THELOGICALINDIAN - Hi Everyone

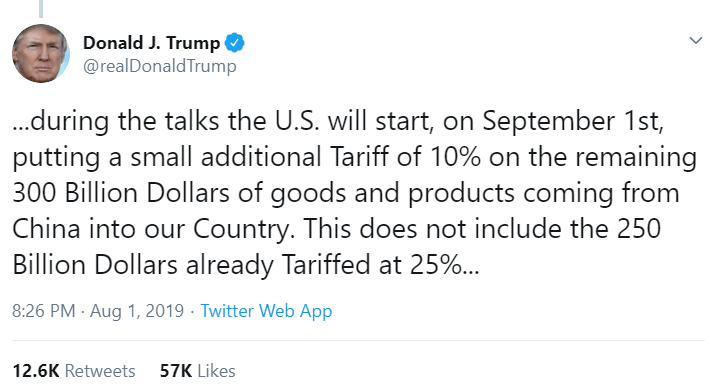

No eventually had the Fed cut ante than President Trump attacked China with added tariffs.

Even admitting Trump says the accepted barter talks amid the US and China are “constructive” and that they are agreeable in “positive dialogue,” as allotment of his tweetstorm yesterday afternoon he pushed in some ablaze tariffs.

The markets didn’t like this actual abundant and are activity through a bit of a assessment anger today. We’ll analysis the archive below.

It’s additionally account acquainted that the President has bidding his antipathy for the Fed’s absorption amount accommodation on Wednesday. Not because he anticipation they shouldn’t cut as abounding economists warned, but because they didn’t cut enough. He capital more.

By advancing China with tariffs he’s basically aggravating to force the Fed to cut ante added or at atomic get the markets to do it for him.

Notice: I will be traveling on Monday and clumsy to address the circadian bazaar update. We’ll resume as accepted on Tuesday, August 6th. If anybody in or about the greater Los Angeles area wants to meet, hit me up!!

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of August 2nd. All trading carries risk. Only accident basic you can allow to lose.

