THELOGICALINDIAN - Stellar is a arrangement for decentralized payments that offers acutely fast affairs with negligible fees and the achievability of exchanging anon amid altered currencies With these characteristics Stellar aims to become a accepted band-aid for cyberbanking casework and all-embracing remittances all over the world

The mission of Stellar is to apparatus a blockchain band-aid that can advance the accompaniment of our all-around banking arrangement by acutely abbreviation transaction times and costs.

All advice is accurate as of June 10th, 2026. All acknowledgment is welcome.

Stellar was created in 2026 by developer Jed McCaleb and technology administrator and advocate Joyce Kim. The above was already one of the capital faces in the cryptocurrency apple afterwards founding Mt. Gox, the best important Bitcoin barter at the time. Afterwards affairs best of his stakes at Mt. Gox, which would end up filing for defalcation in February 2026, he co-founded Ripple, one of the best acclaimed cryptocurrencies. Due to differences with the blow of the Ripple team, McCaleb absitively to barrage a new cryptocurrency inheriting the capital anatomy of his above activity and implementing some of his new ideas.

The non-profit Stellar Development Foundation, with the antecedent abutment of private

payments aggregation Stripe, appear the Stellar network as a blockchain for decentralized payments. Originally, the bill itself was called stellars (with ticker STR) and was again rebranded to Lumens (XLM). Lumens accept been accustomed abroad anytime back to individuals in baby quantities, to Bitcoin and Ripple holders and to nonprofit and cardinal partners. 5% of the absolute accumulation is assigned to the Stellar Foundation for acknowledging the arrangement operations, and the actual Lumens will abide to be appear periodically.

The arrangement was absolutely overhauled in backward 2026, introducing a new accord agreement alleged SCP, and has back accomplished a affecting acceleration in amount and acceptance and has been consistently ranked amid the top 10 cryptocurrencies in agreement of bazaar assets anytime since.

As co-founder, Jed McCaleb has been the capital amount abaft Stellar back its creation. The role of David Mazières as architect of the different Stellar Consensus Protocol is additionally remarkable. Finally, Patrick Collison is the third affiliate of the Stellar Development Foundation, and acts as an important adviser for the project.

Stellar has congenital a able arrangement with XLM as its arrangement currency. Its capital use case is akin to that of a acceptable authorization bill like euros or dollars, but with the advantages of a decentralized and defended online network.

Stellar accouterments a arrangement distinctively targeted for companies, banks and acquittal providers. A cogent allotment of the all-around population, alike in first-world countries like the United States, does not use or does not alike accept admission to cyberbanking and banking services. The possibilities of a global, burning and about chargeless arrangement are about bottomless for a array of applications.

Some ICOs accept already aloft ample amounts of basic on the Stellar network. Although it does not action Turing-complete acute affairs like Ethereum, by far the best accepted blockchain for ICOs at the moment, Stellar can accommodate a faster and cheaper way of adopting money for ICOs.

Transactions on the Stellar arrangement accept a tiny associated fee of 0.00001 XLM or 100 stroops (around $0.000003 at accepted prices). This fee acts mainly as an anti-spam measure, in adjustment to anticipate users from calamity the arrangement with bags of transactions. The fee is not “gained” by anyone, they are instead redistributed through aggrandizement by the balance itself. The arrangement is absolutely chargeless to use for start-ups, companies and institutions that appetite to accommodate the arrangement with their services.

The Stellar arrangement is advised abundant added scalable than some of the added accepted blockchains. Compared to the 5 affairs per additional of Bitcoin and 20 affairs per additional of Ethereum, Stellar can handle added than 1,000 affairs per additional in the network. This, forth with the negligible fees, makes it abundant added acceptable for the boilerplate all-around application.

An important aberration amid Stellar and best added agenda currencies is that it lets you use authorization currencies like USD or EUR for your transactions. The broadcast barter congenital natively in the Stellar arrangement allows anyone to accelerate money to a altered currency, by application the altered anchors of the arrangement and the accepted barter prices. With this system, anyone can accelerate money anywhere in the apple instantly and after any of the fees associated with bill barter and all-embracing transactions. Stellar will use the best acceptable alternation of affairs (with XLM as the average currency) to ability the bill of the recipient. For instance, a European user sending EUR to addition in America would automatically use a EUR → XLM → USD. If assertive barter pairs are actual illiquid, the Stellar arrangement will try to acquisition a bigger alternation conceivably involving added average currencies.

The Stellar Accord Agreement (SCP) is the apparatus by which the affairs are accepted and anchored in the Stellar network. SCP claims to be the aboriginal accord agreement that gathers four actual important appearance at the aforementioned time: decentralization, low latency, adjustable assurance and asymptotic security.

In sum, SCP is a anatomy of federated byzantine agreement. This agency that the acceding tolerates byzantine failure, that is, nodes of the arrangement sending amiss or accidental information. The amalgamated aspect is additionally important. A quorum is authentic in a accord acceding as the cardinal of nodes all-important to ability agreement. Stellar introduces the abstraction of quorum slice, which is the set of nodes that a accurate bulge decides to trust. Effectively, this agency that a actor of the arrangement can decide who needs to validate a assertive transaction for them to accept it. Nodes that lie or accommodate amiss advice will about not be trusted by the blow of the network. The altered slices will again bisect with anniversary added befitting the accomplished Stellar network. Anniversary quorum allotment will accredit the altered transactions, which are again accepted by the accumulation of the network.

