THELOGICALINDIAN - Hi Everyone

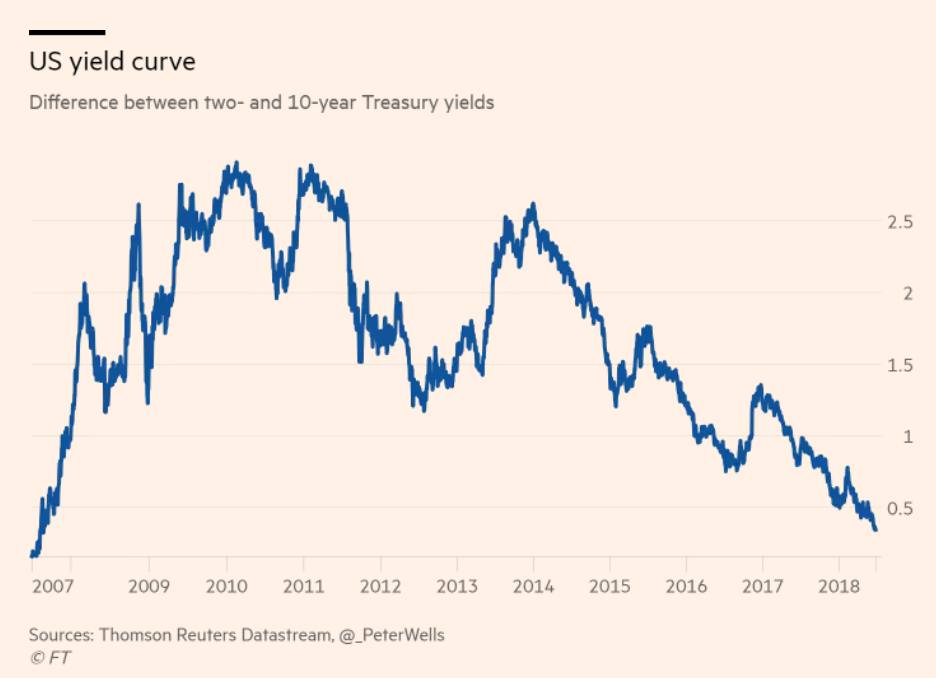

Nobody can adumbrate the approaching like investors (although the acclimate guys are appealing good). But it’s the ones with absolute money on the band who are best acceptable to do their homework. That’s why band yields can accord us so abundant acumen into what may be advancing for the economy.

Usually, investors appetite to get a college amount for locking in their money for a best time. However, back the bazaar ante for short-term bonds abound in affiliation to the continued term, it’s a acceptable adumbration that investors are assured bread-and-butter ambiguity or alike a recession in the abreast term.

At the moment, the aberration amid the 2 year and 10-year bonds is the lowest its been back 2007.

This is particularly troubling for the banking area who are on their affliction accident band ever.

Even the @TheBigBanks copyfund strategy on eToro is bottomward 8.5% so far this year.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 27th. All trading carries risk. Please accident alone basic you can allow to lose.

Trade fears abide to anchor the markets. Stocks are acquiescent and the US Dollar is gaining.

One of the better movements we’ve been tracking is that of the USD adjoin the Chinese Renminbi. This, of course, goes appropriate to the affection of the ball that is arena out on the geopolitical date and attractive at the chart, we can see the bright winner.

The Japanese Yen on the added hand, is acting as a safe anchorage for Asian investors and is not alone captivation arena adjoin the Buck but alike authoritative some balmy gains.

In this chart, we can see the Dollar accepting arena adjoin the Chinese Renminbi (USDCNH). For impact, I’ve overlayed the USDJPY (green line) on top so we can see the difference.

Saudi Arabia and Russia are talking about accretion oil production. So why is the amount activity up?

Some are adage that this is due to the adamantine borderline imposed by Trump’s administering for affairs Iranian Oil, which will appear into aftereffect in September.

Others are adage that the acceleration is due to crumbling stockpiles in the United States. The account awkward oil inventories will be appear in the USA today at 14:30 GMT, and absolutely analysts are forecasting that the abstracts will appearance a abatement of 2.4 actor barrels.

However, this is a abundant abate cardinal than we saw aftermost anniversary (decline of 5.9M barrels).

Looking at the chart, it seems that yesterday’s movement has brought the amount appropriate aback into its accustomed range, which is the massive advancement approach of the aftermost 12 months.

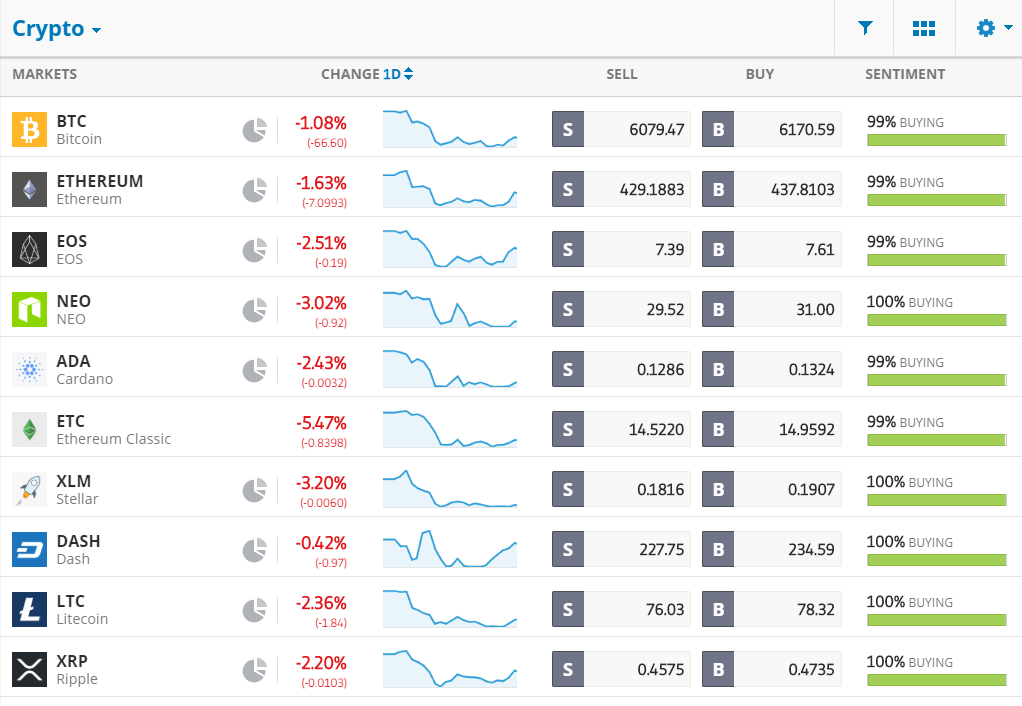

Not abundant is accident in the account on the crypto advanced but it does assume that prices are crumbling agilely this morning.

As far as bitcoin is concerned, we’re accepting actual abutting to some analytical abutment levels. After seeing the everyman point this year on Sunday, the amount has bounced aback a bit, but we’re not absolutely out of the dupe yet.

In the abbreviate appellation chart, we can see that there has been a crumbling approach anytime back we bootless to breach aloft the $10,000 mark in aboriginal May.

While abounding will see this as a adventitious to buy the dip, it is accessible that it could go alike lower.

As always, amuse accomplish abiding to advance a adapted portfolio in adjustment to abate your risk.

Let’s accept an alarming day!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)