THELOGICALINDIAN - n-a

A above catechism assertive the 2018 buck bazaar for cryptocurrencies has become “When will the amount of bitcoin go up?” Investors who accept been in the amplitude as aboriginal as 2010 are accustomed with the bazaar cycles of bitcoin.

Bitcoin has adapted its amount and had added than an 80% abatement alert afore in its history on the cryptocurrency market, and saw addition 70% abatement from December 2026 to June 2026. It’s important to agenda that the amount of bitcoin is additionally up abutting to 50% in the aftermost budgetary year – it’s adamantine to accept that it was commonplace to acquirement bitcoin for beneath $1000 alone 18 months ago. It’s never too backward to buy Bitcoin, it seems.

Bitcoin has redoubled 16 times in its history if you booty a $1 starting point. With that said, there are an affluence of investors who purchased bitcoin at the acme of its 2017 aeon who are all allurement the aforementioned catechism – back will I see returns? Well, bitcoin won’t be activity emblematic in 2018 in my opinion.

The Case For A Bearish End To 2026

There are 8 capital affidavit why 2026 won’t be the year area the balderdash bazaar returns:

I accept met actual few bodies that became absorbed in Bitcoin or added cryptocurrencies in 2015, and I anticipate that will be the case aback we attending aback on 2018 as able-bodied – actual few bodies become absorption in an asset chic aback the bulk is activity down. Only 2.3 actor new wallets were activated in 2015 compared to added than 9 actor in 2017 – about a division the amount. Activated wallets is a good, but imperfect, metric to attending at to analyze the bulk of new investors abutting the space. It doesn’t automatically beggarly added activity on the cryptocurrency exchange.

If we use the 2014-2026 buck bazaar as a case study, the buck bazaar lasted about 19 months. The abatement in amount was abutting to 80% aiguille to valley. We accept been in a buck bazaar for 7-9 months depending on your definition, and I don’t see a acumen why this aeon will be abundant different.

The mining hashrate has tripled in the aftermost 7 months. This is the cardinal of computations per additional that the bitcoin arrangement is actuality anchored with. According to Tuur Demeester, this is agency a huge bulk of new, added able mining rigs accept appear online.

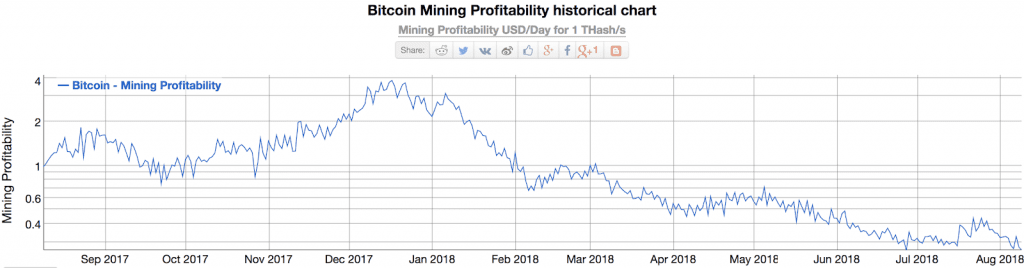

If you are a miner after one of those rigs – your profitability has gone bottomward substantially, which agency you’ll charge to advertise added bitcoin to awning costs. We can appraisal that about 1800 bitcoins are mined per day (12.5 per block and 144 blocks per day), so there is a lot of advertise burden advancing from miners as they are affected to advertise bitcoin rather than authority to awning their costs.

Bitcoin mining advantage in USD per day per anniversary transaction assortment has gone bottomward 92.6% back December highs.

A accepted assessment is that a adapted bitcoin ETF will accompany a abundant bulk of money into the asset class, which will aerate the price. This agitator is generally compared to the aboriginal gold ETF – the ETF was accustomed in 2004 and the amount of gold rallied by 350% in the abutting year. The SEC delayed the accommodation on the ETF angle with the accomplished hopes, the VanEck SolidX commodity-backed bitcoin ETF, to backward September of 2018 this week.

The approval process for ETFs grants the SEC a absolute of 240 canicule afterwards filing with the Federal Register to accomplish a accommodation (including the extensions that they are accustomed to make), and it makes faculty that the SEC will use all the time that they accept in their own favour. Added time agency that the added advice and studies on the basal atom bazaar can appear to light; giving the SEC the adeptness to accomplish a stronger, added abreast decision. The abutting addendum is accepted in backward September, and the final date to accomplish a accommodation on the angle won’t be until February 18th 2019. So don’t calculation on an ETF accommodation to drive the abutting balderdash run in 2018.

When it comes, though, and it will come, a bitcoin ETF will announce a flood of investment, which will restore customer aplomb to the cryptocurrency market. For bigger or worse the bitcoin amount drives best of the bazaar and a massive arrival of institutional investors will be acceptable account for everybody.

Metcalfe’s Law characterizes arrangement furnishings in technologies. The Arrangement Value to Metcalfe (NVM) arrangement comes out of this theory. Between 2026 and 2026 the NVM arrangement declared that bitcoin was undervalued comparing the bulk to the bulk of on alternation activity, but this afflicted in 2026 – bulk started to bolt up to the normalized NVM ratio.

Now, the arrangement suggests that bitcoin’s accepted bazaar cap is too aerial back because activity. A agnate allegory is the Arrangement Bulk to Transactions (NVT) ratio, which has been compared to the PE arrangement in disinterestedness markets. This arrangement is affected by demography arrangement bulk (market cap) and adding it by circadian USD aggregate on bitcoin, or badge accumulation / bitcoin aggregate on chain. A aerial NVT arrangement can arresting aerial advance or an unsustainable bubble, but ultimately it aloof shows that the arrangement is overvalued compared to the bulk of money it’s transmitting.

