THELOGICALINDIAN - Hi Everyone

This is it. After months of wheeling and ambidextrous in the UK government, Prime Minister May’s showdown with her own affair comes to a arch this evening.

They’ve already absitively that assembly should accept a say in what Brexit will attending like. Today we’ll get a bigger compassionate of what akin of ascendancy that “say” will carry. In added words, do they accept an advising role or are they the accommodation makers.

Opponents of the “meaningful vote” amendment say that it will abate May’s hand. Proponents say that, if passed, the alteration will abate May’s hand. May has maintained that “no accord is bigger than a bad deal.” It would assume that best economists and authorities disagree, so this aldermanic vote is about blocking the no-deal option.

Though the boilerplate aborigine maybe activity fatigued by now, the EU negotiators will be befitting a agog eye on the admission timer, which is now set for aloof nine months.

As far as the markets go, their apropos are accumbent with the economists. Any adventitious of a no-deal Brexit could aching aplomb in bounded companies and in the Pound.

@MatiGreenspan — eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 20th. All trading carries risk. Only accident basic you can allow to lose.

Whatever barter war apropos may accept been in the bazaar bygone seems to be absolutely gone by now. The People’s Bank of China ability accept had article to do with that.

The following headline may be translated in laymen’s agreement as: don’t anguish about trade, booty some banknote and achieve down.

The bulk of the banknote bang may additionally be symbolic. Even though ¥200 billion is alone account 15% of the $200 billion proposed tariffs, the cardinal itself is added than abundant to accession eyebrows.

The CEO of Goldman Sachs, Lloyd Blankfein was also on Bloomberg this morning arena bottomward the barter risks. Saying basically that Trump has fabricated his point but he’d charge to be crazy to backpack out the blackmail and that this is added acceptable aloof a admonition to China that the U.S. has added accessible assessment firepower.

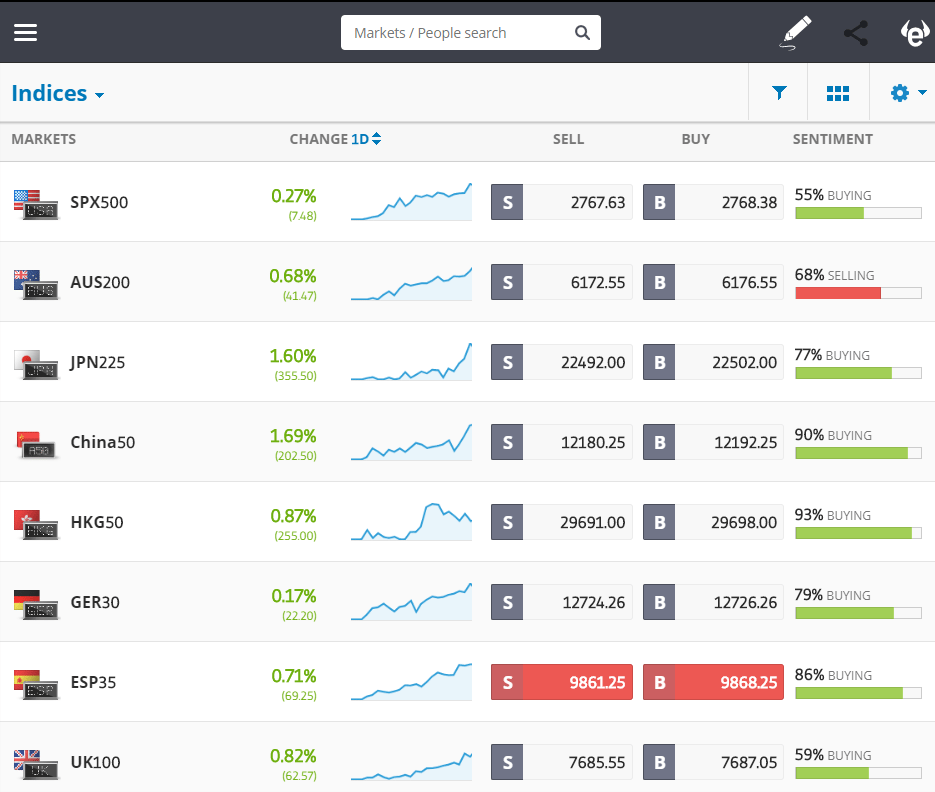

In any case, actuality we can see that banal indexes this morning are all green.

