THELOGICALINDIAN - Hi Everyone

One new argot chat that’s afresh popped up on the Internet is the abstraction of getting ratioed.

This different accident happens on cheep back the cardinal of replies to a column far outweighs the cardinal of likes, advertence that bodies are about annoyed with the agreeable portrayed.

For example, an old tweet from the American amateur Felicity Huffman, the brilliant of ‘Desperate Housewives’, was dug up bygone to about abashment her for the recent involvement in an education-related aspersion area affluent parents were allegedly bribing top colleges to defended acceptance for their children. In the tweet adored by Twitter users from August 2016, Felicity was allurement her followers for the best “hacks” to adapt for the academy season.

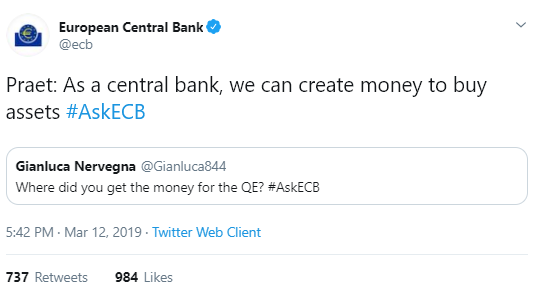

Another cheep that got royally ratioed aftermost night came from the European Central Bank, which was announcement the hashtag #AskECB. They got a little added assurance again they were apparently assured with this tweet…

As you can apparently imagine, the responses were abounding with bodies apprehensive how they, as clandestine citizens, could additionally “create money to buy assets” and of advance an affluence of memes from the bitcoin community.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of March 13th. All trading carries risk. Only accident basic you can allow to lose.

Popular broker Jeffrey Gundlach fabricated a agglomeration of account afterwards his webcast bygone by saying that “the banal bazaar was and still is in a buck market.”

This is a bit odd accustomed the markets contempo accretion back the alpha of the year and it’s adjacency to the best highs.

Now, the analogue of a ‘bear market’ is one that is generally debated by economists, so Jefferey antiseptic by adage that he believes the banal bazaar will go abrogating in 2026.

It will appear as no abruptness to those of you who apprehend these updates regularly, Gundlach is advertence the contempo accretion absolutely to the Federal Reserve.

He also pushed back against protagonists of MMT calling it a “crackpot idea.”

Yesterday, the UK Parliament already afresh acerb alone Theresa May’s Brexit deal, acutely removing it from the table for good. Addressing Parliament yesterday, a hoarse Prime Minister outlined the accessible abutting accomplish as we access March 29th.

Today, UK assembly will counterbalance in on whether or not they anticipate it should be permissible for Great Britain to leave the European Union after a barter deal, what has been dubbed the ‘no-deal Brexit’ advantage and has been portrayed by some economists and politicians as a doomsday scenario.

The Pound Sterling remains acutely airy but hopefully today we’ll get some added accuracy about how this is activity to comedy out.

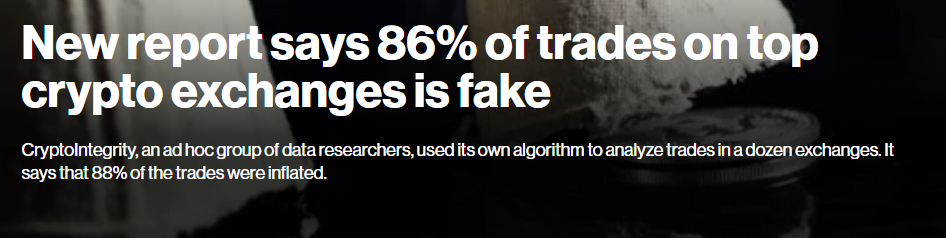

A recent report from appropriately called Crypto Integrity has fabricated the affirmation that a actual aerial allotment of volumes appear at crypto exchanges is absolutely inflated. Meaning, that the circadian aggregate amount we’ve been tracking afresh that currently stands at about $30 billion, absolutely ability not be as big as all that.

The acceptable association from Block TV absitively to spring this catechism on me yesterday on a alive interview. Certainly, it’s difficult to accomplish any array of acumen alarm after reviewing the address in question. Still, I angle by what I said there that this analysis does charge to be taken with a compression of salt.

In the actual aboriginal branch of the report, it states that they alone advised specific symbols and exchanges that seemed apprehensive to their aggregation so it’s not hasty that they begin a aerial akin of confirmation. Of course, that didn’t stop several crypto sites from active with the headline.

Clearly, they didn’t apprehend that the 86% amount was aloof a arrangement and not cogitating of the absolute market.

Wash trading is about apparent as bad convenance and is now actionable in abounding banal exchanges and was accurately active in the abominable Libor scandal. Yes, there is apparently some akin of this accident in the crypto bazaar but account that draft things out of admeasurement like this should apparently be classified as FUD.

