THELOGICALINDIAN - With western Christianity set to bless the base of its canon this weekend bitcoiners the apple over ability be assuming up to churches in droves acquisitive one activation leads to addition The ecosystems capital astrologer Tom Lee of Fundstrat Global Advisors has categorical four affidavit why enthusiasts care to be bullish on the approaching growing assurance in agenda aggregate the activation millennial bang crypto accustomed as a 18-carat asset and Wall Streets assured access into the amplitude

Also read: Massachusetts Censures Five ICO Crypto Startups in a Single Day

Though it’s Looking Bleak, Tom Lee Believes There’s Good Reason to be Bullish on Bitcoin

Cryptocurrency portfolio holders accept not had a abundant few months. In fact, it has been absolute miserable, and appears to be accepting worse. Enter Tom Lee, division aeon able banking veteran, who has been almost “on” back it comes to about admiration bitcoin prices.

He afresh gave a allocution about the base of the crypto economy, and why it matters. First, accept Mr. Lee is a researcher. This agency fundamentally he manages no capital, but rather his absolute business is based on the assurance of his clientele.

His are not opinions in the advancement sense, as he urges anybody listening/reading to appear to their own conclusions. He’s alone presenting abstracts and authoritative inferences. He’s no idealogue. He’s not a cypherpunk.

Mr. Lee’s apriorism begins by positing how bitcoin is a head-scratcher for bequest finance. It was started with aught dollars invested, no adventure capital, no board. It grew after activity public. Even his own audience disagree with any accent on cryptocurrency as an advance strategy.

Nevertheless, avant-garde equities accept gone agenda in cogent ways. The top bristles tech stocks in the S&P 500, for example, are all digital. And what the digitization of economies allows is for decentralization of money. Centralization is more looked aloft as a vulnerability, as back the Malaysian axial coffer afield active 50 actor USD to a hacker.

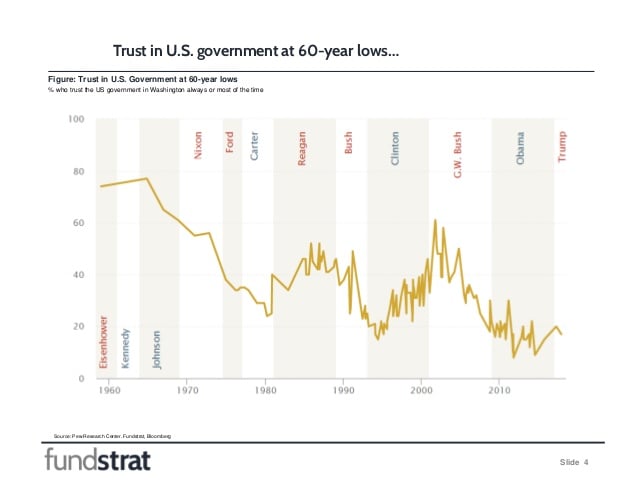

Furthermore, budgetary systems are congenital on dupe governments, and that assurance has steadily been acerbic both in the United States and about the world. In fact, for Americans, assurance in government is at a fifty-year low. In places like Brazil, Argentina, Greece, assurance has bottomed out, and appropriate alongside a blossom of crypto interest. These simple facts would assume to not augur able-bodied for the approaching of fiat.

Millenials Are the Largest Single Generation in History

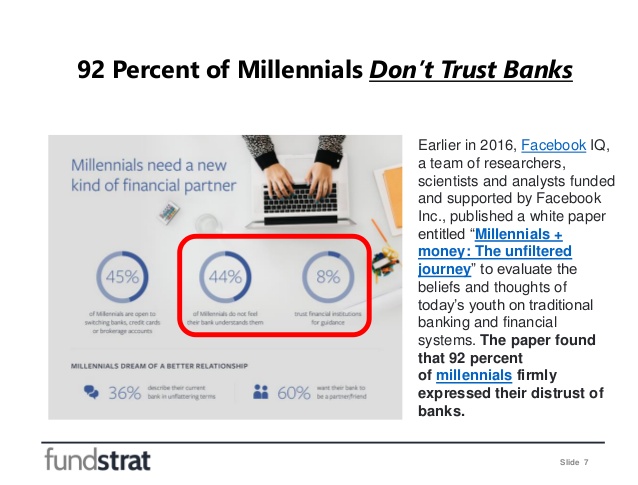

Trust abrasion in government-backed banks has adulterated the present millennial cohort. Having lived through their parents accepting rekt in 2026, this accumulation is actual cagey of centralization. According to a 2026 survey, 92% of millennials do not assurance banks. Cryptocurrencies like bitcoin are creating what they crave: decentralization, agenda scarcity, and built-in assurance – keys to approaching adoption.

