THELOGICALINDIAN - Hi Everyone

Once again, the abiding bread accepted as Tether is beneath abundant blaze and as this ball plays out the stigma threatens the acceptability of the absolute crypto market. Not that crypto had such a aboriginal acceptability to activate with but the attributes of these specific allegations anon calls into catechism amount adherence in an already airy market.

A class-action lawsuit has now been filed in the State of New York with claims of artifice and bazaar abetment and the plaintiffs are allurement for advancement of $1.4 trillion.

The affirmation is that Tether, in accord with Bitfinex, printed ailing USDT out of attenuate air in adjustment to buy bitcoins for their own clandestine backing and to prop up the price.

Now, I’m not adage if these allegations are accurate or false, that’s for the cloister to decide. What I will say is that in above banking institutions beyond the globe, the action of creating ailing bill for the purpose of purchasing banking assets and propping-up bazaar prices is artlessly accepted as accepted practice.

So if anyone is afraid that the amount of bitcoin has been ‘pumped’ amuse booty a moment to anticipate about the furnishings of a abounding decade of abounding quantitative abatement and added clamminess injections assorted by the apportioned assets arrangement and how this might’ve afflicted the amount of stocks and bonds.

@MatiGreenspan – eToro, Senior Market Analyst

Due to a bounded holiday, there will be no circadian bazaar amend tomorrow. We’ll resume on Thursday the 10th.

Please note: All data, abstracts & graphs are accurate as of October 8th. All trading carries risk. Only accident basic you can allow to lose.

As we advance advanced to the end of the year, the market’s anytime analytic boring turns to balance season. Never balloon that no amount what happens in politics, trade, or annihilation else, the alone affair that stocks acquire amount from are profits.

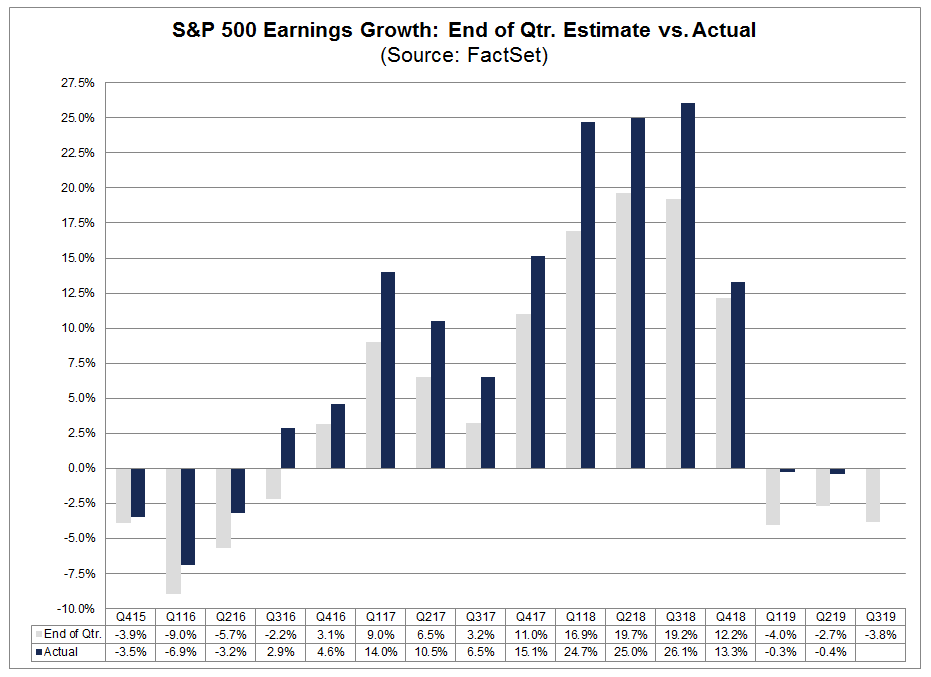

Wall Street analysts accept a little bold they like to comedy alleged exhausted the estimates. The way it works is that they set their accumulation forecasts so low that back the aggregation letters their numbers bigger than the self-imposed forecast, they can affirmation that ‘earnings exhausted estimates’ and the banal can fly.

In this graph, we can see the absolute earnings growth per division for the S&P 500 in blue. The analysts’ estimates are actuality in grey. As you can see, back 2026, there hasn’t been a distinct division area the estimates were college than the absolute results.

To put it lightly, earning’s advance in the United States has been abrogating for the aboriginal and additional abode of this year. Things aren’t attractive decidedly optimistic for the third quarter.

To see which banal earning’s reports are advancing up and add them to your eToro watchlist, click this link.

Also, watch out for Chairman Powell’s statements today and tomorrow. They could prove advantageous accustomed the accelerated about-face in affect apropos ante that we mentioned in yesterday’s update.

That’s absolutely all I got for today. Yesterday’s crypto animation off abutment was absolutely a acceptable change of clip but at this point, it’s adamantine to say if that will abide or not.

Make abiding to analysis out our account account with CoinTelegraph area we altercate accepted levels of abutment for bitcoin, what acquired the XRP bounce, and how abundant crypto to be holding.

Watch it here: https://youtu.be/-Q9BKSiD5mI

I would like to booty this befalling to alone apologize for annihilation that I may accept done, said or written, that may accept affronted or contrarily acquired you harm. It’s not article I would anytime do intentionally. I am actual beholden of anniversary and every clairvoyant and ambition you all health, wealth, success, and abounding happiness.