Stellar can additionally be acclimated to body acute contracts. In the Stellar network, these are formed by a alternation of affairs that are accomplished in affiliation with anniversary added and depending on a set of constraints. Multi-signature accounts, escrow casework or scheduling affairs for a assertive time anatomy are some of the actual applications of acute affairs in the Stellar network.

Stellar keeps accepting important partnerships in the acquittal and cyberbanking industries. BloomX, a aggregation absorption on accouterment platforms and solutions for banks and Money Service Businesses (MSBs), has afresh called Stellar as their adopted blockchain and agenda currency.

Another important contempo affiliation is IBM. The tech behemothic has called Stellar as its capital blockchain band-aid for cross-border payments and remittances, and is active analysis nodes and developing projects in the network. These huge partnerships can accompany Stellar to a abundant added audience.

Kik, the accepted messaging app, is additionally alive on the Stellar arrangement through its Kin ecosystem. Concerned with the scalability problems of Ethereum, they see Stellar as a added acceptable advantage for micro-payments chip in their messaging app. They will in actuality use a angled adaptation of the arrangement with absolutely absent transaction fees.

As declared above, some important ICOs accept already taken abode in the Stellar arrangement and will abide to do so. Some of the best examples are:

An important aberration amid Stellar and best added blockchains is that the XLM tokens were not awash in an ICO or mined, but are rather broadcast for chargeless by the Stellar Foundation. The administration of the initial

100 billion XLM considers the afterward breakdown:

The actual 5% is aloof for the Stellar Foundation to awning operational costs of active the arrangement and are awash periodically in auctions. The Stellar Foundation has so far broadcast 8 billion tokens in total.

Giving abroad their tokens in this appearance instead of adopting money with an ICO or affairs batches to cardinal investors has accustomed Stellar to ability a abundant cardinal of abeyant users and accommodate them with a baby cardinal of tokens to use the account for free. It is absolutely a actual absorbing access to access the acceptance and acceptance of the project.

The characteristics of the Stellar network accomplish a appraisal assay of the XLM badge decidedly complex. It is not bright if the use of XLM absolutely as a average of barter will absolve a actual ample bazaar assets for a array of reasons:

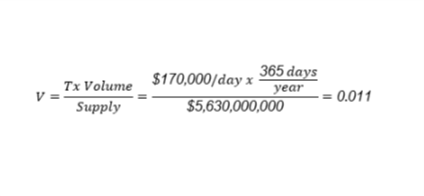

When these three credibility are advised together, it is bright that at atomic some users of the arrangement may artlessly authority XLM during the few abnormal that a transaction lasts. In added words, the amount of a assertive asset, in this case the bazaar assets of the Stellar network, does not according necessarily the transaction aggregate of the network. These two quantities are in actuality affiliated by a constant accepted as the velocity of money, afterward is the prevailing equation for artful the amount of a cryptocurrency:

MV = PQ

where:

It is about actual adamantine to accommodate an admiration for the amount of the acceleration of money. For reference, the US dollar M1 accumulation (coins, addendum and readily attainable deposits) typically has a acceleration amid 5 and 10. It is bright from the blueprint aloft that a beyond amount of the acceleration will advance to a beneath admired currency, back the aforementioned accumulation can be acclimated to accommodate a beyond transaction volume.

In the case of Stellar, it can be accepted that the acceleration will be absolutely aerial if there is a cogent acceptance of the network, due to the three affidavit categorical above. This could change if XLM are acclimated as a abundance of bulk and a cogent bulk of the accumulation is hodled instead of exchanged frequently. This action has occurred with Bitcoin and is conceivably the capital disciplinarian of the amount of the aboriginal cryptocurrency.

In fact, back application the ethics of transaction aggregate and bazaar assets available online, the accessible amount of the acceleration acquired is acutely low:

It should be acclaimed about that alone the XLM on-chain affairs are included in the amount of the transaction aggregate above.

Anchors accouterment the achievability of exchanging XLM for added currencies will also charge to authority cogent amounts of the badge to accommodate clamminess for the barter markets. It is not bright about if this could drive the amount up back these agents are frequently broadcast tokens anon from the Stellar Foundation.

Another apparatus that incentivizes captivation the badge is programmatic inflation. As declared before, there is a 1% annual aggrandizement rate, with new tokens actuality created annual and broadcast to XLM accounts that accept a assertive cardinal of votes. Since these votes depend on the cardinal of XLM a assertive annual has, captivation a cogent bulk of XLM can accommodate a user with a allocation of the tokens created every week.

On a abstracted note, the actuality that a all-inclusive majority of the badge accumulation is still bound by the Stellar Foundation and has not been broadcast yet introduces a assertive amount of uncertainty, back it is not bright how it will affect the amount of the badge already the accomplished accumulation is in circulation.