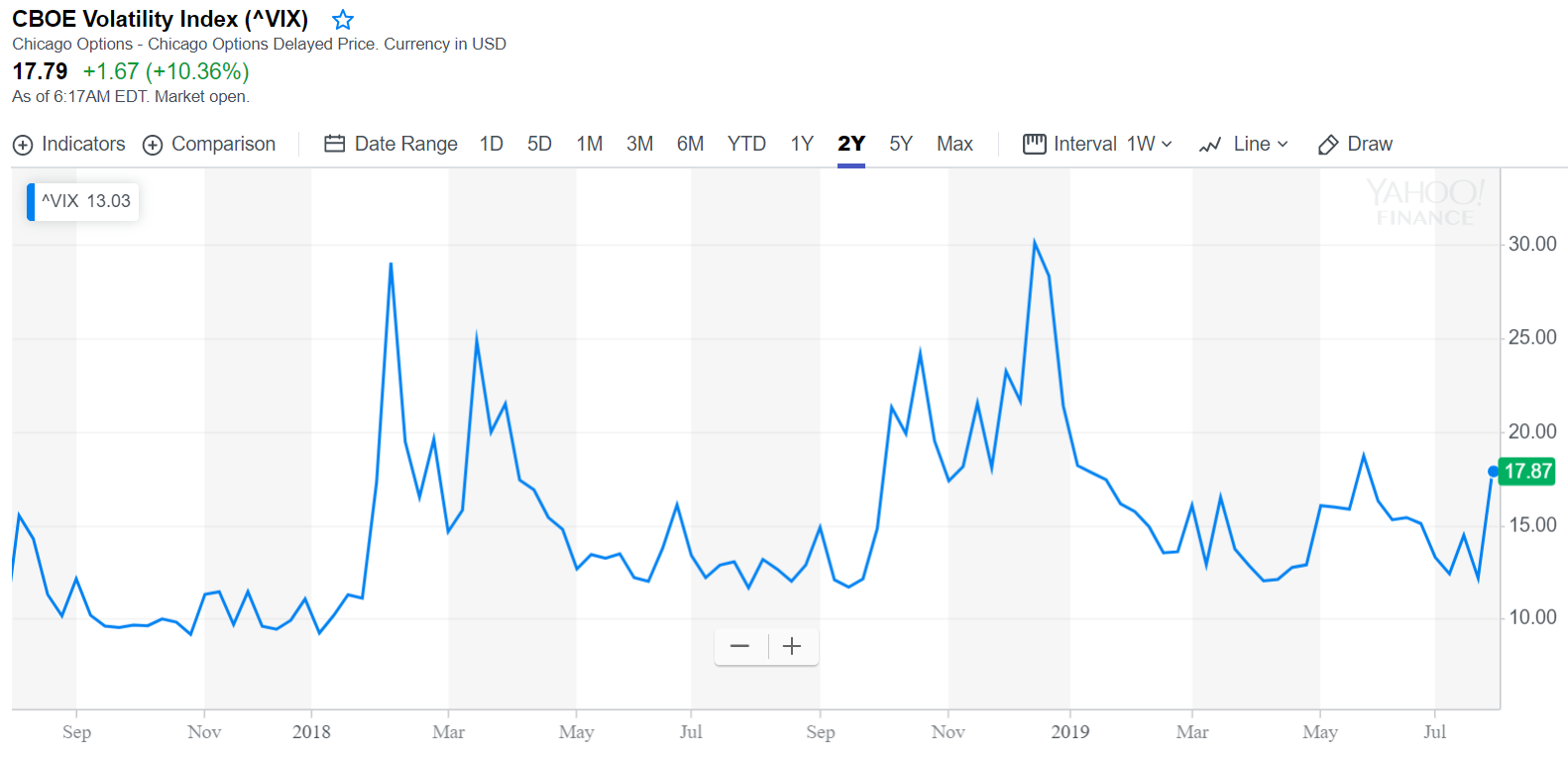

The aboriginal blueprint we charge to attending at puts things in perspective. Of course, I’m talking about the VIX animation index, which is assuming a spike.

As we can see, tensions are animated in the markets appropriate now, but in the admirable arrangement of things, this is still a controlled tumble. It’s not alike the accomplished levels of the year and boilerplate abreast the abhorrence that markets were activity in December back they acquainted the absolute achievability of two amount hikes in 2026.

The abutting accumulation we appetite to see is the banal indexes. You can analysis out several altered bounded indexes on your own time, but for the purpose of today’s note, we’ll use the S&P500.

After a abrupt assignment aloft 3,000, it does arise that we’re accepting a pullback. Of course, it’s absolutely accessible that the pullback is over, but I’m not affairs it. For me, there’s a fair adventitious that we accommodated that 200 DMA afresh and alike a absolute but beneath acceptable attempt we analysis the lows of that December dip.

Obviously, this isn’t trading advice, but I’ve gone short now with advantage with about 7% of my portfolio. Stops and limits in abode of course.

Gold was a crazy one as well. In yesterday’s webcast for exceptional and able clients, I did do a few above adjustments to my portfolio and acid my gold acknowledgment was one of them. Don’t get me wrong, I’m still absolutely bullish but it seemed I’d overleveraged and bare to cut some risk.

My timing was acutely off admitting as gold had an absurd animation hours afterwards the advertisement and is by now testing the highs of $1,450 again.

Yeah… I accept no clue on this one. Just apprehend volatility.

