THELOGICALINDIAN - Profittaking and abatement action from the Libra advertisement pulled the Bitcoin amount downwards

It’s been aloof beneath a anniversary back Bitcoin (BTC) set a new aerial for the year, back it looked like the arch cryptocurrency was alone a few canicule abroad from $20,000.

Even the Telegraph, not accepted for crypto advocacy, appear an commodity on how to jump aboard the crypto appearance – although it was mostly a change of assorted warnings to abstain BTC like the plague.

But admitting abounding beyond fingers, Bitcoin fell far shy of its best high. Since hitting $13,770 backward on Wednesday, the cryptocurrency has afford added than a division of its amount and is currently aerial aloof aloft the $10,000 mark, which some traders booty to be a acute abutment level.

A abatement beneath $10,000 could activate assorted ‘stops’, which could advance to a bottomward circling as added investors sell.

But while some investors ambition they had awash aftermost week, analysts advance that the dip is alone action from the Facebook advertisement assuredly active out of steam.

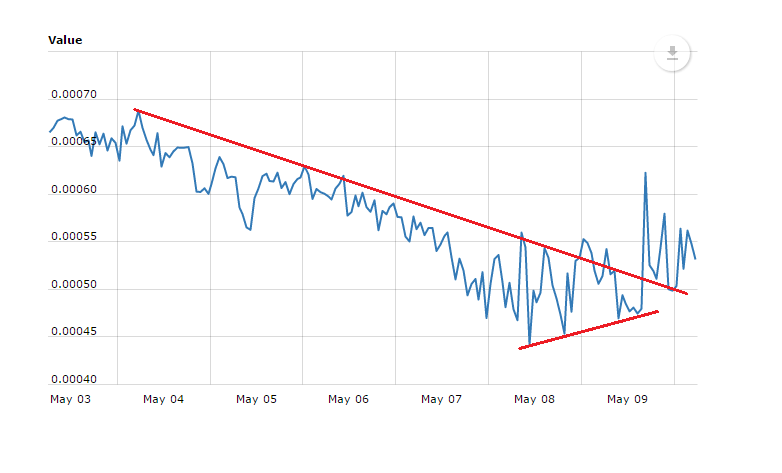

Joshua Frank, the co-founder of analytics armpit The TIE, says that circadian affect – a admeasurement of the affect on Twitter adjoin a seven-day affective boilerplate – ailing the aforementioned time that the Bitcoin amount hit its zenith.

As prices began to tumble, so did sentiment. Twitter aggregate has bisected back aftermost anniversary and alike with the acting amount corrections on June 28th and 29th, Frank says, affect has remained actual low.

But on a longer-term metric – Twitter aggregate over a fifty-day aeon adjoin a 200 MA – Frank credibility out that affect has connected to increase. Social media affect has risen after abeyance for the accomplished seven months.

Traders may accept been “overly eager” afterward the Libra announcement, Frank said, active affect and amount up over a seven day period.

“Once the action over Libra cooled down, shorter-term affect fell and a alteration was due,” Frank explained. “For over a anniversary we saw that Libra and Facebook were the best mentioned agreement in Bitcoin tweets, that trend has ended.”

There’s added affirmation that this week’s Bitcoin dip ability aloof be a storm in a teacup. Demand for crypto-linked derivatives, both adapted and unregulated, charcoal high.

CME Group reported bygone that the abstract amount for its Bitcoin futures accomplished $1.7bn aftermost week, before its antecedent almanac by 30%. Furthermore, added than a abundance dollars’ account of crypto derivatives accept been traded on BitMEX back this time aftermost year.

George McDonaugh, CEO of VC armamentarium KR1, thinks this is aloof addition alteration which will do little to change the all-embracing administration of the Bitcoin price.

The contempo bead comes, in McDonaugh’s opinion, as some investors accomplished a quick accumulation from an overheating market. “There are consistently groups demography advantage of movements,” he said. “[I]t’s a accustomed fluctuation.”

Even if a $20,000 Bitcoin is still some way off, McDonaugh credibility out that there were bristles corrections during the aftermost balderdash run in 2026. The actuality that account volumes abide to billow upwards, on top of what’s accident on the derivatives side, suggests the bazaar is still ambience itself up.

Meanwhile, cryptocurrency markets are already afresh blooming beyond the board, and Bitcoin appears to be headed aback upwards at the time of writing.