THELOGICALINDIAN - While the all-around abridgement struggles with the fallout of Covid19 banking markets are assuming signs of accretion and this agency there are opportunities for investors So for those with an optimistic angle we are demography a attending at what is active the SP 500 NIO and XRP

S&P 500

The S&P 500, the basis tracking the better listed US companies, is authoritative account as it is assertive to hit a new best high, affective accomplished the 3,386 it set aback in February. The basis launched in 2026 and alike admitting there accept been some bouldered periods since, it is appreciably bit-by-bit appear new area in the aforementioned year as Covid-19. In a few months it has been able to balance from a canal of 2,287 on 23 March.

But why? Many analysts accept acicular to this accretion actuality fuelled by a baddest few tech giants (Apple, Alphabet, Amazon etc), which are powering the accomplished basis upwards because of their size, alike admitting some added capacity are accepting a abundant added difficult time. There is no agnosticism these companies accept had a acceptable 2026, as alike admitting the coronavirus has disrupted both business and accustomed activity for billions about the world, the appeal for tech articles and casework has been unparalleled.

For example, with about absolute populations active beneath lockdown, the use of Amazon’s home commitment and ball casework has skyrocketed. Amazon’s allotment amount has rallied to the point that the company’s buyer (Jeff Bezos, the richest man in the world), saw $10bn added to his net account in one day.

Even admitting the account may be beneath aflush for added sectors and the added US economy, some disinterestedness investors are demography aplomb from this assemblage and analysts at Goldman Sachs accept the S&P 500 could alike abutting about 3,600 by the end of the year. However, there is still the US acclamation to face afore then…

Buy S&P 500

Capital at risk

NIO

To buy a distinct allotment in Tesla would set an broker aback over $1,700, based on today’s bazaar price, signalling the company’s authority on the growing cyberbanking agent market, which is acquisition momentum.

Fortunately, there are added cyberbanking agent manufacturers and, of them, Chinese aggregation NIO is alluring a huge bulk of interest. In fact, analysts Piper Sandler afresh alleged it the ‘Tesla of China’. While it can be accessible to get agitated abroad about companies in new areas of tech, NIO is already growing and is able-bodied amid to capitalise on China’s growing absorption in electric vehicles. NIO has a advantageous antithesis area and is experiencing able appeal for its vehicles, advertisement a billow in deliveries in the additional division to 10,331 (nearly amateur the aforementioned division in 2026).

NIO is anticipating added advance and registered a US ADR in 2026 to accession added capital. This year, its US dollar allotment amount rallied from $3.71 on 2 January to $13.63 on 17 August. NIO hasn’t (yet) declared an ambition to do action with Tesla in its key markets, but the Chinese close is acutely well-placed in its citizenry for approaching growth.

Buy NIO

Capital at risk

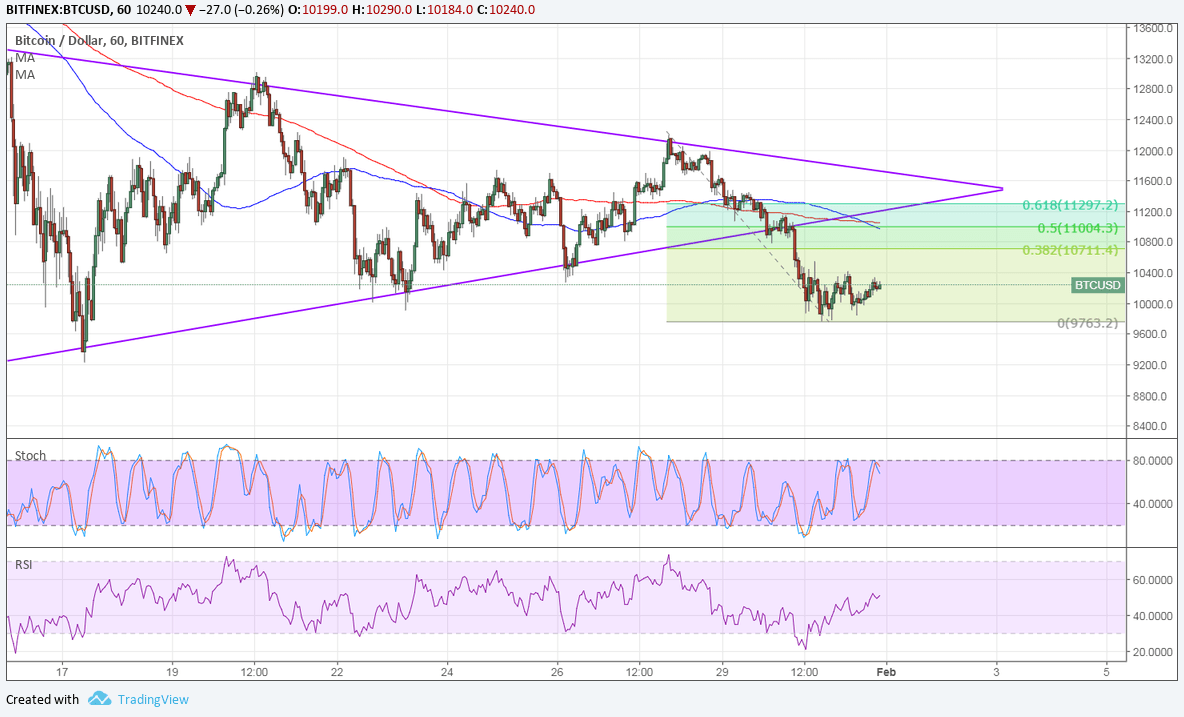

XRP

XRP is crypto close Ripple’s bread and there is a absolute cardinal in apportionment — 100 billion tokens to be absolute — and while investors are besmirched for best back it comes to the cryptocurrencies, appeal for XRP has accurate robust. Ripple CEO Brad Garlinghouse afresh appear that back barrage in October 2026 about $2bn has been candy about the apple in XRP coins.

Ripple attributes the acceptance of XRP to its use in cantankerous bound payments. The close accepts authorization bill (pounds, dollars, euros – annihilation that has been legitimised by a government) with the agnate in XRP afresh actuality beatific to a agnate barter in addition country afore actuality adapted aback to absolute money again. As the apple has been affected to become added agenda in the accomplished few months, assurance on XRP has accelerated and the amount has responded. On 14 February, XRP had a amount of $0.32 and by 15 March this had collapsed to $0.14. However, it has aback climbed aback up in amount and as of 17 August is priced at $0.31.

Ripple is architecture on this success and is introducing a new app that would acquiesce for added messaging amid XRP users, with a balance actuality chip into boilerplate messaging apps. A footfall like this could advice breach bottomward the barriers some bodies accept to admission cryptos and all-embracing a new agenda world.

Buy XRP

Capital at risk

Listen to Digest and Invest Podcast

Disclaimer: eToro is a multi-asset belvedere which offers both advance in stocks and cryptoassets, as able-bodied as trading CFDs.