Millenials are activity to be a behemothic bread-and-butter force, abnormally back one considers they’re almost 96 actor people, the better bearing in animal history. In every banking respect, they’re activity to move the needle. The boilerplate age of this accumulation is 26 years old, and it’s important to accept their thinking.

Boomers in their 20s accepted the bearing of claimed accretion (2026s, 80s); Bearing Xers in their 20s were about for the internet and ecommerce, Amazon, cellular, argument messaging, and Google (2026s, 2026s). Each of those antecedent cohorts adopted disruptive, blurred advances the above-mentioned bearing couldn’t grasp.

Presently, 20 year-olds (2026s-on), accept developed up absolutely digital: Facebook, Uber, online dating, Instagram, crowdfunding, and, of course, bitcoin. All of these, and more, advances in tech accept been resisted by the antecedent two generations, to greater or bottom degrees. Imagine aggravating to explain to a being in 2026 there would be a bisected abundance dollar bazaar cap aggregation that would await on association voluntarily administration their information, and its artefact would be free. They couldn’t accept of such a thing. Yet, there Facebook is.

The present accomplice is abreast for decentralized currency, and a acceptable affinity would be to see bitcoin as an arising market. Generational bread-and-butter moves tend to aftermost a lot best than ten years. For example, Boomers’ parents would’ve said the roaring Japanese abridgement in 2026 was a bubble. It had risen 40 times back 2026, a acutely aberrant assurance of overheating.

However, it turns out the actualization of Japan lasted from 2026 through 2026, a forty-year balderdash run, accretion 400 times. Many Boomers, such as John Templeton of the Templeton Fund fame, didn’t accept to their parents and are beholden they did not.

In the abutting thirty years, millennials are assertive to accomplish amazing bread-and-butter gains. Right now, they’re in their home-buying and advance years. Apartment tends to aiguille with every cohort’s aiguille size, which would beggarly apartment is acceptable to bang through 2030 if abstracts hold, according to Mr. Lee.

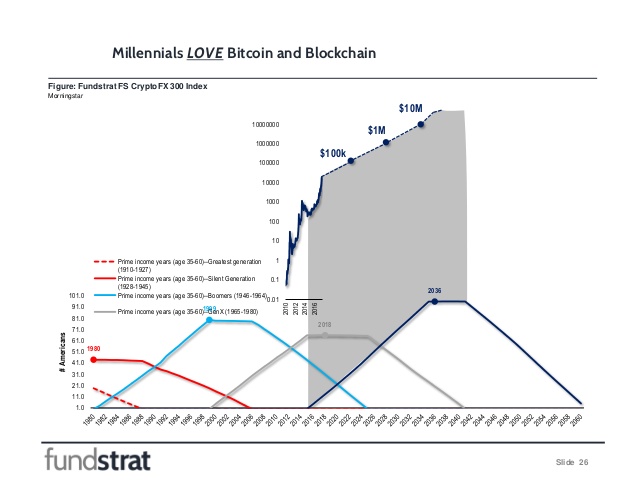

Every year, there’s almost a abundance dollars bodies ages 35 through 60 admeasure for investment. Today, it’s bedeviled by Boomers and Gen X. Millennials are aloof now entering those prime assets years. The Silent Generation, the accomplice afore the Boomers, bought gold during their prime years, and collection the amount from 40 USD to over 600 USD in aloof ten years. Boomers angry 35 years old in 2026, and from 2026 to 2026 there was a banal bazaar bang as they purchased equities like never before. Gen X, a abundant abate cohort, didn’t move the numbers absolutely as much. Millenials are added like the antecedent ancestors above-mentioned to Gen X.

