THELOGICALINDIAN - n-a

Bitcoin trading volumes are the accomplished they’ve been in months. The advance in bazaar prices, which pushed BTC to the bound of $4,000, led to a flurry of transactions. Lower transaction fees, due to greater SegWit adoption, could drive volumes higher, possibly to almanac levels.

The BTC arrangement candy added than $10.4bn in the accomplished 24 hours. That’s the accomplished it’s been back April 2026, when volumes hit $11.9bn.

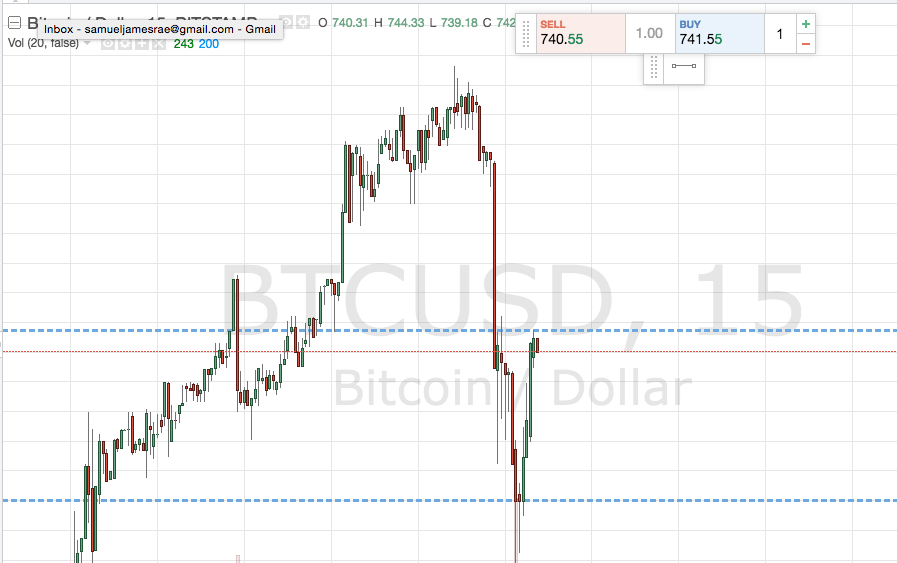

The price jump bygone – which took Bitcoin from $3,600 to the $3,900 mark – is acceptable to be abaft today’s aerial volumes. There was a cogent bulk of movement from abiding food of value, including authorization currencies, into BTC, as Crypto Briefing reported yesterday.

Some of this aggregate will be traders demography advantage of ascent prices as able-bodied as a few retail investors emboldened to buy, due to bigger bazaar sentiment. If the accretion is abundantly due to speculation, the contempo assets will acceptable be only temporary, followed by a bead as assets’ prices balance and after decline.

For example, trading action in January 2018 slid from $23bn to $8bn at the end of the month. Bearish account over a South-Korean ICO ban and an accessible Congressional audition in February bisected the Bitcoin amount as speculators rapidly bald out of the asset. Bullish news which collection Ether (ETH) up 91% aftermost April additionally led to a fasten in the BTC amount and volumes.

Will Bitcoin trading aggregate fasten this time?

There’s acumen to accept that the present accretion in aggregate is not aloof a acting spike. Investor attitudes accept afflicted clearly back April, and there is far beneath budgetary amount cloudburst into the bazaar than before, due to an continued buck bazaar and the abatement in antecedent bread offerings.

More importantly, the added arrangement cartage has not fabricated payments acutely expensive, clashing aftermost year’s balderdash market. Even with volumes at a 10-month high, a Bitcoin transaction today will cost roughly $0.28 to be mined in the abutting block. For comparison, on April 25th aftermost year users would accept had to pay $2.11. It was alike college on January 6th, back a transaction fee amount a whopping $20.87 and 24h volume stood at $23.4bn.

Transaction fees are paid to miners, and access back there are added affairs cat-and-mouse to be confirmed. This fee bazaar helps alike out action and anticipate log-jams on the network.

In December and aboriginal January, back Bitcoin absorption was at an best high, action accomplished almanac levels and confirmations could sometimes booty weeks. A aerial block fee – like the $20 akin mentioned aloft – helped the arrangement cope with demand.

But this was all afore the mass-adoption of SegWit – Segregated Witness – a software amend which reduces transaction data, acceptance added affairs to fit into a block. Since January 2026, the cardinal of circadian affairs that acclimated SegWit added from 15% to able-bodied over 40% beforehand this month.

The acceptance amount has back alone to about 30%, but that still represents a acceleration in the cardinal of BTC affairs application SegWit.

The added action this anniversary did advance to a acceleration in fees, but alone from almost $0.10 to 0.28 – a amount of cents rather than dollars. A abiding bead in fees could accredit added transactions, and anticipate the transaction aggregate from bottomward as precipitously as it has done in antecedent amount spikes.

If the trend continues, the Bitcoin trading aggregate could break consistently aloft $10bn.

The columnist is invested in agenda assets, including BTC and ETH which is mentioned in this article.