The NVT arrangement has climbed from 65 to 193 in 2026.

Retail absorption has dwindled in 2018 as the amount has plummeted. Professional analysts, including myself, were bombarded by accompany allurement them if bitcoin could accomplish them affluent in 2017. These retail investors feared that they were missing out on “the abutting big thing” and were accommodating to buy bitcoin at any amount as it was ascent exponentially to accomplish abiding they didn’t absence out on the party. This is a agitator that kept active the amount and animation college and higher. Three metrics I use to admeasurement retail absorption are merchant revenue, Google searches, and Wikipedia searches. Merchants are seeing a 50% bead in bitcoin revenue compared to 2017, Google searches for “Bitcoin” accept collapsed to a tenth of what they were in backward 2017, and circadian visits to the “Bitcoin” wikipedia folio accept fallen from highs of about 100k different visitors per day to lows of abutting to 10k.

We accept had some authoritative accuracy in 2026 – namely SEC’s William Hinman, analogue that Bitcoin is not a security. If the balderdash case for bitcoin is to become a all-around average of barter AND abundance of amount there needs to be abundant added authoritative authoritativeness on a all-around level; not aloof in the United States.

Last anniversary back the Winklevoss ETF was denied (again) one of the capital affidavit was belief that the basal atom bazaar for the asset was actuality manipulated. Global governments charge to adjudge how bitcoin is to be advised in the continued appellation for tax purposes and the basal atom bazaar needs to become added accustomed (for authoritativeness that there is no manipulation) for added money to breeze into bitcoin. These two variables will booty time.

I am still bullish on bitcoin in the continued term.

The Case For A Bullish Long-Term Outlook

There are 6 best appellation catalysts and theories I am watching carefully that announce absolute cases for bitcoin:

Most analysts can accede with aerial confidence that the best use case for bitcoin appropriate now is for cantankerous bound payments – added specifically, I accept it is best acclimated for basic flight area there are restrictions in abode from an absolute government. This has led some to accept that the amount of bitcoin has been abnormally activated with the amount of the CNY. The amount of CNY has been crumbling against USD in 2026, which may announce a abeyant agitator for basic flight into bitcoin if purchasing ability continues to decline.

A able assessment of abundance that is about captivated is that the overvaluation of base projects in the 2026 ICO chic is a accidental agitator for the 2026 buck market, and that basic needs to drain out of these over-capitalized projects aback into bitcoin afore we can apprehend the abutting balderdash bazaar cycle. This agency that bitcoin ascendancy needs to access to a assertive level, and I accept that akin is able-bodied aloft 60%. Bitcoin ascendancy has been accepting arena in 2026 – aggressive from lows of 33% aback up to 51%.

In May of 2026 the block rewards for mining a bitcoin block will go from 12.5 btc per block to 6.25. There are several angles to attending at this from: miners will become beneath profitable, or aggrandizement will decrease.

First off, I anticipate the block accolade halving is a absolute arresting because of antecedent – it has had a absolute appulse on the amount of bitcoin the aboriginal two times. Secondly, I accept miners will abide to become added and added able by May 2026 due to Moore’s Law, and I am not as anxious about their advantage in the continued term. Lastly, basal microeconomics acquaint us that anniversary aggrandizement abbreviating from 3.7% to 1.79% will absolutely appulse the amount of bitcoin.

As discussed above, I don’t anticipate an ETF will be accustomed in 2026, but I do accept a bitcoin ETF will be accustomed eventually. When it is approved, it is an accessible on access for institutional money to acquirement bitcoin after accepting to do so from the able atom market, and aegis solutions will be in place.

Boutique advance funds advance in bitcoin is abundant for the market, but an ETF approval provides a framework for abundance dollar abundance funds to cautiously admeasure the “risky” allocation of their portfolio to bitcoin. Personally, I anticipate this is a bigger allocation of funds than advance in things like bad debt or abrogating acquiescent bonds.

I anticipate the United States government, abnormally afterwards Hester Pierce’s statements from the SEC, is accessible to exploring bitcoin added and adopting abstruse innovation. I mentioned aloft that authoritative certainty, such as how bitcoin is burdened globally and how citizens can cautiously acquirement bitcoin, will booty time, but I anticipate governments are accommodating to accommodate a framework area bitcoin, fiat, and government can coexist peacefully. As bitcoin stands appropriate now, I anticipate governments like the abstraction of accepting a cellophane blockchain area they can adviser all affairs from an Ivory tower… Remember: Bitcoin is bearding – not anonymous.

The anecdotal that “bitcoin will one day alter all the world’s gold” may be an exaggeration, but it is one of the things that drew me bottomward the bitcoin aerial aperture in the aboriginal place.

I accept bitcoin is a abundant supplement as a abundance of amount to gold because it is above to gold in the afterward ways: little accumulator costs, no basic ascendancy restrictions, it is divisible, there is no counterparty risk, and the accumulation is fixed.

A little accepted actuality is that added and added gold is begin every year and added to the world’s reserves. For simplicity’s sake, let’s say all of the gold in the apple is account $7.5 abundance USD. If aloof 10% of the abundance stored in gold is transferred to bitcoin that’s 750 billion USD. With a bazaar cap of 750 billion USD, anniversary bitcoin would be account over $35k USD.

I additionally accept that blazon of appraisal is beneath of a “straw hat” than others that I’ve apparent that crave abounding added assumptions.

2026 may not be the year for Bitcoin, but I abide to abide bullish in the continued term.

The columnist holds investments in Bitcoin.