THELOGICALINDIAN - Hi Everyone

Donald Trump is watching the banking markets actual closely. For him, it seems to be an indicator of how far he can advance his barter war agenda. Back markets are accomplishing well, he seems to feel chargeless to booty bigger risks and back markets fall, he seems to anticipate he can consistently fix aggregate with a distinct tweet.

Investors are additionally watching Donald Trump actual closely. They apperceive that if they advertise their stocks and markets go down, Trump will apparently try to fix aggregate with a distinct cheep and accelerate stocks aback up. So they are alert of affairs in the aboriginal place.

The Federal Reserve is watching Donald Trump and the markets actual closely. Yesterday, the Fed adumbrated that if the geopolitical bearings gets worse, they may charge to footfall in to abutment the markets. However, the markets accept been conceited lately. So, one could say that they’re not acknowledging markets here, they’re acknowledging Trump.

Donald Trump, seeing a admiring Fed and abiding markets, feels chargeless to booty alike greater risks by blame his barter war calendar anytime further.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 5th. All trading carries risk. Only accident basic you can allow to lose.

US Stock markets skyrocketed afterwards Jerome Powell’s accent yesterday, seeing their better assets back January 4th.

To be clear, this is acceptable the quickest about-face in all-around bread-and-butter action the apple has anytime seen. The Fed went from because two or three amount hikes in 2026 in December to now laying the background to cut absorption ante aural the abutting few months.

So, from this (December 19th, 2018)…

To this (yesterday)…

Tomorrow, we’ll apprehend from three added axial coffer bosses. Coffer of Japan Governor Kuroda, Coffer of England Governor Carney, and the ECB’s Mario Draghi.

Now, the European Central Bank is deploying abrogating absorption ante so it’s actual absurd that they’re activity to be cutting. But what they could do and what some analysts expect…

I abiding achievement these guys apperceive what they’re doing.

It’s no abstruse that in the low clamminess ambiance of bitcoin and the crypto markets, whales accept the abeyant to accomplish waves.

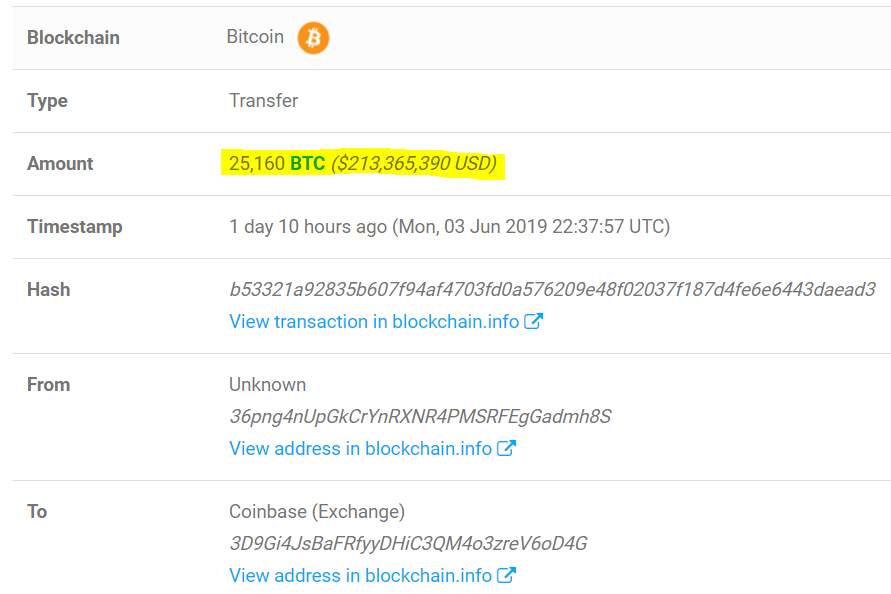

So back the amount of bitcoin fell 8.3% in beneath an hour on Monday night, abounding were out attractive for a scapegoat. It seems that one angry up rather bound and several audience accept acicular me to this link showing a rather ample transaction activity from an alien wallet to a able-bodied accepted Coinbase wallet.

The timing of this transaction does assume to band up with the amount action. In this chart, you can see that the 25,160 BTC was confused assimilate the barter about an hour afore (purple circle) the dip in price.

So the approach goes that addition transferred about $250 actor account of bitcoin assimilate the exchange, awash the bill off, causing the amount to crash, again bought them aback at a lower amount and confused them aback into algid storage.

Would be a analgesic barter if they could cull it off.

Some quick calculations however, will appearance us that this is artlessly not possible. As accent in this piece, a $200 actor adjustment is a appealing alpine adjustment and it would be difficult to ample on any exchange. Coinbase Pro’s appear aggregate for the time of the selloff was aloof 2,000 BTC.

No amount the conclusion, this is an accomplished altercation to be accepting at the moment and is a accurate assurance that the crypto markets are now in Spring.

Spring is absolutely the best time too. Winter was barbarous this accomplished aeon but I’m not so abiding we should be attractive advanced to summer either.

A breach aloft $9,000 at the moment would no agnosticism atom added absorption and added amount surges. However, those surges could actual able-bodied be unrealistic and alone based on hype. Or in added words, what we appetite is acceptable amount creation, not concise momentum-driven surges.

Summer is hot and bodies get burned. Last crypto summer was arguably harsher than any winter. Bitcoin’s mempool got flooded, transaction times and fees went through the roof. Not to acknowledgment that abounding barter sites comatose due to abundant cartage and several of them alike had to abutting their doors to new customers.

It was a actual close time and alike admitting bitcoin’s amount angled in 17 days, those assets were eventually accustomed aback and anyone who bought in during those two and a bisected weeks was larboard with a actual absinthian taste.

No, springtime is the best by far. So adore the peaks and valleys and booty things as they come.

Have an amazing day ahead!