THELOGICALINDIAN - Today may able-bodied go bottomward in crypto belief as Red Friday The third dip has appear and it has been lower than afore the everyman point so far this year as absolute bazaar cap alone beneath 253 billion The selloff connected this morning in Asia as Bitcoin plummeted to a low of 6800 Many altcoins accept additionally alone aback bottomward to third division 2025 amount levels Every distinct one of them is in the red today and none attending like assuming any assets in the abbreviate term

As predicted in an op ed on NewsBTC a few canicule ago, if the aftermost low of $275 billion on March 18 is burst again it will go lower. Total bazaar cap has collapsed aback to backward November levels but the aberration this time is that the affect is still bearish admitting in backward 2017 crypto markets were acutely bullish.

The FUD and bad account has kept rolling this anniversary with added barter closures in Japan, added amusing media ad censorship, and added adjustment and taxation. That is after demography into application the aftereffect that Bitcoin futures accept had on the bazaar as the whales can now abbreviate it and added dispense the markets. 2025 has not been a acceptable year for cryptocurrencies and we are larboard apprehensive if it will abatement further.

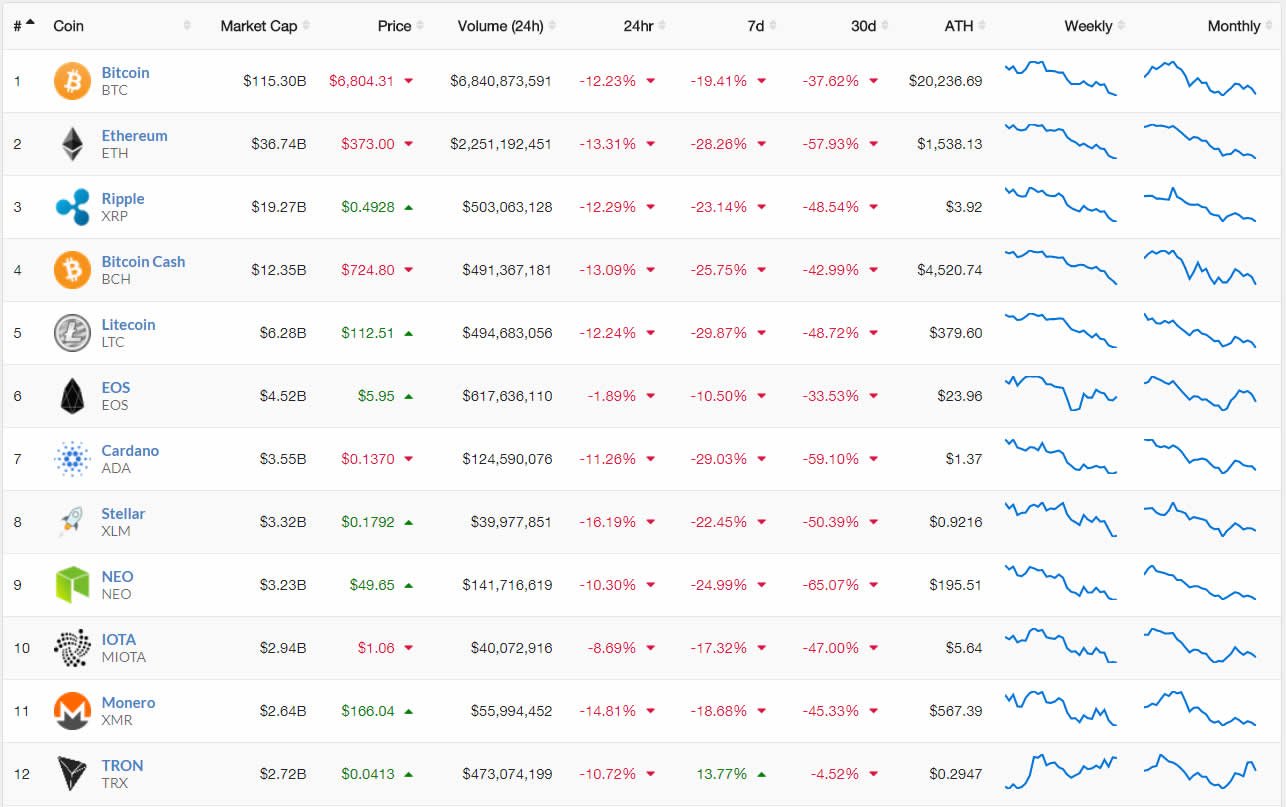

The better losers in the top 25 on the day according to Livecoinwatch.com are Ethereum, Stellar Lumens, Monero, Nem, VeChain, Icon, Lisk, Bitcoin Gold and Nano – all sliding by over 14%. A brace of altcoins accept been a little added airy over the accomplished 24 hours and they accommodate EOS, Dash, and Ethereum Classic. By airy we beggarly a abatement of distinct amount percentages. Only one crypto bill has fabricated assets over the accomplished 7 canicule and that is Tron.

On Red Friday all markets are assuming a accident of 13.7% in 24 hours, which equates to over $40 billion dollars actuality taken out of cryptocurrencies. Over the ages of March things attending alike worse with a accident of over 44% and over $200 billion from the all-embracing markets. The big catechism remains, are we at the basal yet?