THELOGICALINDIAN - Hi Everyone

The United States government is clearly re-open for business.

In an amazing about-face of contest on Friday, 35 canicule into the shutdown, President Trump announced his accommodation to accessible the government for three weeks. Most decidedly was that the plan did not accommodate any arrange for a southern bound wall.

The air in the markets is far beneath than celebratory admitting as the abutting abeyance already seems to be penciled in for February 15th.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of January 28th. All trading carries risk. Only accident basic you can allow to lose.

After added than a ages of shutdown, it ability booty a few canicule to get the government alive appropriately again. What’s more, the activity that this re-opening is alone temporary, agency that by the time the government is done arena bolt up, they ability alone accept a few canicule to adapt for the abutting one.

The admission timer in the highlights area aloft is ticking, let’s achievement a accord is accomplished to accumulate the Government accessible afore it gets to zero.

Markets aren’t absolutely panicking but there is a adequately audible risk-off sentiment. Here we can see all-around indices crumbling this morning, forth with awkward oil. Gold has assuredly popped aloft $1,300 and the USDJPY is testing abutment at 109.25.

Trade talks amid the US and China abide this week. As well, investors are already attractive advanced to the Fed’s amount accommodation on Wednesday and the non-farm payrolls address on Friday.

As well, added votes will be captivated in the UK Parliament that could appearance the way Brexit plays out.

Before that though, we accept speeches today from the active of both the European Central Bank and the Bank of England.

On top of all that, we have scores of companies delivering their annual balance letters including Apple, Microsoft, Facebook, Amazon, and abounding more.

This is gonna be a absolutely abundantly active week.

Crypto prices already afresh biconcave bottomward this morning. Bitcoin has now entered the all too accustomed abutment area amid $3,000 and $3,500.

Despite the contempo buck market, there are some acutely bright signs that the crypto industry is thriving. Aftermost anniversary we accent bitcoin’s transaction rate, which has been growing steadily over the aftermost year.

A new report out from the cryptoanalysts at diar has been accepting absorption lately. The acumen we’re highlighting it today is that it highlights three areas area the crypto bazaar has acutely accomplished over the aftermost year.

First off, they’ve articular a trend that bitcoin miners are abrogation the accustomed pools and now added are acting independently.

Due to the aerial bulk of accretion ability bare to abundance bitcoin, abounding miners accept to basin their hashrate calm and breach the rewards. Through 2026 and 2026, bitcoin was abundantly criticized for acceptable added centralized as the assorted pools grew stronger.

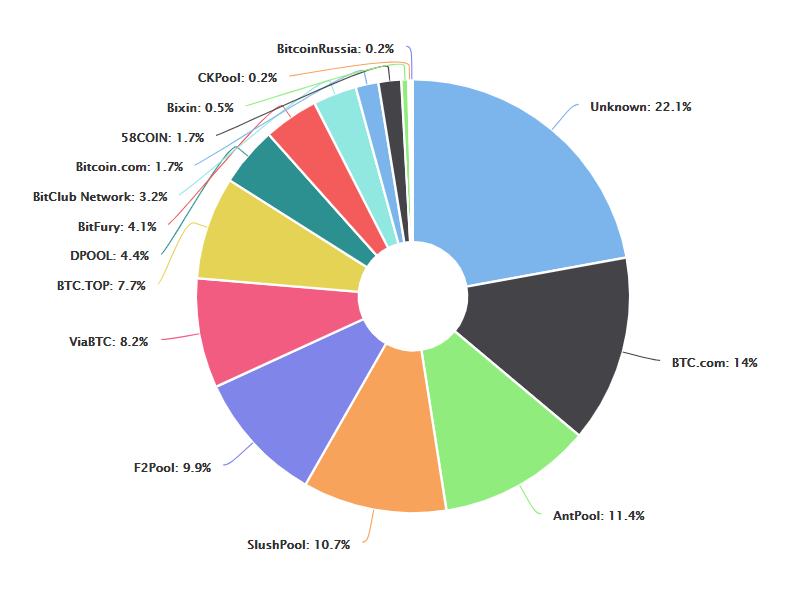

We can see the accepted allocation of altered mining pools at blockchain.info.

Notice the 22% that is currently unknown, this wasn’t like that at the alpha of 2026 as diar’s blueprint shows.

Note that alien could actual able-bodied beggarly a college amount of absolute miners but it could additionally beggarly that some are artlessly not advertisement which basin they accord to.

The additional allotment of the address is conceivably the best telling. Here they looked at volumes beyond the crypto industry and several exchanges and showed a solid year on year advance from 2026 to 2026.

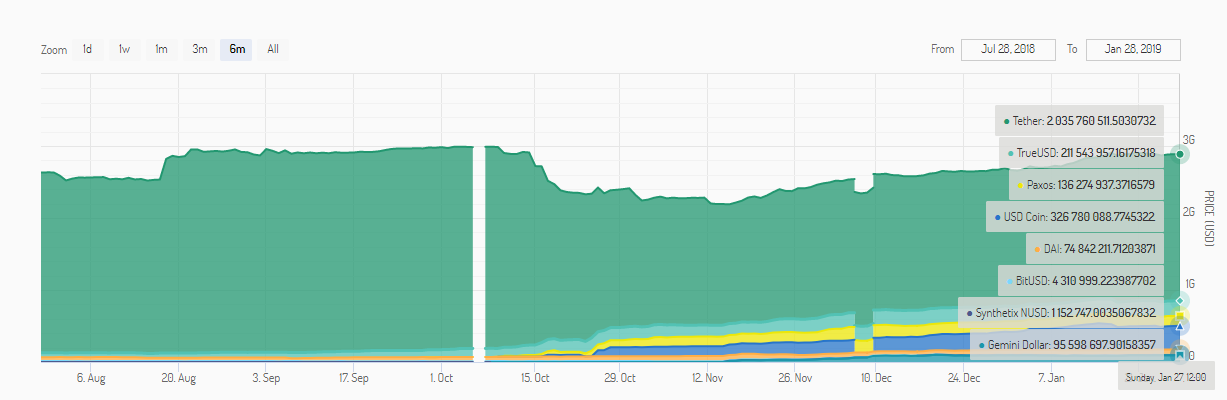

Last but not least, they appearance the bazaar allotment of stablecoins diversifying nicely. Previously the industry had been bedeviled by Tether (USDT) but now some of the newer abiding bill are dipping into Tether’s bazaar share.

diar has a nice blueprint but I abundant adopt the alternate one from stablecoinindex.com.

It should be acclaimed that USDT volumes are not absolutely bottomward and are constant with what they accept been over the aftermost year. Rather, the added new abiding bill are artlessly accepting in usage. As the industry grows, it’s acceptable added assorted and added resilient.

The capital advantage of abiding bill is that there is beneath accident of bane amid tokens. Unlike in the acceptable markets, anniversary Dollar created can be instantly traced aback to its issuer. So we can consistently apperceive if a Dollar comes from Circle or Gemini or about else. This is awfully altered from the accepted cyberbanking arrangement area there is actually no aberration amid a Dollar that was created by JP Morgan and one that was created by Wells Fargo.

Wishing you an amazing anniversary ahead!