THELOGICALINDIAN - Investors could be ambiguity adjoin the acceptable market

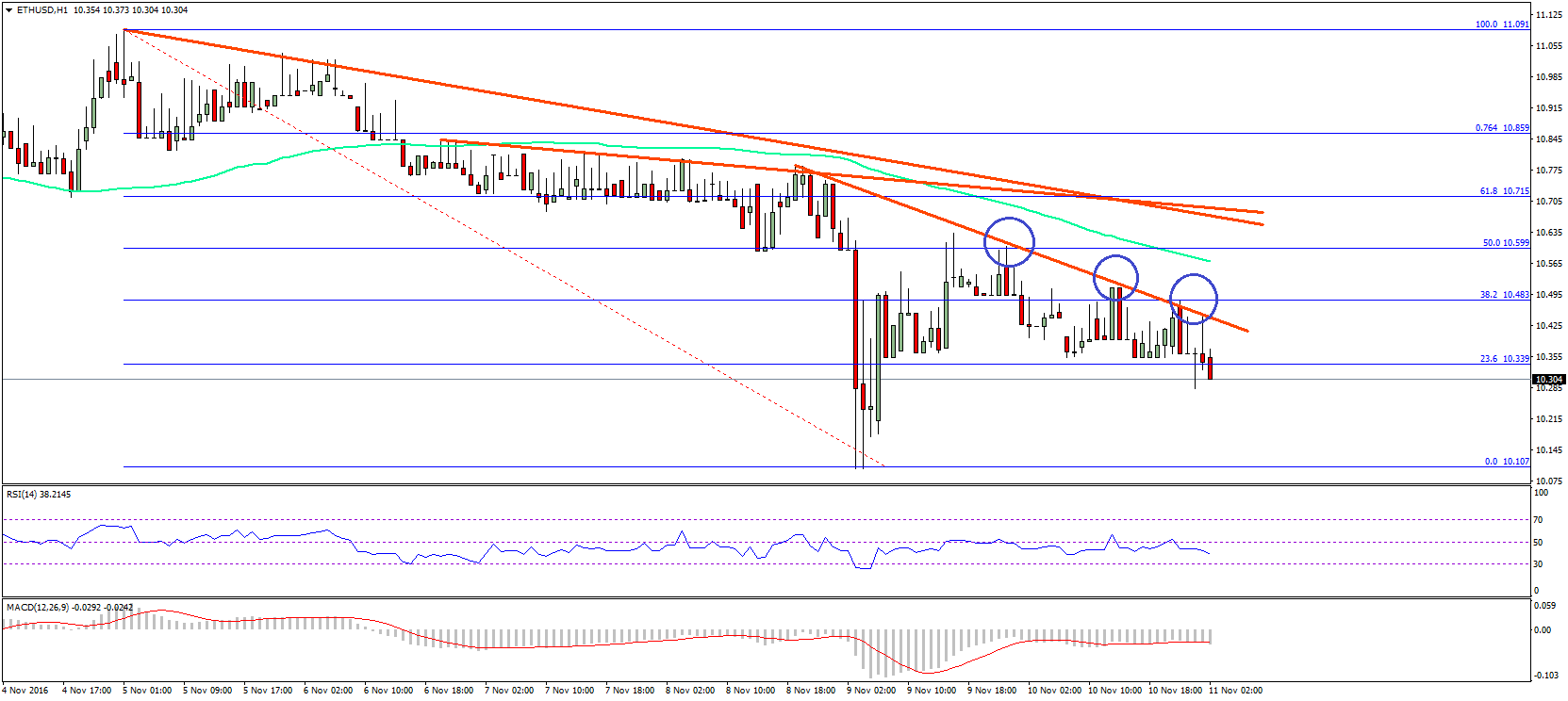

Yesterday’s Bitcoin (BTC) dip was short-lived, and the aboriginal cryptocurrency is now aback to double-digit gains. Reports that the FCA is affective to ban all crypto-linked derivatives accept almost abject the coin’s trajectory.

After airy off the $9,800 abutment level, Bitcoin surged far aloft the crisis zone. BTC was trading at about $11,400 at columnist time, 13% aloft its account low and cutting aback appear the annual aerial of $13,700.

So what’s causing the rebound? As Crypto Briefing suggested yesterday, this could be a assurance that the latest alteration – which wiped about $4,000 from BTC prices – is now absolutely over.

The market’s aisle charcoal durably bullish. Institutional absorption is high, as booming derivatives trading on CME and BitMEX can attest. According to Travis Kling of Ikigai Capital, the Federal Reserve’s accommodation to about-face quantitative tightening sparked a spending bacchanalia in all assets – including Bitcoin.

But there may be addition account – one which suggests institutional investors are advancing for a all-around bread-and-butter downturn.“[A] global barter war and a no-deal Brexit abide growing possibilities not certainties,” said Bank of England Governor Mark Carney, which could advance investors appear historically safe assets.

Global ambiguity has already led to a assemblage in absolute bonds, and U.K. and German bizarre yields – which move inversely to band prices – hitting almanac lows. The band assemblage puts Brevan Howard on clue for the best half-year achievement in a decade, afterwards the barrier armamentarium bet on falling band yields, as the Financial Times reports.

Gold, a acclaimed barrier adjoin spirals in the acceptable market, additionally surged upwards advanced of the G20 Summit in Osaka, Japan. It has back adapted afterward the almost absolute outcome, as barter tensions between the U.S. and China began to subside.

Gold’s cachet as a safe anchorage was anchored during the banking crisis, believes Simon Denham, Chief Risk Officer at trading belvedere TigerWit. He accent that both gold and Bitcoin allotment agnate characteristics as they are “getting beneath big-ticket to authority continued appellation and, by their nature, both accept a carefully bound supply.”

A abrupt change in the accumulation or appeal for either asset could calmly account a billow in the atom price, Denham added.

A altitude of growing ambiguity ability be affecting today’s Bitcoin price. Mati Greenspan, eToro’s chief bazaar analyst, says that the alternation amid Bitcoin and gold prices is at the accomplished akin back 2026. Both assets accept been “moving in lockstep” back the alpha of June.

“[I]t does assume like bitcoin is acceptable added chip with the blow of the banking markets,” Greenspan said.“Seems like bitcoin is assuredly starting to acknowledge to alien factors.”

Crypto Briefing has ahead appropriate that Bitcoin ability become a barrier adjoin ambiguity in the acceptable markets. That ability explain why there has not been a agnate billow in added cryptocurrencies – investors appetite to barrier adjoin the market, not brainstorm on altcoins.

Bitcoin ability prove added adorable than added assets because its amount doesn’t await on a centralized ascendancy – either a accessible listed company, activity or absolute state. The latest jump could announce added frayed fretfulness on acceptable markets.