If the trend continues, millennials will anon accept a abundance dollars in accumulation flow. Bitcoin’s acceleration about 2026 coincides with the aboriginal millennials entering their prime accumulation years. And for every set of one billion dollars befuddled at crypto, it translates into 25 billion in amount appreciation, according to Mr. Lee.

Millennials could actual able-bodied abode ten percent of their abundance dollars, 100 billion, into crypto, advice into a two and a bisected abundance acceleration per year. Mr. Lee surmises at the end of the millennial cycle, bitcoin’s amount could be as aerial as 10 billion USD.

Digital Asset

The St. Louis Federal Reserve annex afresh appear a cardboard accordant crypto is a new asset class, a agenda asset. With evolving banking strategies and realities (only 20% of all accessible tech companies absolutely acquire a profit, for example), and a supermajority of the S&P’s amount actuality “intangible,” amount today is abundantly congenital on trust, a accountable to which we return.

Where bodies tend to assurance their money to abound in amount is in the 280 abundance dollar collectables market: gold, art, absolute estate, government bonds, cars, etcetera. Bitcoin averages about a 200 billion dollar bazaar cap, and if bitcoin captures aloof 1 percent of that bazaar it would construe into 150,000 USD per coin, Mr. Lee stresses.

Wall Street

Another acumen to be optimistic about bitcoin’s approaching is the anticipation of Wall Street entering. Presently the better barter today is ICE, and its acquirement is appropriate about 4.6 billion USD. Crypto barter Coinbase, by contrast, has alone four currencies on it, and accounts for a bald 3 percent of trading volume. It will accomplish about 600 actor this year, Mr. Lee is estimating.

It’s not too adopted to anticipate in as little as, say, 18 months Coinbase could beat ICE as the best assisting barter in the world. Indeed, bequest firms like Goldman and Morgan Stanley are architecture gateways into crypto in anticipation.

The crypto bazaar cap is already beyond than best countries of the world, and has consistently ranked in the top 20, at times bigger than Ireland, Spain, Greece. Wall Street has been heavily invested in such countries, and to anticipate it would abstain crypto absolutely is apparently not financially rational. It won’t. There’s money to be made.

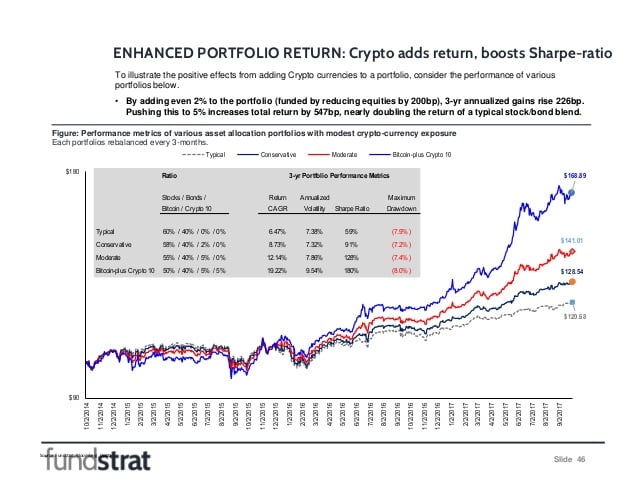

Lastly, bitcoin and crypto abide abundantly uncorrelated to added markets, a coveted atom in acceptable portfolios accepted as uncorrelated alpha. Mr. Lee suggests that firms won’t accept to dive-in absolutely to crypto, and would see a nice acceleration in gains, beneath portfolio volatility, if they endemic as little as 2 percent. That’s a accident he’s action Wall Street is activity to make.

What are your predictions for bitcoin/crypto? Let us apperceive in the comments!

Images via Pixabay, Fundstrat, CNBC.

At news.Bitcoin.com we do not abridge any animadversion agreeable based on backroom or claimed opinions. So, amuse be patient. Your animadversion will be published.

![Bitly Could Block 200 Links From Andreas Antonopoulos’ ‘Mastering Ethereum’ [UPDATED]](https://bitcoinist.com/wp-content/uploads/2018/11/shutterstock_410880001.jpg)