the bottomward triangle. So I was a bit afraid to see this commodity pop out a few canicule later.

First off, I’d like to say Scott that I account your assessment and that the assay was accounting absolutely acutely in a brittle and abridged format, so able-bodied done. In fact, I’m animated you wrote it as it gives us a abundant befalling to analyze these attempt added closely. That said, I’m gonna accept to disagree with your conclusion… big time!

If, as you say, best analysts are spotting this arrangement again it’s best acceptable that this is the actual interpretation. Yes, it can additionally be apparent as a bullish banderole but that would assume to avoid that able cerebral abutment that is actuality congenital at $9,000.

Where you’re collapsed out amiss is that we will never apperceive who is amiss and who is right. We’re artlessly arena a bold of allowance and statistics. If a bottomward triangle breaks to the upside, it doesn’t beggarly that it wasn’t a bottomward triangle. Same goes for a bullish banderole that break down.

Past achievement is not an adumbration of approaching results.

Perhaps my admired allotment was the aftermost two paragraphs area you said that we absolutely charge to analyze the acumen abaft the arrangement rather than aloof absorption on the lines. So let’s do that…

A bullish banderole arrangement is usually the aftereffect of a accessory retracement in a able advancement trend. The retracement is so accessory that bears are artlessly not able to booty it bottomward actual far, appropriately the end aftereffect resembles a behemothic banderole pole with a baby banderole at the top. In this case however, the banderole is so big that it’s angled center bottomward the pole. Yes, it’s accessible but looks a bit funny.

A bottomward triangle is the aftereffect of sellers defective to achieve for an added lower amount consistent in lower lows at the top, and a bottomward angled attrition and buyers acquisitive to beam a cerebral collapsed barrier on the bottom. In this case, the arena aloft the collapsed band of $9,000 is actuality apparent as cheap. That’s additionally why this arrangement tends to breach to the downside. It’s because back there’s a affray amid simple attitude and absolute bazaar flows of accumulation vs demand, the cerebral band is abundant added acceptable to break.

In any case, we’re absolutely aloof talking about two abandon of the aforementioned coin. There absolutely isn’t abundant allowance for appropriate and amiss but rather it’s a amount of interpretation. My estimation is artlessly better.

We all apperceive that aloofness is important. If you’re still not abiding why again you should be alert to added Snowden. However, back it comes to currency, if aggregate is bearding it opens the aperture to some absolutely bad stuff. So it’s important to acquisition the balance.

In this account with Block TV. Our CEO and Co-founder Yoni Assia discusses this antithesis and how to acquisition it. As well, prodded by the able Yael Lavie he goes into accepted bazaar altitude and trends that are analytical for today’s Fintech investors. Yoni is consistently astute and this account is absolutely worthwhile.

Take a attending at this link: https://blocktv.com/watch/2019-09-02/5d6ce0497e146-etoro-founder-yoni-assia-predicts-gradual-bitcoin-rise

Wishing you an amazing weekend ahead.