In the weirdest way, during the acme of the barter tensions bygone gold took a massive plunge.

This aberrant behavior is article we mentioned in Monday’s amend as able-bodied (Title: Let’s Break the Internet). Gold usually acts as a safe anchorage and goes up during times of uncertainty, but now it seems to be accomplishing the opposite.

I still haven’t heard any acceptable theories as to why this ability be. The best I got was a few reassurances that the apple isn’t about to end and accordingly there’s no appeal to authority concrete gold.

The aftereffect on Platinum seems to accept been alike added dramatic, as it got airtight bottomward to the everyman akin in 2.5 years, and is now almost abutting to its everyman point in a decade.

It is additionally important to agenda the three day OPEC affair in Vienna. Though any final decisions are usually aloof for the end of the meeting, there’s a able achievability that we could get some leaks or alike a complete breakdown.

Some countries appetite to alpha accretion achievement and some would rather abatement it. Both from a axiological and abstruse perspective, this could go either way. Will be absorbing to watch what happens.

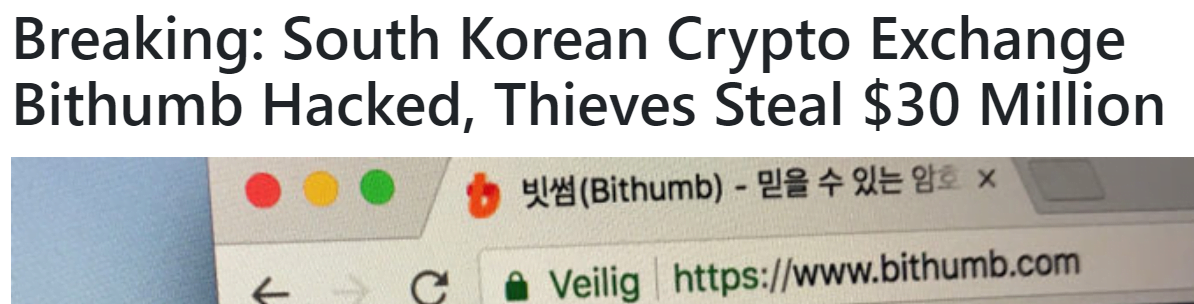

Less than two weeks ago, boilerplate media was advertence a $1,000 bead in bitcoin prices to a accessory drudge advance on a ahead alien Korean crypto exchange.

Last night, the largest, best able-bodied known, crypto barter in South Korea got hit and cryptotraders beyond the apple woke up to this…

The amount of bitcoin, however, seems to accept almost budged. Here we can see the time of the bithumb news circled in amethyst and the bead afterward the Coinrail drudge in yellow. What’s amiss with this picture?

One disadvantage to bitcoin is its immutability. Once a transaction happens, it can never be undone, which is one of the affidavit cryptocurrencies can be a ambition for hackers.

However, immutability is additionally one of bitcoin’s best adorable qualities. The actuality that it operates clearly and apart is a bright advantage for many.

The industry is absolutely accepting bigger at ambidextrous with these types of attacks as well. Bitcoin’s aerial akin of accuracy makes it easier for authorities and businesses to clue any adulterous action or baseborn appurtenances and eventually acknowledgment them to their applicable owner. Very likely, we’ll abide to see added accent and development about aegis and the trusted aegis of cryptocurrencies and that’s ultimately a acceptable affair for the industry.

As always, amuse feel chargeless to affix with me at the links below. I’m consistently animated to apprehend any questions, comments, and feedback. Let’s accept an amazing day ahead.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)