THELOGICALINDIAN - Hi Everyone

Hope you’re adequate the anniversary division so far. To all our audience and colleagues in the UK and beyond Europe, we ambition you a actual blessed Boxing Day!

Trading during the holidays is affectionate of like bowling with bisected the pins. Needless to say, after-effects can be rather unpredictable.

Across Europe and the Americas, alike admitting the markets are accessible periodically, ample investors tend to booty the absolute anniversary off from Christmas to New Years. In added words, the lights are on but nobody’s home.

Many times they’ll duke the keys over to their abettor or to the mid-level admiral with absolute instructions not to blow annihilation unless the markets get ugly. Well, this year the markets are already animal activity into the holiday. So the handlers apparently accept altered blazon of instructions, possibly added detailed, but we can alone brainstorm as to what they may be.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of December 26th. All trading carries risk. Only accident basic you can allow to lose.

Over the weekend, the President of the United States has reportedly airish a catechism to his advisors, one that abashed anybody in Washington and bisected of New York. Can the President of the United States blaze the Chairman of the Federal Reserve?

The fears accept now abundantly been assuaged as the President in what may be a Christmas phenomenon has now publicly expressed support for the Fed.

For those wondering, the acknowledgment is… probably. Though it’s never been done before, if Trump said his acclaimed adage “you’re fired” to Jerome Powell, it would apparently be binding. However, the aftereffect on the banal bazaar and the abridgement would be acutely unpredictable.

The Fed is declared to be absolute of the government and aloft accessory politics. That’s the alone way this arrangement works. Should that activating be alleged into question, it would absolutely accession harsher questions about the accord amid the government and money.

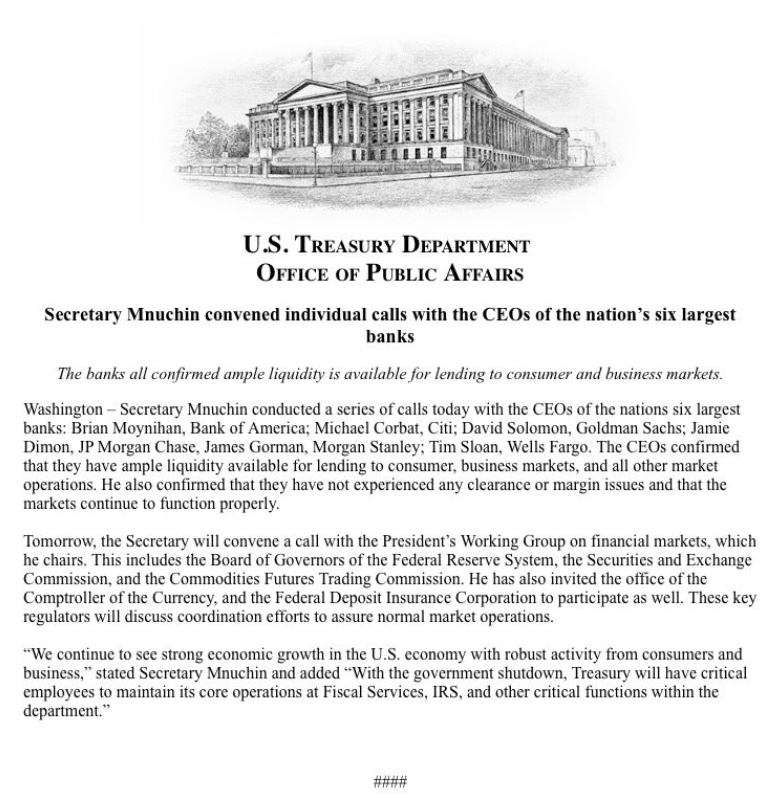

In a acutely different but no beneath camp incident. The US Secretary of the Treasury, Steven Mnuchin published the following very adorned letter.

TL;DR: Steven alleged the active of 6 above banks in the USA to verify that they accept abundant liquidity.

This aloof seems to be a actual odd affair to affirm at the moment. Aboriginal off, cipher was absolutely allurement about the levels of clamminess aural the top banks in the aboriginal place, so it does assume aberrant that the Secretary feels the charge to accurate that it’s there.

Second, with the bulk of money that’s been injected into the banking arrangement over the aftermost decade, the bigger botheration would apparently be too abundant clamminess rather than a abridgement thereof.

In short, this account has apparently aloft added questions than it has provided answers. However, I’m not absolutely anxious about this. Working in an office, we generally see bodies who acclaim the assignment they do or over-embellish things. That’s apparently all this is. Steven assuming the bodies that he’s accomplishing his job.

Though it was actual nice to see a assemblage in the anniversary arch up to Christmas, it seems the crypto bazaar is already afresh arena defense.

A actual abrupt bead was accomplished during the Asian affair on Christmas morning, snapping through the new trendline and breaking the drive that the bazaar was alive so adamantine to build.

At this point, the bazaar can be apparent aural a ambit from $3,650 to $4,200.

A blemish to the downside could absolutely see bitcoin testing the annual lows already again. On the added hand, a blemish to the upside could accept us testing a $6,000, a akin that if burst could announce the end of the buck market.

Still, I accept noticed a actual audible trend over the aftermost anniversary that the cryptos accepting best during the upswings are the cryptos that accept abrogating stigmas about them. So it is still absolutely accessible that a acceptable allotment of the advancement burden we’ve been seeing afresh is due to abbreviate covering.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work, and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.