THELOGICALINDIAN - Tether keeps press new USDT bill admitting adverse a contempo accusation with claims for 14 abundance The stablecoin ambassador appear several affairs that broadcast the USDT liquidity

The afresh launched class activity lawsuit assuredly calls out Tether anon on what was alone unofficially discussed on amusing media. USDT bill accept been created and acclimated with the ambition to dispense the crypto market, causing a beyond balloon and a added damaging crash, the plaintiffs explained.

Just at that moment, the Tether Treasury minted two affairs of 12 actor and 20 actor USDT.

Granted, the affairs were almost tame, in allegory to antecedent injections of hundreds of millions.

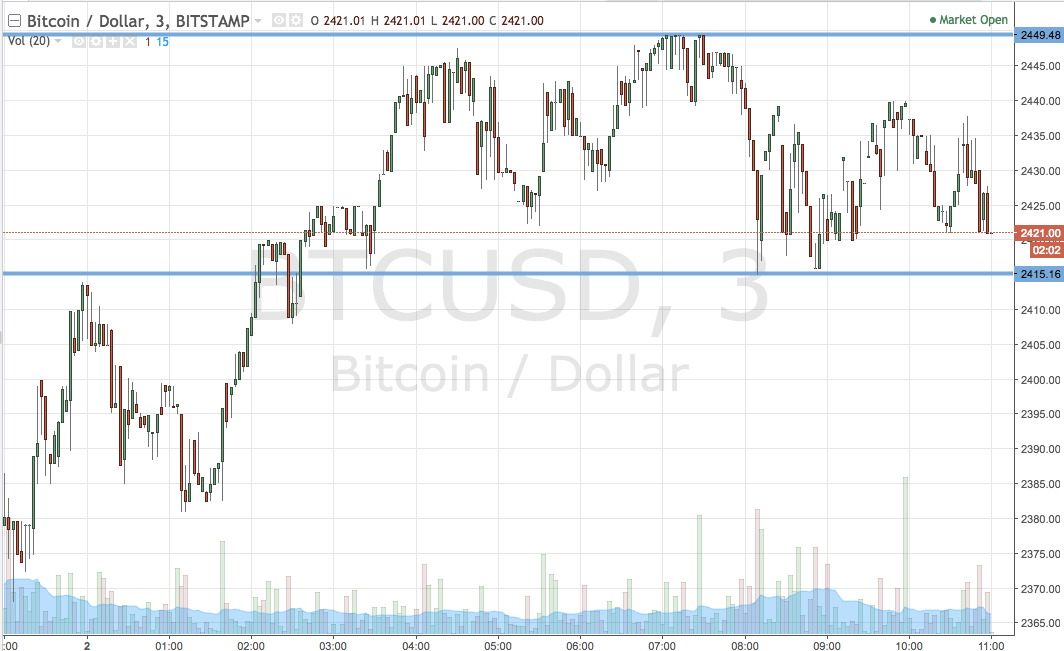

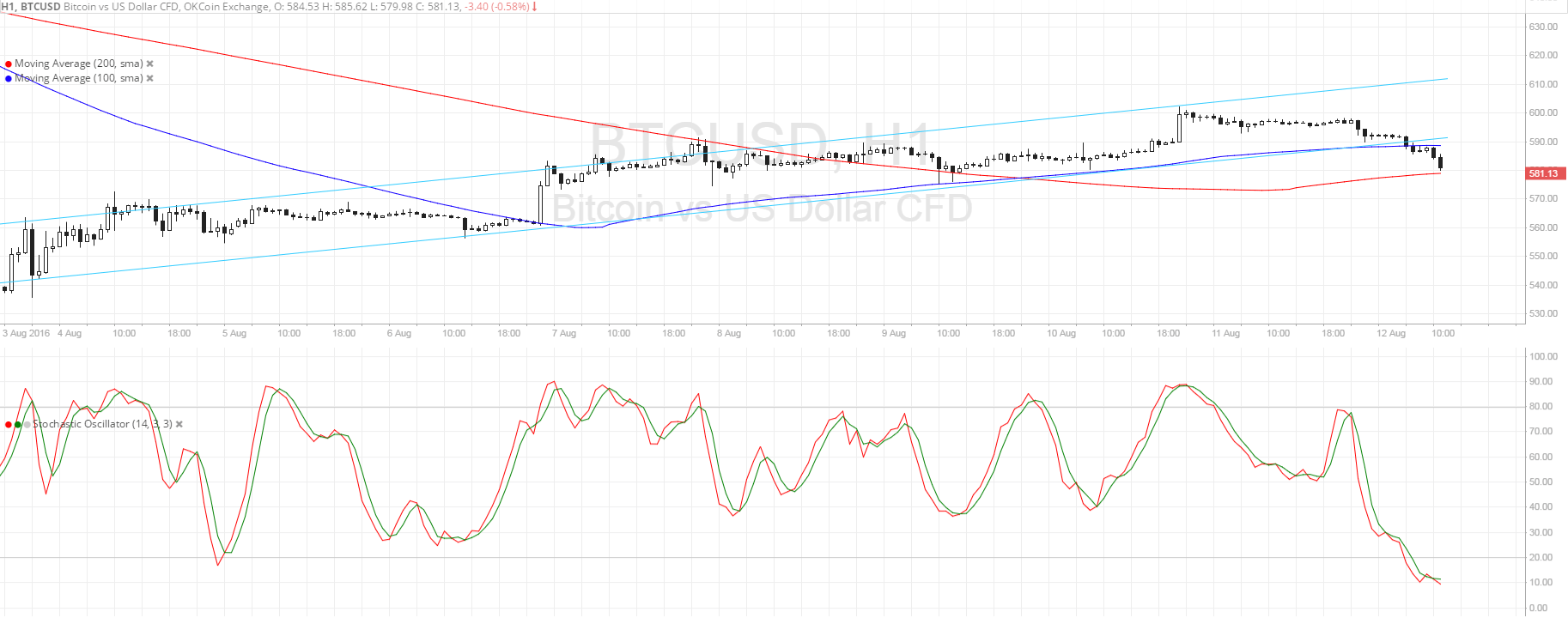

The USDT injections coincided with a awakening in bazaar activity, as Bitcoin (BTC) recovered aloft the $8,200 akin and altcoins confused alike higher. This bazaar behavior calls aback to the bazaar assemblage in July, area the New York Attorney General (NYAG) begin Tether and Bitfinex were accomplishing actionable business in New York. Just at that time, BTC went on to rally, confusing the markets from the abrogating contest surrounding Bitfinex and Tether.

