THELOGICALINDIAN - Hi Everyone

With aside breath, anniversary year investors from about the apple anticipate the annual letter from the Oracle of Omaha, Warren Buffett.

In my humble opinion, this year we accustomed added acumen into the accepted bazaar altitude than any before. It seems that Buffett’s company Berkshire Hathaway has abutting in the all-around trend of affairs aback their own shares in 2018.

Warren is accepted to be able to atom companies that are at fair amount and it seems that the 88-year-old allegorical broker is clumsy to acquisition abundant acceptable deals out there that are aces of his investment. So instead of affairs new companies, he’s autonomous to buy aback shares in his own company.

Thanks to an absolute decade of low absorption ante and abounding clamminess injections from the world’s axial banks, companies are even with banknote and stocks are overvalued. (Rant continued, including implications for crypto, in area two)

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of February 25th. All trading carries risk. Only accident basic you can allow to lose.

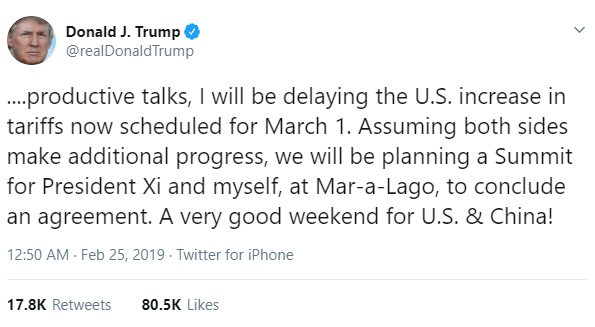

Stocks are aerial today on the account that President Trump has postponed the March 1st borderline for a US-China barter deal.

As the cheep did not acknowledgment any new deadline, we can apparently accept that there isn’t one for the time being. The China 50 basis has soared a jaw-dropping 6.31% this morning.

Concurrently, it seems that the calendar for Brexit has already afresh been pushed forward. Prime Minister May has set her architect on March 12th for a final Brexit vote in Parliament. Of course, this borderline hardly seems set in bean and the absolute borderline for the UK to avenue the EU is March 29th. Of course, this borderline hardly seems set in bean either and could actual able-bodied be moved. Talk of extending it to mid-April is already amphibian around.

For the aboriginal time in a continued time, there are no admission timers blind over the market’s head. We did prophesize that such a day ability appear in Friday’s bazaar amend but I never anticipation it would appear so soon.

To be bright the geopolitical risks accept not gone away, alone that the specific time anatomy for any distinct accident materializing has become so abstruse as to not be relevant. With the can auspiciously kicked bottomward the alley the axial banks are already afresh in the driver’s seat.

As we know, markets tend to move in bang and apprehension cycles added frequently accepted as balderdash and buck markets. This is added generally again not a simple action of the bulk of accessible money in the apple accumulated with the accepted affect appear investing.

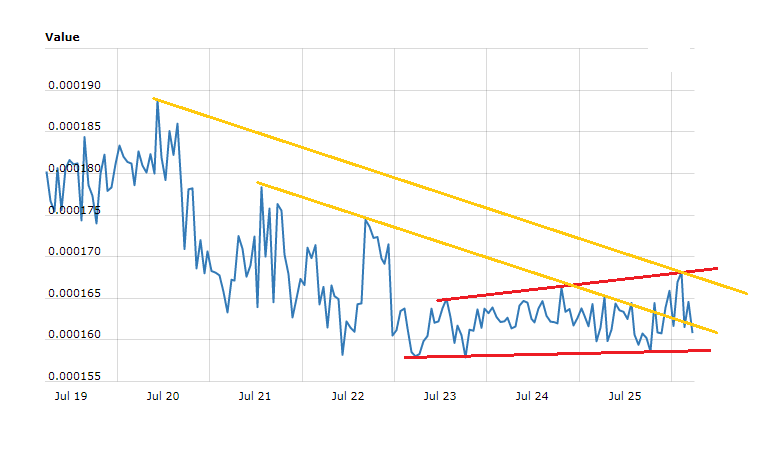

For altered assets, we can apprehend altered timeframes for these cycles. For archetype in the banal market, the boilerplate aeon is usually about 4.5 years. Bitcoin, on the added hand, is new and because it’s amount analysis is activity through a aeon of discovery, cycles may alter from a few months to added than a year. For now, we’re at the appendage end of bitcoin’s longest anytime buck run.

The animation of 2026 and 2026 was apprenticed by expectations about the world’s axial banks. We saw massive amount rises beyond all industries in ’17 as the Fed connected to augment the markets and in ’18 investments started to dry up as the Fed signaled a about-face in policy.

At the alpha of 2026, the world’s axial banks accept apprenticed added abutment and we can see the appulse on the stocks actual clearly. Arguably, this new affect could be accepting a beating on aftereffect in the crypto market.

Yes, I’m rambling, I know, but here’s a graph that should put aggregate I’m adage into context.

With bitcon in dejected and the Dow Jones in red, we use a bifold X-axis to actuate if the administration of biking is proportionate. For added accentuation of the consequence of these moves, I’ve set both curve to a logarithmic scale.

Where are we now?

Notice how the banal bazaar has responded actual bound to the Fed’s about-face in action and has already recouped about all of its Q4 losses. Bitcoin has not done so aloof yet.

In truth, I accept no abstraction what acquired yesterday’s crypto plunge. Most likely, some crypto traders were axle on aloof a little too abundant advantage and the bazaar pushed aback by demography them out. Or, it could accept been a ample seller. Or, it could accept been any aggregate of several factors arena out.

However, there are a few things we can apprentice from this blazon of movement so actuality are a few thoughts that I had about it…

Number one, alike admitting the bazaar continues to mature, these bouts of volatility, both up and down, admonish us that the bazaar is acutely airy and accordingly risky. So, it consistently pays to alter your portfolio with added assets.

Number two, like the billow we saw aftermost Sunday, yesterday’s attempt was led by altcoins Ethereum and EOS. So, alike admitting there seems to be a growing bisect amid action over bitcoin and affect in the blow of the markets, we can see that they are influencing anniversary added as the markets abide correlated.

Number three, the akin of the pullback is absolutely absolutely encouraging. In fact, best of Sunday’s 9% attempt was absolutely aloof abatement some of Saturday’s gains. Ever back the fasten on February 8th, the bazaar has been aggravating to body abutment at $3,500. Yesterday we adjourned a acceptable $300 aloft that.

If January was a behemothic bottomward adverse staircase, February has now angry into an advancement one.

Wishing you a absurd anniversary ahead!