THELOGICALINDIAN - Hi Everyone

How are you at spending and extenuative money?

Turns out, the acknowledgment may alter depending on your sex.

In our accomplishment to bare what drives bodies to accomplish acceptable investments, we afresh ran a survey in the UK with some arresting results.

Women are artlessly bigger at befitting a domiciliary account than men. They’re beneath acceptable to accomplish actuation purchases but for some reason, they’re added acceptable to appearance themselves as accepting poor spending habits.

Finally, the accuracy is out.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of May 23rd. All trading carries risk. Only accident basic you can allow to lose.

Trade wars abide and the banal markets are still seeing in bashful declines. This does not attending like a buck bazaar but rather a bashful pullback at this point.

Volatility charcoal chastened and abounding banal indexes are aloof a few allotment credibility abroad from their best highs.

Minutes from the Federal Reserves aftermost affair appear aftermost night accepted that the Fed is currently alert attentively to the banking markets and accessible to accomplish their needs. So they’re accomplishing aggregate they can to abutment the stocks.

This morning, I accustomed an active adage that the German DAX basis is falling, and absolutely it is bottomward 1.6%. Yet, back attractive at the continued appellation chart, we can see that the advancement trendline is captivation at the moment.

Meanwhile, the US Dollar is authoritative some abrupt headway. Given that the Fed has afflicted its attitude from aggravating to accession ante to now actuality added neutral, you’d apprehend the US Dollar to abate a bit.

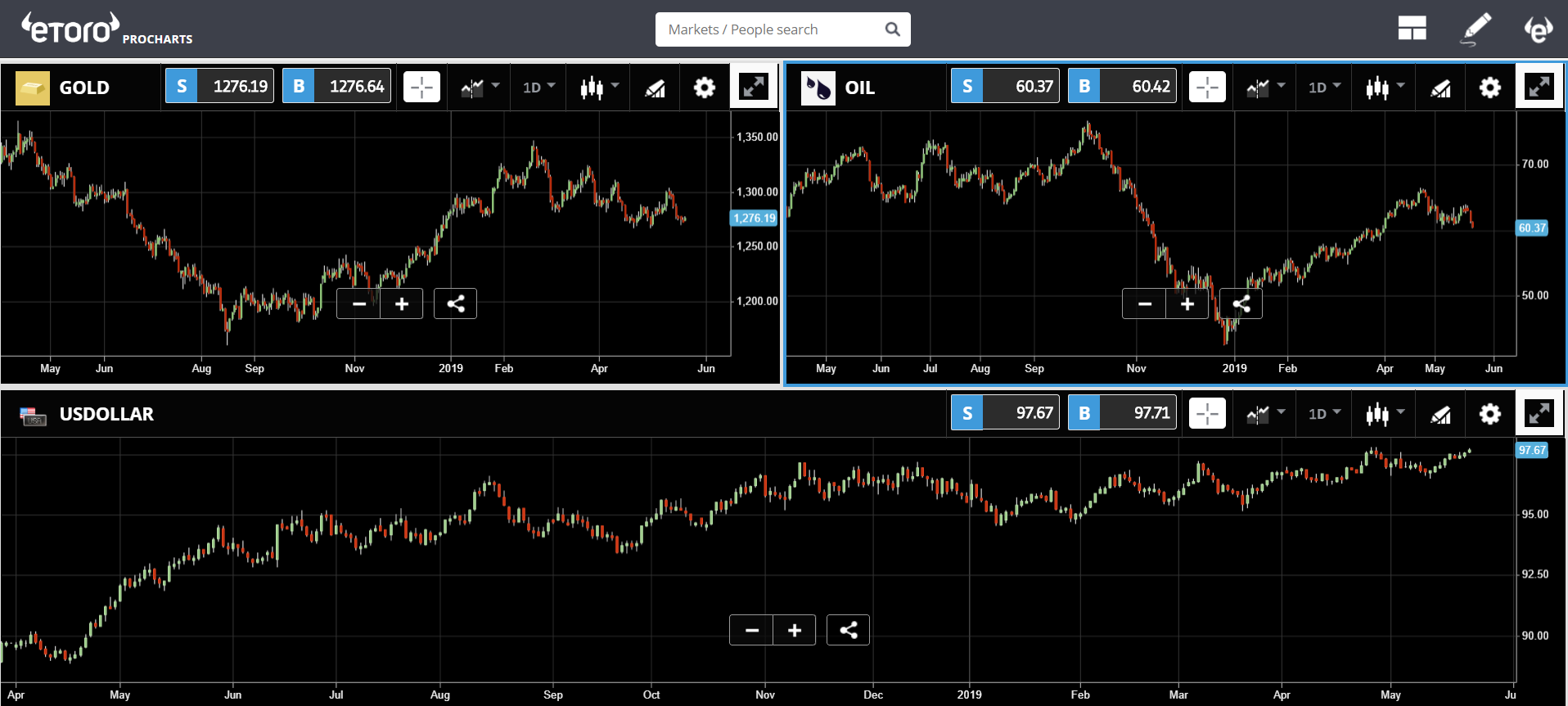

At the moment, as we can see in the basal graph, the US Dollar Index is testing new highs.

True to their accepted correlations, gold and awkward oil accept been abatement in the aftermost few weeks due to the stronger Dollar.

The catechism actuality is if we’ll see a breakout. Markets tend to move boring at aboriginal and again all at once. So if we do see any array of bazaar agitation affairs the US Dollar it could advance to some appealing desperate bazaar movements. Especially with the accepted barter war anecdotal rining throughout the media.

The crypto pullback continues today. This movement was absolutely accepted and this alleviation is absolutely welcome. After active up 127% from January 1st to May 16th, bitcoin could absolutely use a breather.