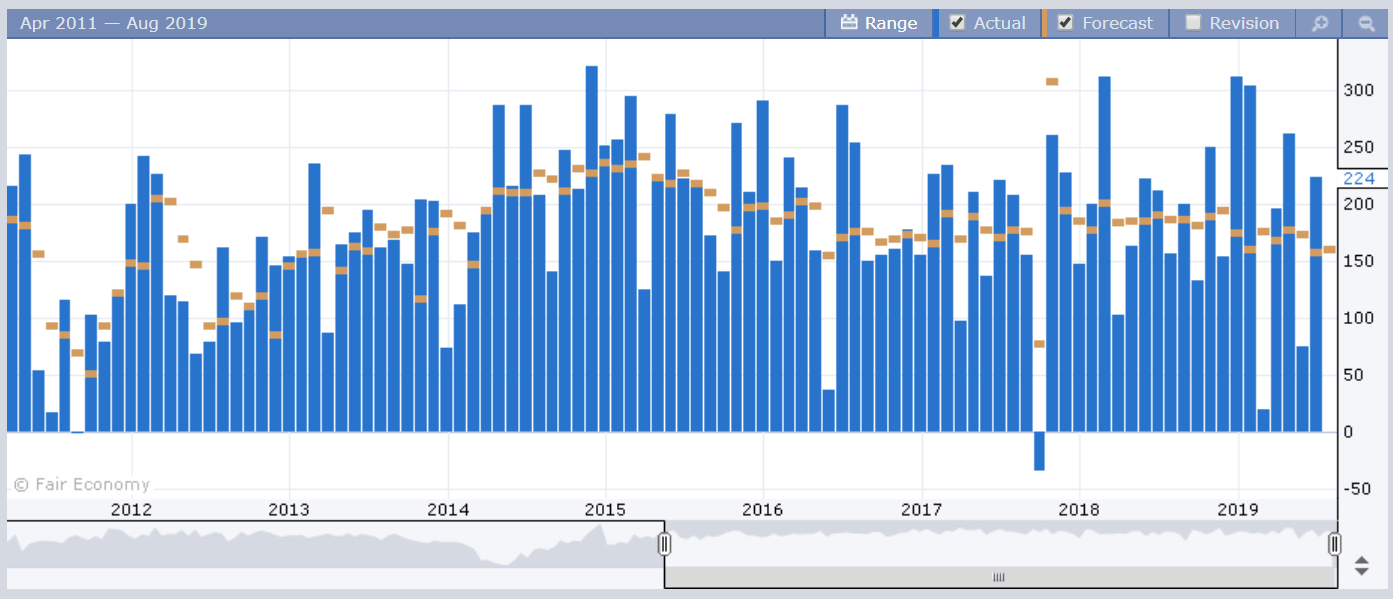

As we apperceive the Non-farm payrolls advertisement is usually appealing airy as the United States releases its account job report.

Analysts are forecasting mild job advance of 164,000 employees.

Given contempo activity from the Fed and the White House, it will be acutely difficult to adumbrate how the bazaar will acknowledge to any accustomed numbers. What we can say though, is that the added the aftereffect is from the forecast, the added animation we can apprehend to see.

