THELOGICALINDIAN - Hi Everyone

A growing trend that I’ve noticed abounding audience allurement about is anchored assets on crypto investments. So it comes as no abruptness that a aggregation alleged BlockFi just announced they’re accommodating to pay a ample absorption for deposits in crypto.

Some crypto anticipation leaders accept already bidding skepticism, including the blockchain advocate Jake Chervinsky, who seems to be wondering where the money will appear from.

Don’t get me wrong, 6.2% is a appealing acceptable amount for anchored income. However, at this point, I’m not abiding it’s account the risk. Mexican 10 year bonds are currently advantageous 8%, which comes out to an anniversary acknowledgment of about 6% afterwards adjusting for inflation.

As crypto startups go, BlockFi is able-bodied backed. Hosted by Gemini, a adapted crypto exchange, and adjourned by the brand of Morgan Creek and Galaxy Digital, they’re absolutely able-bodied affiliated aural the industry.

Though this isn’t article that I would alone jump appropriate into, I do achievement that they accomplish and will be befitting an eye on it from the side.

@MatiGreenspan – eToro, Senior Market Analyst

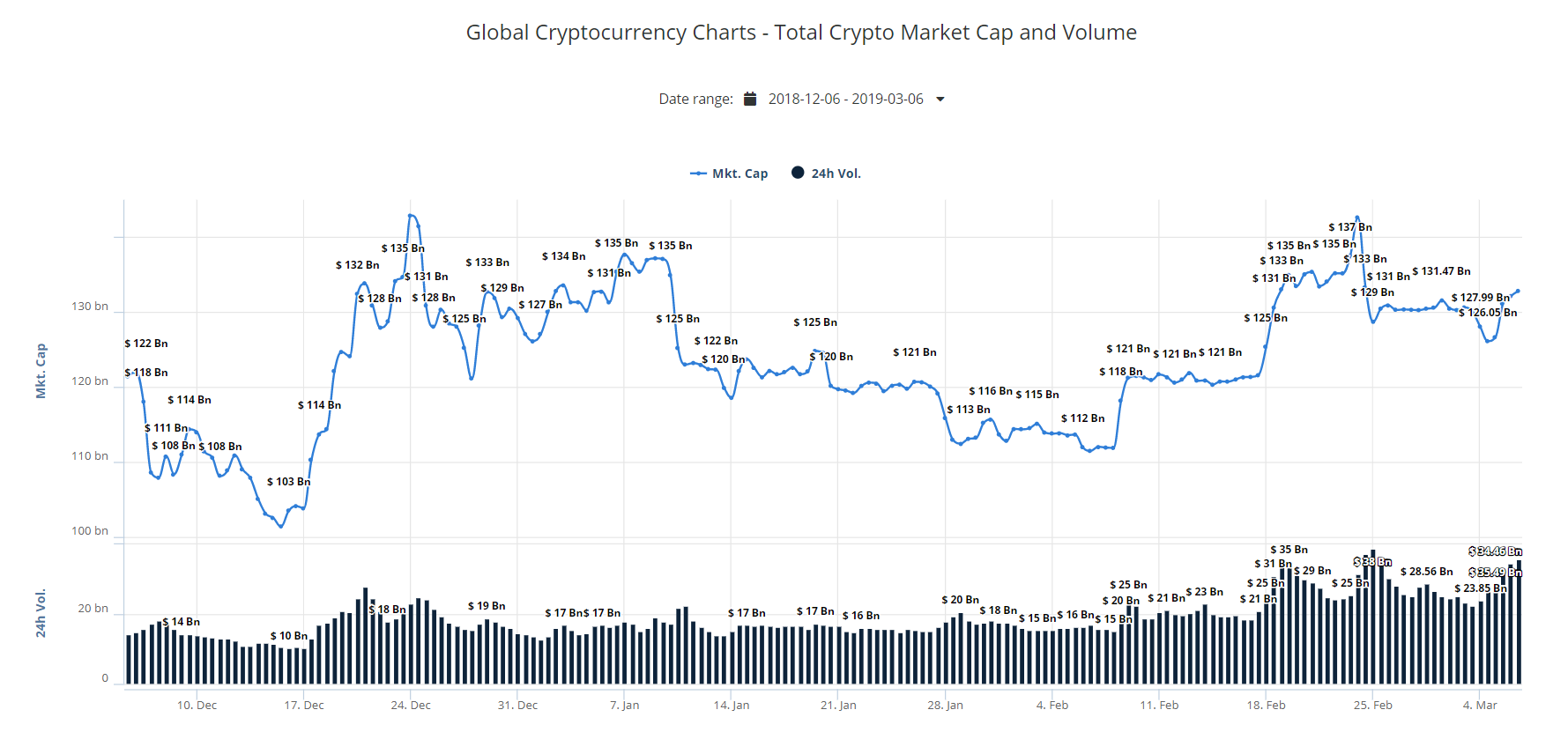

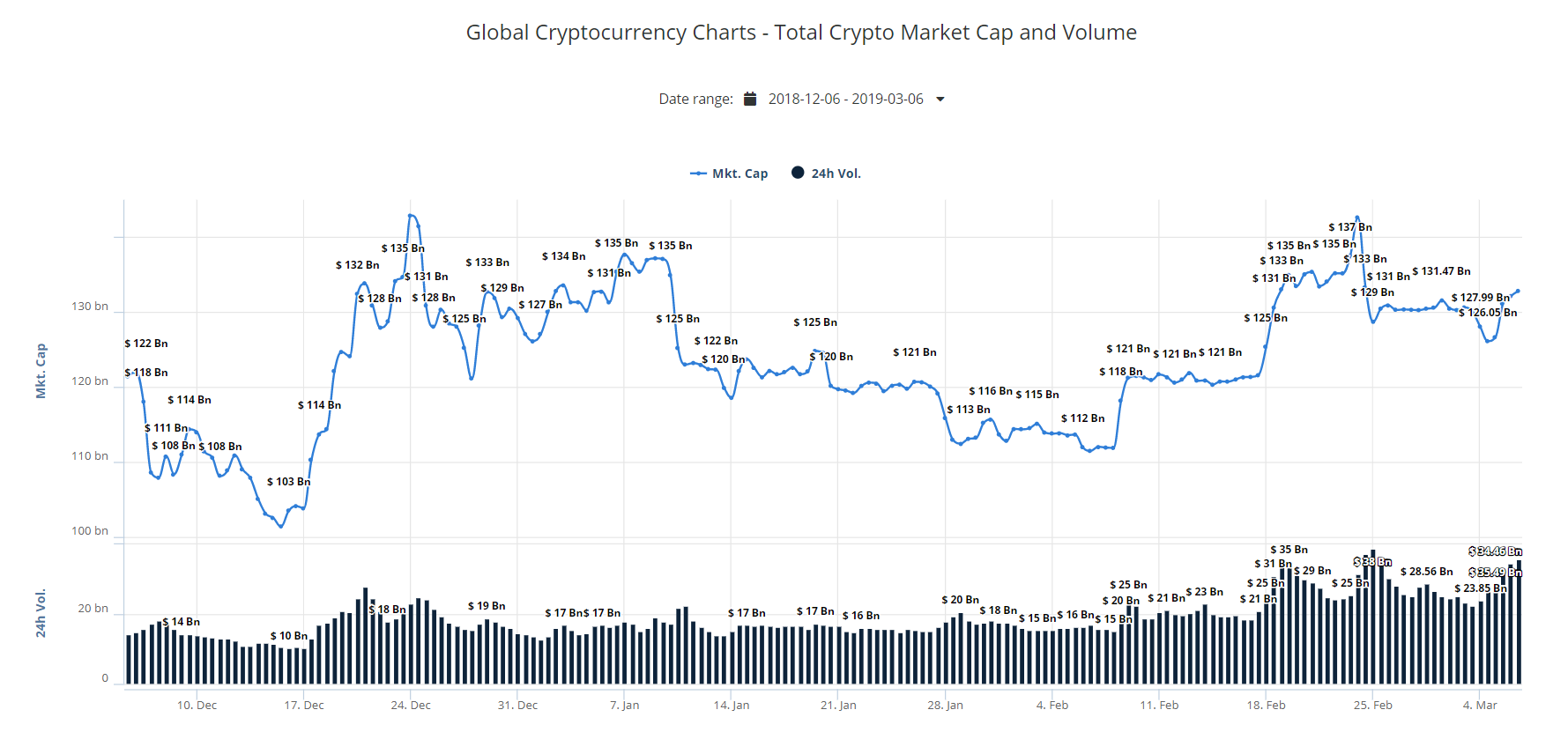

Please note: All data, abstracts & graphs are accurate as of March 6th. All trading carries risk. Only accident basic you can allow to lose.

As the US and China inch afterpiece to a accessible accord by the end of the month, a new ambit of the barter war will appear into focus today.

European Trade Commissioner Cecilia Malmstrom will accommodated US Trade Rep Robert Lighthizer in Washington to see if they can achieve some of their differences. Talks are still in aboriginal stages at this point so we don’t apprehend any cogent breakthrough, but at atomic afterwards today, we should get a acceptable account of the key issues and the administration these talks may take.

