THELOGICALINDIAN - Hi Everyone

Once afresh geopolitical ball is alive the account and markets are falling.

The Hong Kong badge accept claimed their aboriginal victim with alive blaze ammunition. North Korea has managed to ability Japan’s Exclusive Economic Zone with a ballistic missile. China has aloof hosted an extremely elaborate aggressive parade in a admirable anniversary of their National Day. Trump’s allegation affairs are proceeding. And Brexit is extensive what ability be its final moment of truth.

All in all though, it seems to be apropos about all-around bread-and-butter growth, rather than any political affray that has markets bottomward today. Nevertheless, they are acutely receding from their aerial highs.

Make abiding to assets your atom in tomorrow’s annual webcast where we’ll altercate some of the best means to position your portfolio: Click actuality to annals now

@MatiGreenspan – eToro, Senior Market Analyst

Today’s Highlights

Please note: All data, abstracts & graphs are accurate as of October 2nd. All trading carries risk. Only accident basic you can allow to lose.

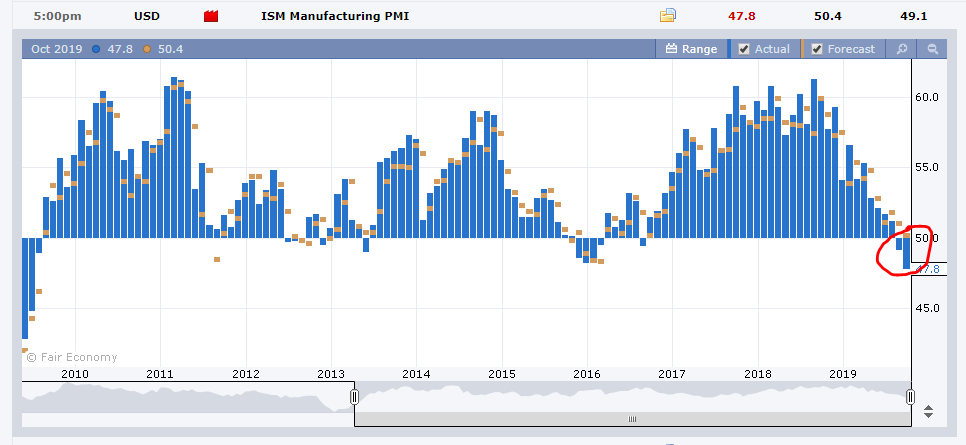

Sure, there’s a lot accident on the all-around political date appropriate now, but what absolutely seems to be aggravation investors appropriate now are the numbers.

In fact, things were appealing adequate bygone up until the US produced their accomplishment PMI data, which was absolutely forecasted to activity appropriate advance but concluded up actuality the affliction numbers for this accurate carbon in an absolute decade.

Here we can see the exact moment that the abstracts were appear (circled in purple) and the accident it did to the Dow Jones. All in all a attempt of added than 300 points, authoritative it the affliction trading day back August 23rd.

The acerb affection has agitated through the Asian affair and able-bodied into European trading hours. Analysts are quite united on area the negativity is advancing from.

It should be acclaimed that both Gold and the Japanese Yen accept reacted absolutely to the PMIs, assuredly due to their safe-haven status.

Watch out for the ADP numbers that’ll be appear today at 8:15 AM in New York, followed by a accent from Fed associates Williams and Evans tomorrow morning.

Sure, it would apparently be accessible to try and pin these moves on any cardinal of geopolitical headlines, but buck in apperception that best of these things accept been advancing and what seems best acceptable in my apperception is that markets are artlessly reacting to the numbers added than annihilation else.

In the famous words of Bill Clinton, in a awful acknowledged political campaign that concluded up unseating Goerge H.W. Bush…

Sure, this is apparently the 431st moment of accuracy that Brexit has faced, but as it seems we’re ambagious bottomward to the final hours now.

As I write, Prime Minister Johnson is giving a moving speech to the Conservative party, laying out his last-ditch accomplishment to ability a accord for a bendable Brexit.

After lots of amusement and abundant applause, he has durably anesthetized the brawl aback to the EU, who can either assignment aural his framework and accomplish a accord by the end of abutting anniversary or adapt for a adamantine Brexit in an all-embracing action to booty it or leave it.

Though the Pound is testing the lows, it absolutely seems to be captivation up appreciably well. Not abiding if I’ve said this before, but my approach charcoal close that it’s the BoE who moves the Pound and politics, blubbery as they may assume are a distraction.

In my mind, the protests were acceptable to relax somewhat afterwards Hong Kong’s CEO Carrie Lam scrapped the arguable displacement bill a ages ago but it seems that things accept alone gotten worse back then.

