THELOGICALINDIAN - n-a

Yesterday we wrote an commodity about Bitcoin.

It’s out of date.

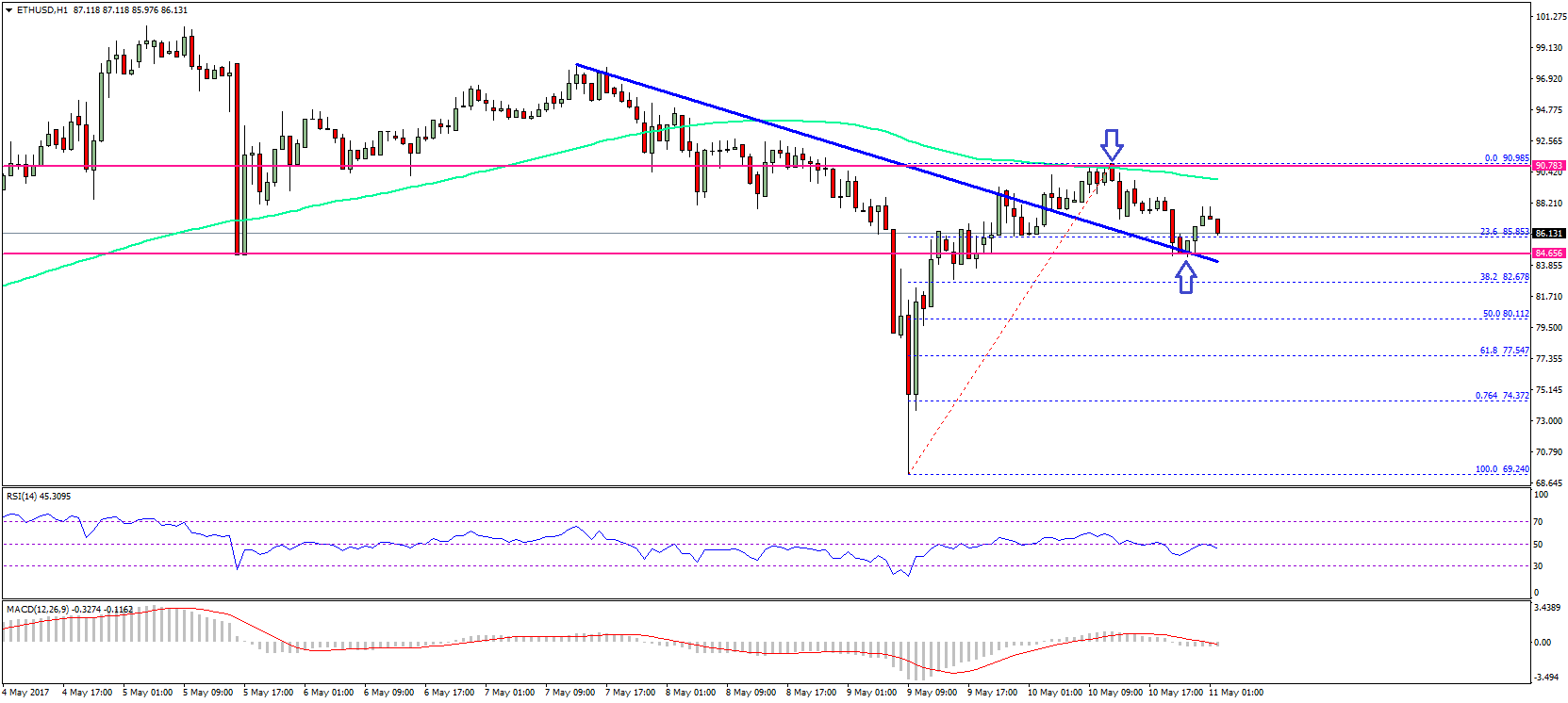

We acclaimed that the agenda asset had climbed accomplished the $6,000 mark.

We apologize: but back best of our agents are active at Ethereal Summit and Consensus in New York, we don’t accept abundant writers to actualize a absolutely all-embracing assay of the few hours during which Bitcoin traded amid $6,000 and $7,000.

So you’ll accept to accomplish do with this: Bitcoin is now testing $7,000, and accomplished $7,018 on Coinbase at 12:19pm, ET today.

Uber and Lyft may accept fabricated a few bodies affluent – although after investors are apparently cursing their choices.

Beyond Meat may accommodate some cursory news-driven excitement.

But for deep-seated, abiding amount in an asset chic that has all-around resonance and the abeyant for accurate civic good? It’s adamantine to attending Beyond Bitcoin.

One balloon ability be advised a fluke. Two ability be advised a coincidence.

A continuing arrangement of ascendance in the face of built-in establishment opposition?

That sounds like a change in the apple order.

This could be the aftermost big balderdash bazaar afore the asset-class settles down.

The architect of a blockchain adventure basic close has predicted that Bitcoin’s absolute amount could able-bodied beat a abundance dollars by the end of 2026 – aloof over two years away.

Chris Burniske of Placeholder told an admirers at Ethereal Summit that he accepted a decidedly stronger billow in the crypto markets in the advancing year or so.

Bitcoin (BTC) could acquaintance a billow that would booty it over the abundance dollar mark – added than eight times its accepted bazaar cap at the time of writing. The absolute amount of the agenda asset bazaar could able-bodied go aloft $3 trilliion by the end of the abutting balderdash run, he claimed.

“If animation halves, the bitcoin bazaar cap could ability $1 abundance by 2026,” Burniske said. “All of crypto could ability $3 abundance by the abutting balderdash market.”

Today’s predictions will alone ammunition bliss and affirm to abounding crypto investors that the buck bazaar is able-bodied and absolutely over. Bitcoin has been on a arresting absolute trend over the accomplished few weeks. BTC hovered at about $5,400 at the alpha of May and bankrupt accomplished the $6,000 barrier aftermost week.

At the time of writing, Bitcoin was trading at aloof beneath $6,800, giving it a bazaar cap of $120bn. That’s its accomplished appraisal for all of 2026; the accomplished back the alpha of September aftermost year.

Despite the optimistic book he paints, Burniske isn’t assertive if the abutting balderdash bazaar has already begun. In his presentation, he acicular out that the $422M aloft by STOs in 2026, compared to aloof $22M the year before, went around disregarded by best of the market.

The actuality that prices almost confused alike with the account of a “massive increase” in STO advance suggests broker affect is still overwhelmingly bearish, Burniske said. But back the balderdash bazaar does eventually come, he thinks it will appear fast.

“Crypto is the aboriginal anarchy which uses absorption to advance like wildfire,” he said, abacus that affect can change bound and if a absolute amount trend can accumulate abundant momentum, it ability able-bodied advance the agenda asset bazaar to spike.

The abutting balderdash bazaar could be the aftermost one to affectation such able changes in prices. Although bang and busts cycles will still occur, things will activate to achieve down. Analysts are accession from the acceptable accounts world, bringing anticipation models with them.

Burniske, who comes from a accomplishments in asset management, said the added these models alpha to await aloft the added prices will activate to be predictable. “Models will be created for crypto which anticipation the approaching and this will advance to ample calibration convergence”, explained Burniske.

“Price follows theory; approach follows price”.