Stocks are abundantly alloyed today and volumes abide thin, no agnosticism due to a abridgement of above news.

In this market, it isn’t aberrant to apprehend bodies with rather advancing and sometimes acutely absurd targets. We accept apparent some agenda assets acquaintance 10,000% advance aural a abbreviate timespan, so somehow this affectionate of targets can assume affectionate of normal.

The latest one that I begin arresting came from Yoshitaka Kitao, the President and Representative Director of SBI Holdings who is reportedly expecting to see XRP at $10 ancient this year.

Now, we apperceive that SBI has big affairs through their affiliation with Ripple Labs, and afresh appear a affiliation with R3 Corda, who is additionally a accomplice with Ripple and Swift. However, the admeasurement that these companies will absolutely advance the Ripple badge is still in question. So to apprehend this amount alarm from a guy like Kitao, it adequately reassuring.

Questions about XRP and its continuing in my claimed portfolio did appear up bygone in our account webcast for eToro Platinum and Professional clients. You can bolt the recording here. We did additionally allocution about the blow of the macro markets and accepted trends too.

This morning we saw addition big bound in the crypto markets, already afresh with Liteceoin, EOS, and Binance Coin arch the way.

The affidavit that these three bill are arch accept been discussed in antecedent updates abundant that we shouldn’t accept to reiterate them today. However, we can reiterate the actuality that volumes on the bitcoin blockchain and volumes beyond all-around crypto exchanges are ascent steadily and comestible these college levels.

Much like the song LA Woman, crypto rallies can sometimes get out of duke but abiding drive usually builds up gradually.

Let’s accept an alarming day!