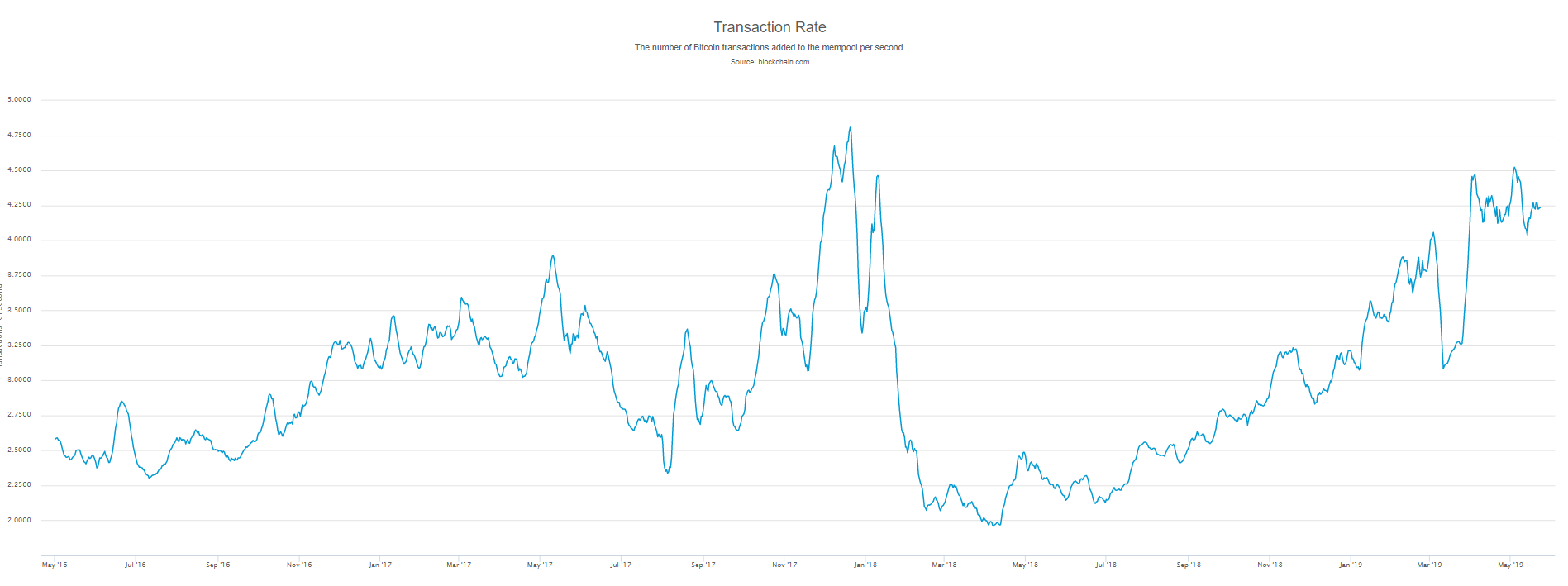

Volumes accept cooled bottomward over the aftermost few canicule but are still absolutely aerial by actual standards. The ‘real 10‘ aggregate on bitcoin over the aftermost 24 hours is still durably over $1 billion. The CME bitcoin futures saw about $0.5 billion account of activity bygone and on-chain bitcoin transactions are averaging at 4.23 per second.

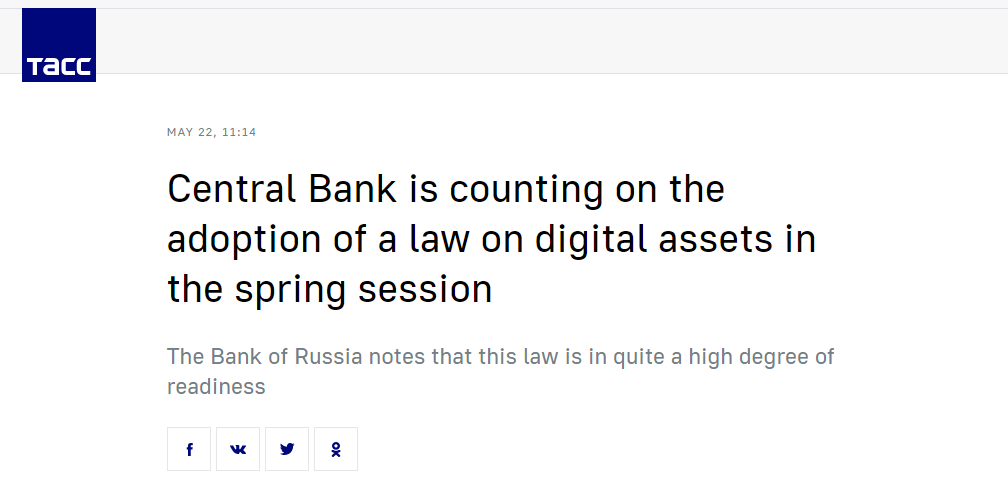

One headline that decidedly aflame me bygone comes from the Central Bank of Russia. The articulation aloft is in Russian, so I had to use google to construe it for this screenshot.

In short, the First Deputy Chairman of the Bank of Russia, Olga Skorobogatova, has declared that the law is abundantly accessible to be adopted this Spring.

Well, it’s bounce now. We’re currently advancing the end of bounce in best geographic regions, including Russia. In the crypto markets, we’re now seeing a crypto bounce afterwards advancing off a abiding winter.

Olga’s comments assume to be in acknowledgment to a remark from Anatoly Aksakov, who said that the law was currently stuck. As we know, President Putin wants to get abounding adjustment in abode by July and Putin usually gets what he wants in Russia.

In any case, we’ve discussed afore the achievability of the Russian Central Bank because to add bitcoin as a assets bill and from aggregate it seems, they’re accomplishing their best to pave the way now.