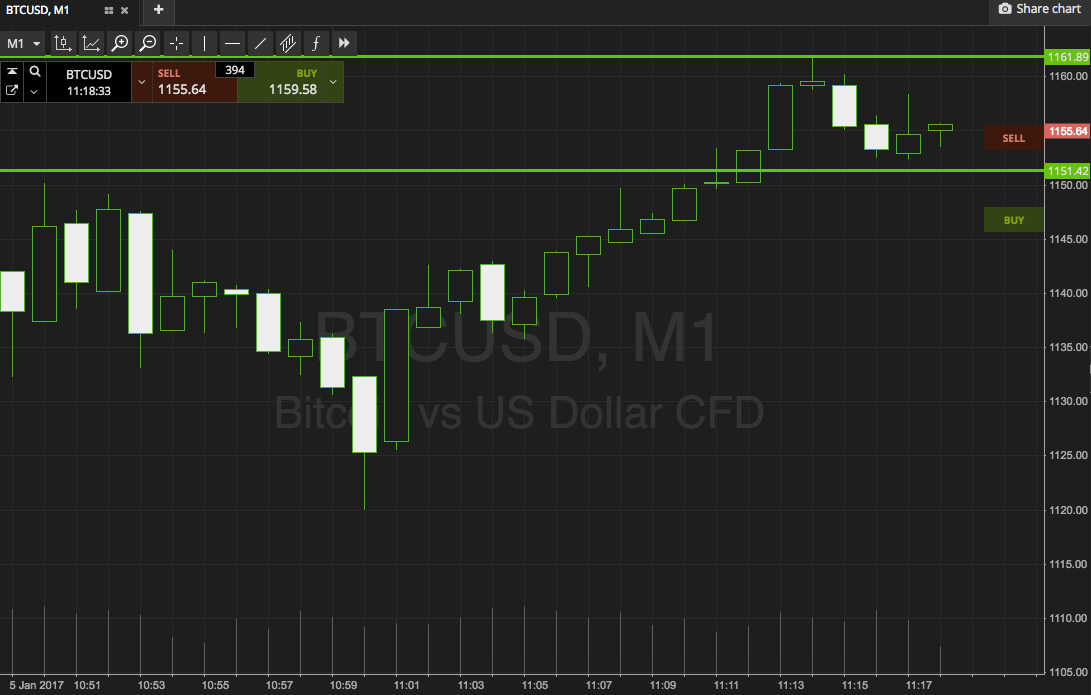

THELOGICALINDIAN - Bitcoin hit a amount of 20260 today afterward months of acute advancement movement Its the accomplished amount the cryptocurrency has accomplished in its history

Bitcoin surged accomplished $20,000 on assorted exchanges today, agreement its amount aloft aiguille bazaar prices during its abominable December 2026 surge.

Bitcoin Breaks Crucial $20,000 Mark

The arch cryptocurrency has burst its best aerial price, trading at $20,271 at the time of autograph with little attrition ahead.

Eyes accept been afterward Bitcoin’s bullish run for some time: it’s angled in amount back July. Positive affect surrounding the cryptocurrency space, accurately BTC, has been decidedly apparent back the end of the summer.

Several aerial contour investors accept declared their absorption in Bitcoin as a abeyant store-of-value, cementing its contempo “digital gold” narrative. Among them was MicroStrategy architect Michael Saylor, who’s additionally been a articulate apostle for the arch crypto throughout the year. His multi-million dollar move into crypto absolutely aggressive abounding others to chase suit.

Recently, 169-year-old allowance close MassMutual confirmed a behemothic $100 actor purchase.

PayPal, meanwhile, fabricated huge moves in adopting cryptocurrencies, acknowledging that BTC will be added to the account for all U.S. barter and anon accessible as a acquittal option. PayPal CEO Dan Schulman said that he was “bullish on agenda currencies of all kinds.”

The added agency that’s contributed to Bitcoin’s celebration is this year’s Black Swan, Coronavirus. The communicable has contributed to what some accept referred to as the affliction all-around bread-and-butter crisis in a century. It seems that BTC has appear to represent a barrier adjoin aggrandizement in the bosom of Coronavirus-induced money printing.

Bitcoin’s contempo amount moves accept been broadly covered in the media. Much like in the backward 2017 balderdash run, this no agnosticism fuelled the speculation. Previous Bitcoin skeptics like Ray Dalio conceded that BTC could accept value. In contrast, publications like CNBC and Bloomberg accept consistently covered the currency’s agrarian amount movements over the aftermost few months.

Some accept likened the agenda asset’s acceleration to gold in the 1970s, suggesting that there could be abundant added allowance for growth. Memorably, Citibank acquaint an commodity suggesting that Bitcoin could beat $300,000 in the abutting brace of years.

Bitcoin’s bazaar cap is now over $375 billion. It’s account added than JPMorgan Chase amid abounding added ample calibration banking institutions.