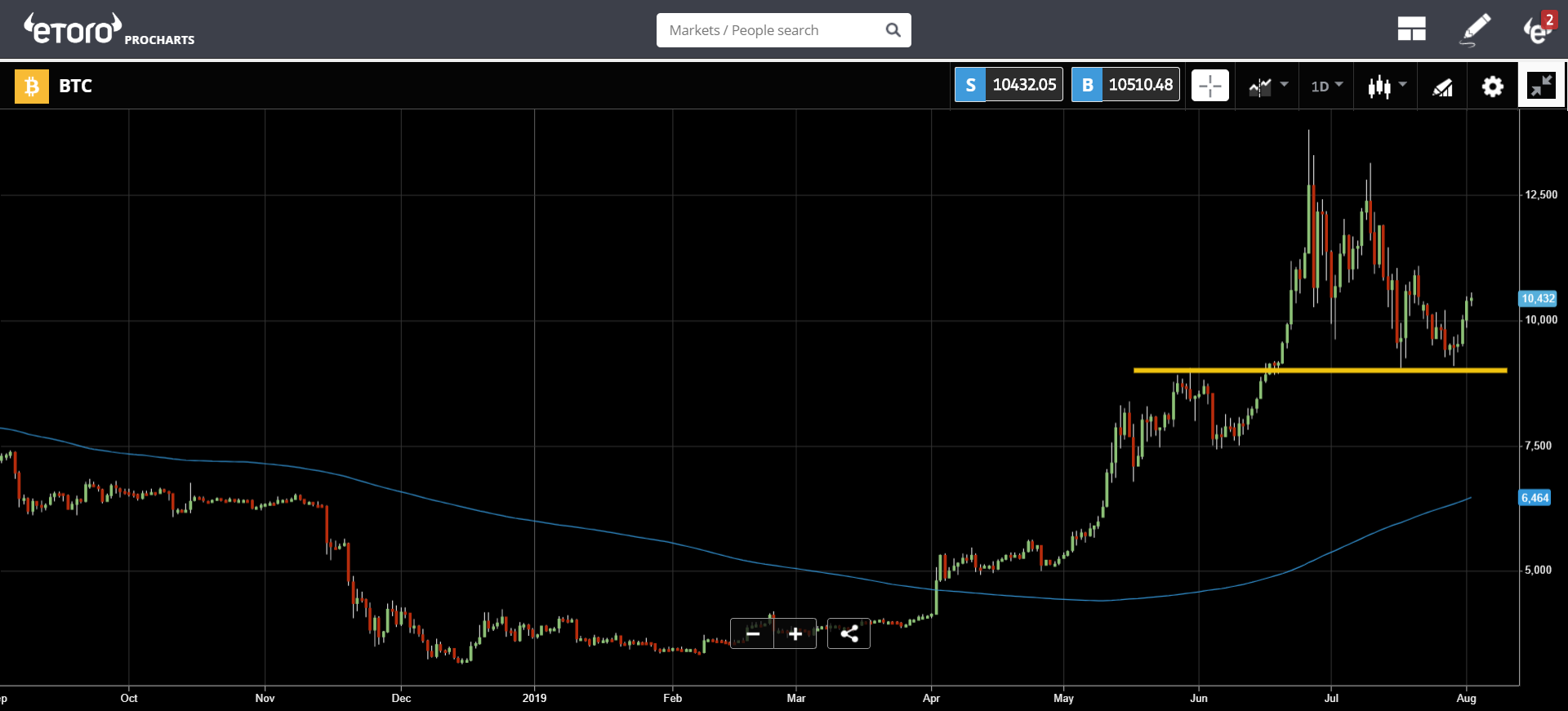

Even admitting alternation does not according account and we still don’t accept abundant data, it’s difficult to avoid the accompaniment that bitcoin rose acutely in May and June while the US and China barter tensions were at their height. Today, already afresh we see the astriction ascent amid the world’s two better economies and Bitcoin is on a close footing.

At the alpha of the week, we saw bitcoin bouncing accurately off abutment at $9,000 (yellow line) with able volumes. We’re still way aloft the 200 day affective boilerplate (blue line) and my activity is that we ability charge to analysis that afresh afore a balderdash bazaar can be confirmed.

For ball this weekend I capital to allotment article that some of you may accept already seen. It is affectionate of alarming up on crypto twitter. But if you haven’t apparent it yet or appetite to watch it again, accomplish abiding to analysis out.

The Golden Debate – This agitation has Pomp aggravating to argue acclaimed gold bug Peter Schiff that bitcoin can be a applicable abundance of amount aloof like gold is.

It’s expertly hosted by CNBC’s Ran Neu Ner, who asks at the end, who won?

Well Ran, back you asked…

Peter won. If the ambition was to argue Peter, it doesn’t assume like that happened. To be fair, it was apparently an absurd ambition to activate with though.

One abode I anticipation Pomp could accept adequate was his closing argument. It seems he chose the FOMO access but in agitation terms, this is an calmly academic aberration called Pascal’s Wager.

Example, adage that you should accept in G-d artlessly because if you don’t there will be after-effects does not absolutely prove the actuality of an absolute absolute being.

Pomp could accept adequate his altercation by active home the actuality that Peter’s own website, in fact, accepts bitcoin.

Regardless of the actuality that his website uses a middle-man account that accepts bitcoin and delivers him Dollars, Peter is still a accidental affiliate of the Bitcoin network. By abacus addition abode area bodies can absorb bitcoin he’s aback accretion the admeasurement of the arrangement and with it the amount of bitcoin.

Have an alarming weekend!!