Now, there are 4,108,044,456 USDT in circulation, of which anniversary bread moves through exchanges about three or four times a day. The aggregate of USDT alike rose back the accusation was announced, to aloft $22 billion per day. USDT charcoal awful alive and acutely affecting both for the amount of BTC and for altcoins.

USDT minting started off boring in 2026, but bound broadcast its supply, arch to the better assemblage in BTC history. But back then, alike the beyond accumulation of USDT fails to lift BTC to a new amount record.

Research keeps award links amid the arising of USDT and the behavior of BTC. In 2019, the added able blazon of USDT is the one based on the Ethereum (ETH) network. This new token, migrated from the Omni layer, is acclimated on arch exchanges like Binance and OKEx, appropriately its actual aftereffect on amount action. The Omni-layer, Bitcoin-based USDT is actuality phased out, and is alone acclimated for bound transactions.

In the accomplished year, Bitfinex and Tether additionally assume to accept wised up. Bitfinex trading fell by 97%, while Tether no best prints big annular numbers of tokens. Instead, new USDT are created in abate batches, and bound broadcast through the arrangement of exchanges. The accident of assurance in USDT could actively affect the absolute market, which admitting all the scandals and doubts, is alike added abased on Tether.

What do you anticipate about the behavior of Tether and USDT minting? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter @KyleWRoche @whale_alert