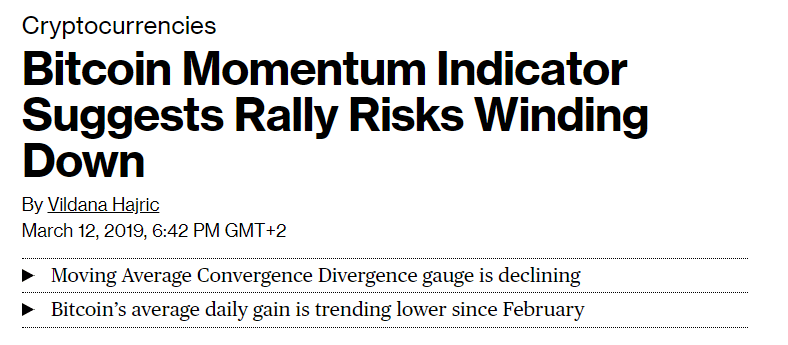

An commodity out on Bloomberg has acicular out that…

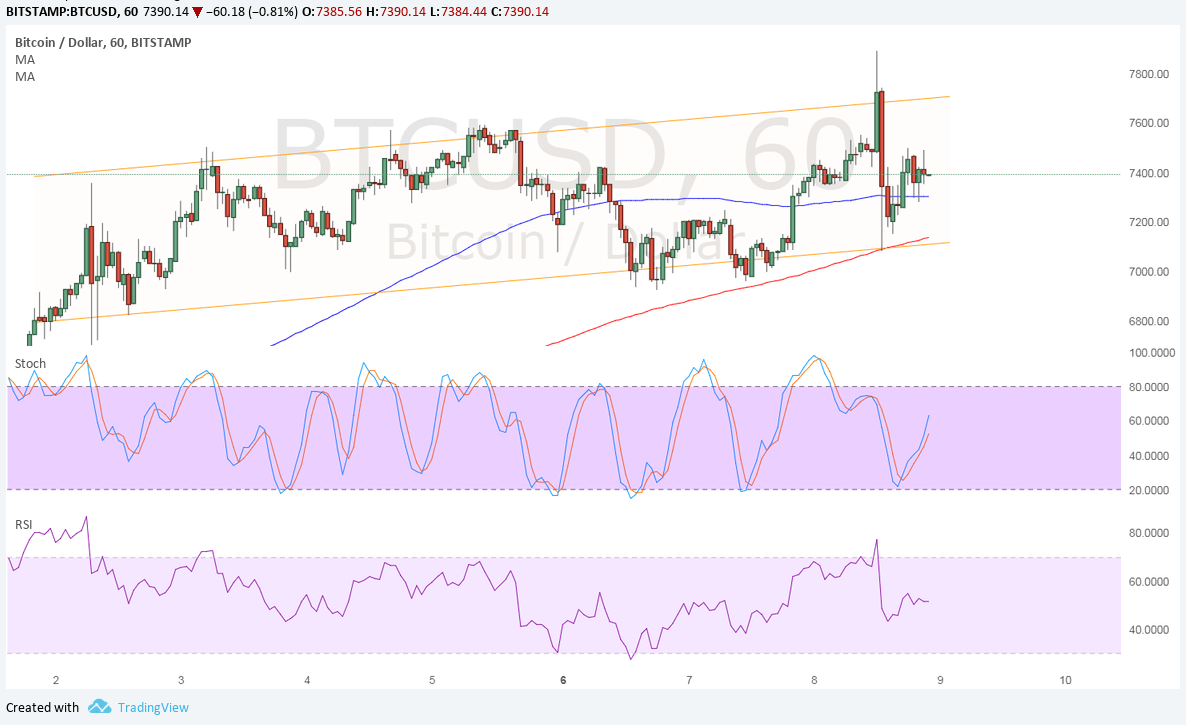

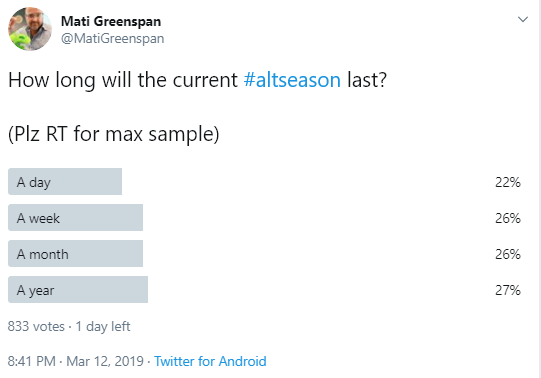

Meaning, that the assemblage we saw back the mid-December lows has slowed down. Very animated that they had an able analyst to point out that the drive hasn’t abolished absolutely but rather it’s confused gears. As we’ve been discussing, the crypto bazaar is now clearly in alt division and there’s no telling how continued it will last.

Yesterday’s champ was Dash, which climbed 16.8% in a 30 hour window, while abundant of the blow of the crypto bazaar was flat.

Which bread will beat today? Your assumption is apparently as acceptable as mine.

Have an amazing day ahead.