THELOGICALINDIAN - Hi Everyone

One above agency of ambiguity may now be removed from banking markets, possibly paving the way for a abiding aeon of aberrant adherence for investors.

President Donal Trump has officially kicked off his 2020 presidential campaign.

From now until November 2026, Donald J Trump is acceptable to be on his best behavior, at atomic as far as the markets are concerned.

@MatiGreenspan— eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 19th. All trading carries risk. Only accident basic you can allow to lose.

The long-awaited and much-anticipated Federal Reserve absorption amount accommodation will be delivered at 2:00 PM New York Time followed by a appropriate columnist appointment with Chairman Jerome Powell at 2:30.

The markets accept been salivating afresh over the acutely dovish about-face the Fed has taken afresh and the banal bazaar is aural ambit of its best aerial already again.

Will the markets get aggregate they appetite from the Fed today? From the way I see it, it doesn’t assume likely. Don’t get me wrong. Markets rarely bead back Powell is talking, but somehow it seems that the Fed can’t get any added dovish after adopting some austere anxiety bells.

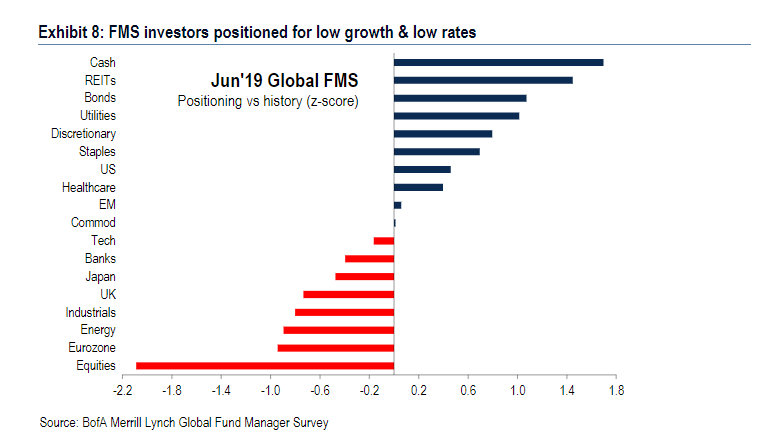

It’s important to agenda that alike admitting stocks are on a tear, armamentarium managers are still absolutely pessimistic. Analysts from Bank of America accept recently concluded that the markets are the best bearish they’ve been back the banking crisis.

Which of course, is actuality taken as a absolute assurance by abounding pundits who say that they can’t get abundant added bearish so the abutting move charge be bullish.

This blueprint from Bloomberg shows appealing acutely how portfolios are currently abundant beneath into chancy assets and abundant added into safe havens than they usually are.

In any case, it will be an absorbing accident today.

To be altogether honest, I was absolutely amiss about yesterday’s Facebook announcement. My activity was that we would get a baby columnist absolution or blog column acknowledging which of the boundless rumors were accurate and which were not.

Instead, we accustomed a massive abstracts dump with affluence of affidavit and alike an aboriginal attending at the opensource cipher of the new ‘blockchain’.

As far as it seems, the tech is actual agnate to that of XRP or XLM. At this point, I wouldn’t say that the above has abundant to anguish about but the closing ability be in a atom of trouble. Stellar Lumens’ capital bazaar is remittances, the exact bazaar that Libra aims to disrupt.

To be clear, this new artefact is no adversary to bitcoin. Bitcoin is open, borderless, censorship-resistant, and immutable, and absolutely decentralized in all aspects of the network. Libra is not.

With all the acutely acceptable intentions from Facebook, there’s alike a fair adventitious this activity never gets off the ground. Within hours of the abstracts release, French Finance Minister Bruno Le Maire presented some serious opposition. Not alone that, it seems that alike US assembly may not be 100% onboard and some called for a complete arrest of the activity awaiting added details.

Even admitting this is a abiding coin, abounding bodies are absolutely bullish. So it’ll be absorbing to see this comedy out.

Over the aftermost few weeks, abounding audience and journalists accept asked me aloof how abundant of the accepted assemblage in bitcoin is due to Facebook’s new crypto?

Well, I couldn’t absolutely say but we should get a clearer account in the abutting few days. As the old bazaar adage goes, “buy the rumor, advertise the news.”

Well, actuality we can see the massive run up on bitcoin. The dejected amphitheater is area Techcrunch announced the absolution date of the white cardboard two weeks ago, the chicken band is back the time the white cardboard was released.

So, depending on the admeasurement of any abeyant pullback we ability be able to get a acceptable abstraction of how abundant of this is fluff.

Let’s accept an alarming day.