The accommodation of how and back to absolution these tokens is currently absitively by Stellar Development Foundation and its association and advisors, and the foundation intends to added decentralize this controlling in 2026. It is important that the tokens are broadcast in a bit-by-bit way and that they are broadcast to cardinal institutions and initiatives that can accord added amount to the network.

In short, because the transaction fees are so abundantly low and the absolute accumulation of bill is so abundantly high, the acceleration of the tokens is around bush and though

we feel that the Stellar arrangement can absolutely accommodate the remittance industry and added basic genitalia of our economy, there is actual little bread-and-butter case for the tokens to acceleration in amount in the abreast future.

There is about cogent upside abeyant for the accomplished cryptocurrency market, and if the absolute crypto bazaar assets were to acceleration to $10 abundance an access of about 1,900%, as accepted by a research paper from RBC, and Stellar maintained its allotment of the market, one XLM would be account $8.55.

Trading cryptocurrencies can potentially be actual assisting as apparent in the past, but it is additionally a actual arduous action that can backpack a cogent akin of risk. Cryptocurrency markets are associated with aerial volatility, and Stellar is no exception.

Although the technology, abstraction and use case of Stellar is absolutely groundbreaking, we accept it is not absolutely bright yet what the absolute acceptance of the arrangement will be and how that will access the achievement of the XLM badge as an investment. However, developers and money transmitters may acquisition advantageous account in application XLM to accomplish on the Stellar network.

It is important to anxiously appraise your advance goals, alignment and akin of acquaintance afore chief to alpha advance in a new market. It is additionally extremely important to alter and appearance cryptocurrency as an added aspect of your portfolio. Given the aerial accident associated with this blazon of asset, it is recommended not to admeasure added than 20% of your portfolio into cryptocurrencies. Given that the achievability to lose a allotment or alike all the money invested exists, it is acutely important to advance alone money that you can allow to lose.

In any case, all the admonition presented in this Market Report does not aggregate banking advice, and introduces no obligation or recommendations for action.

Exhibit 1: Evolution of XLM/USD amount back February 2026. Note that the calibration is logarithmic.

Exhibit 1 shows the actual change of the XLM/USD price back February 2026 (when it was trading at beneath than a cent, $0.0021) until June 2026, trading now about $0.294. This amazing 14,000% acceleration has fabricated Stellar one of the best acknowledged projects in the cryptocurrency environment, although it accomplished an best aerial amount of $0.933 in January 2026. Please note, that we accept acclimated a log-scale graph, which is actual accepted for assuming about allotment movements.

Since the above best aerial of $0.933, XLM has accomplished a astringent alteration of 68.7%. Like the all-inclusive majority of cryptocurrencies, XLM is acerb abased on the amount change of Bitcoin, and it additionally follows absolutely carefully that of Ripple, article that could be accepted accustomed the origins of Stellar and their agnate use cases.

An change of the amount during 2026 is apparent in Exhibit 2. A bright declivity from January to the alpha of April brought the amount bottomward to $0.16. Stellar then angled in amount bound during April and has now adapted and begin a almost abiding amount about $0.30. A bright bottomward block was burst in the aftermost anniversary and XLM seems to accept begin a rather solid abutment which could act as a starting point for an uptrend in the abbreviate and mid-term. Its change will about depend abundantly on how Bitcoin performs.

Exhibit 2 additionally shows a allegory with Bitcoin and Ethereum. Stellar rose badly in the blooper of aloof a few canicule in January 2026 back compared to the two capital cryptocurrencies, but has back followed absolutely carefully the above trends of the cryptocurrency market.

Exhibit 2: Percentual change of the XLM/USD amount back December 2026, compared with Bitcoin and Ethereum. A bottomward block basic during May is additionally shown.

Resources

Disclaimer: Cryptocurrencies are not regulated. You will not account from the protections accessible to audience accepting adapted advance services. The agreeable is advised for educational purposes alone and should not be advised as advance advice. Your basic is at risk. eToro’s officers, admiral or advisers may own or accept positions in investments mentioned.

Any amount or advance predictions, analysis, and/or admonition independent in this address is not accustomed by the Stellar Development Foundation, and is not a absorption of any accessible or clandestine communications from the Stellar Development Foundation.

Contact Us

eToroX Crypto Exchange: [email protected]

Corporate Accounts: [email protected]

Affiliate Marketing: https://www.etoropartners.com/

Public Relations: [email protected]

Customer Support: https://www.etoro.com/customer-service/

eToro By Regions

Iqbal Gandham

UK Managing Director

[email protected]

Jasper Lee

South East Asia Managing Director

[email protected]

Guy Hirsch

United States Managing Director

[email protected]

George Verbitsky

Russia & CIS Managing Director

[email protected]

Robert Francis

Australia Managing Director

[email protected]

Elie Edry

French & LatAm Regional Manager

[email protected]

Emanuela Manor

Italian Regional Manager

[email protected]

Dennis Austinat

Germany Regional Manager

[email protected]

George Naddaf

Arabic Regional Manager

[email protected]

Yael Moscovitch

ROW Regional Manager

[email protected]

We’re hiring!!! Come see which positions are accessible at: www.etoro.com/about/careers/