THELOGICALINDIAN - n-a

Market assets is the blockchain agnate of an online horoscope. It’s absolute bollocks, but it holds a able fascination. And admitting again pointing out the fallacies of the metric, we’re not allowed to fixating on it ourselves: every time there’s a drop, we analysis the archive for the latest flippening.

But new abstracts suggests that cryptocurrency bazaar cap may assuredly be a metric account noting. It’s not as automatic as the adjustment acclimated by Coinmarketcap, but neither does it arise to be absolute bunk.

Here’s the botheration with bazaar capitalization, at atomic back it comes to appraisal a currency’s value. Back CMC calculates the Bitcoin bazaar cap, they do a aboveboard multiplication: latest bazaar amount times the absolute cardinal of absolute coins.

That agency bazaar assets is as authentic as barter prices: in added words, not at all.

If you were John McAfee, or a bet-losing Roger Ver, all you’d charge to do is bazaar buy a few satoshis for a hundred dollars anniversary on a big barter – and hey presto! Your bill has a multi-trillion-dollar bazaar cap!

And this doesn’t alike accommodate the all-inclusive cardinal of lost, missing, or artlessly dormant coins that are not impacting the crypto-economy.

The botheration is worse for forks: their bazaar assets includes all possible coins, alike those that accept not been claimed. For Bitcoin Cash (BCH) that’s not a huge issue: 9.3 actor BCH accept been active back Block 478558, back the angle occurred, compared to 9.8 actor BTC coins.

But it’s a huge baloney for Bitcoin SV, area the assets is affected on the apriorism that there are 17 actor BSV bill aloof cat-and-mouse for the appropriate buyer. Actual abstracts affected through the Blockchair API appearance that, of the unspent outputs absolute on BSV at the time of the fork, alone 4.2 actor accept absolutely been activated. BCH didn’t book abundant better, with 5.4 actor bill actuality spent.*

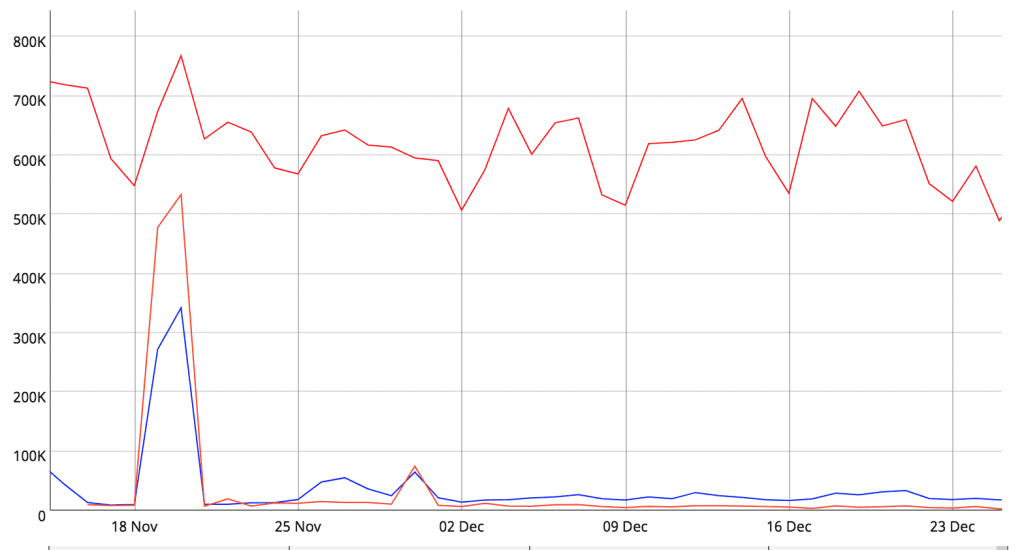

That agency that one in bristles BCH hodlers are too apathetic to breach their wallets, even for chargeless money, if that chargeless money is advancing from Craig Wright. Counting the cardinal of alive addresses makes the aforementioned point in a altered way:

Active addresses for BTC (red), BCH (blue) and BSV (orange).Except for two spikes, the cardinal of alive BSV wallets ambit amid a division to a bisected of BCH activity, and both were absolutely askew by BTC. With beneath than a division of accessible bill actuality activated, BSV’s ‘real’ bazaar cap should lie about amid Maker and NEO.

CoinMetrics Realizes The Problem

Luckily, we’re not the alone ones who acquisition CMC’s data… incomplete. CoinMetrics, which bankrupt the adventure of the airy BTCP Premine, has fabricated a business of accurately barometer blockchain activity, and they’ve invented a new admeasurement for crypto value.

The aftereffect is “realized capitalization,” a acting for bazaar assets which places added weight on contempo affairs than on on earlier ones.

Transactions outputs in this altitude are admired according to the bazaar amount of their latest movement. According to CoinMetrics, “Its body is to amount altered allotment of the food at altered prices, instead of application the circadian abutting as bazaar cap does.”

The aftereffect looks article like this:

This is still an amiss metric–the weighting arrangement has been apathetic to bolt up with the latest drops, giving BTC an improbably-high assets of $80bn.

So why is that?

The metric gives a historically-weighted assets for anniversary Bitcoin transaction based on anniversary coin’s latest movement. For example, Satoshi’s bill are admired at about $0, analogous the amount back back they were mined, but a contempo bitcoin movement will be admired at accepted prices. Realized assets does accept some distortions from the added acceptable metric, but it does inject a admeasurement of absolute bread-and-butter action into cryptocurrency movements.

According to this metric, the doodle on the appropriate is Bitcoin SV–with a absolute amount about amid Doge and Bitcoin Gold, at about $500M – a far cry from CMC’s advancement that its bazaar cap is $1.5bn.

Right now it alone works for UTXO ledgers, like Bitcoin, but Coinmetrics says that it can be ambiguous to added blockchains “with some effort” For account-based currencies like XRP or Stellar, the accomplished assets metric would acceptable omit abiding escrows and unreleased tokens.

As always, attention is in order, abnormally back ambidextrous with new metrics. Bill on a careful barter ability change easily several times after alteration their blockchain address, and some users ability move bill amid several wallets after appointment ownership.

All the same, the abstracts arise to affirm what best of the crypto world already knew: that BSV is absolutely one letter too long. Despite accepting a nominally aerial bazaar cap, any austere metric would put Satoshi’s Vison actual far alfresco the top ten.

The columnist is invested in Bitcoin, Bitcoin Cash and Bitcoin SV, which are mentioned in this article.

*Special acknowledgment to Blockchair‘s Nikita Zhavoronkov for allowance us with the API.