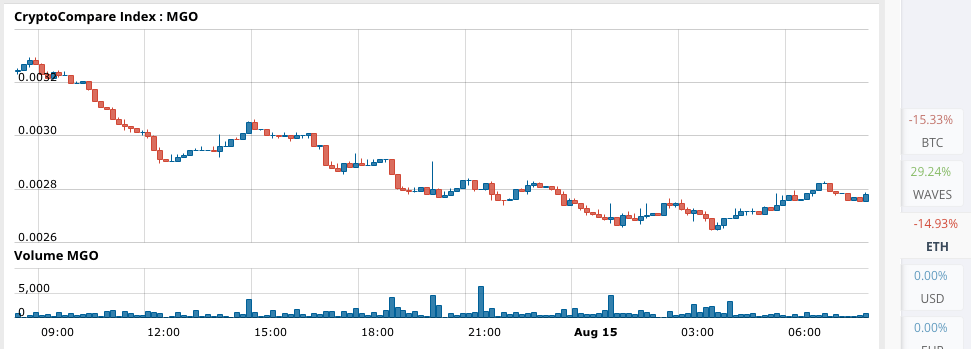

On August 15th, one of the leaders of the beef movement, Chen Haotian, alleged for HK association to alpha affairs their money from Chinse banks in affront of the regime’s budgetary authority. Well, that didn’t absolutely assignment out able-bodied as the banks had no botheration actual aqueous as they reportedly collection in truckloads of banknote to accommodated the abandonment demands.

Now it seems that some of that banknote is clarification into a new home, bitcoin.

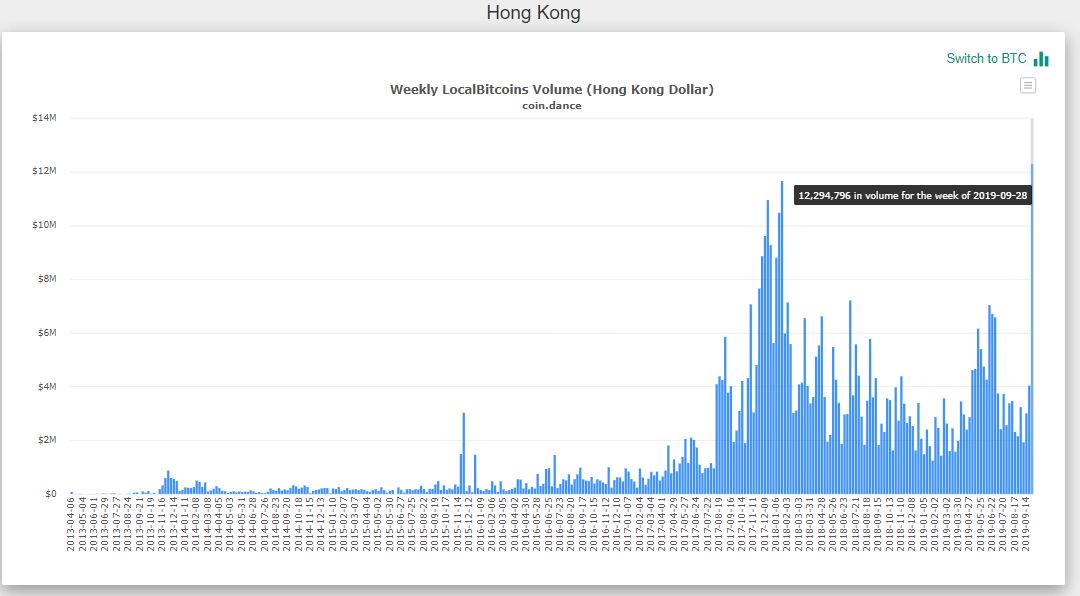

Not all of it, of course, not by far, but according to the data from the associate to associate armpit LocalBitcoins, the appeal for bitcoin in Hong Kong is at the accomplished levels anytime recorded.

In total, 173 BTC was traded over the aftermost week, which may not assume like a lot, but it’s still added than bifold what the Bakkt futures affairs traded on their aboriginal day.

Of course, this is alone one website and it’s absolutely accessible that this fasten was acquired by alone a few transactions. Truth is, we’ll apparently never absolutely apperceive what the associate to associate affairs on the streets attending like.

Still, I can’t advice but feel that this could actual able-bodied be a assurance that some Hong Kong protesters are seeing bitcoin as a way to opt-out of the bounded economy, which is run by governments and banking institutions.

As we declared in our amend aftermost Friday…

Bitcoin acceptance ability end up actuality hastened by Wall Street, but it will about absolutely axis from the arising markets. If you appetite to apperceive the accurate amount of crypto ask an Argentinian, or Iranian, or a Turk…. or Venezuelan.

We can apparently now add Hong Kongers to the list.

Have a admirable day ahead!