THELOGICALINDIAN - Theyve been ambience the advance for best of the year according to Ikigais CIO

A baby accumulation of deep-pocketed traders has been able to accomplishment bazaar affect and set the aisle for crypto prices, according to one asset manager. Travis Kling, Founder and Chief Investment Officer at Ikigai Asset Management, believes that there could be acceptable drive to booty Bitcoin (BTC) accomplished its best high.

Based on advice calm from his own analysis, as able-bodied from conversations with added institutional investors, Kling hypothesizes that a baby accumulation of “risky whales” bogus the contempo bazaar upswing.

“We accept a almost baby cardinal of awful sophisticated, well-capitalized, awful accident advanced bazaar participants accept been walking this crypto bazaar college over the aftermost seven weeks,” Kling aboriginal wrote in a agenda appear April 1st.

Through a alternation of accommodating buys accomplished at key moments, these chancy whales may accept antipodal the market’s aisle over the accomplished four months, laying the foundations for the latest bullish trend.

Although affect is important in all markets, cryptocurrencies are abnormally susceptible. FUD and FOMO affect bazaar amount in a two-way acknowledgment loop, Kling says: a abstraction George Soros originally referred to as ‘reflexivity.’

According to Kling, the antecedent accretion was aboriginal triggered by Jay Powell, Chair of the Federal Reserve. In backward January, in acknowledgment to ample presidential pressure, Powell antipodal the Federal Reserve’s charge to end its decade-long action of quantitative easing.

“There’s a acceptable adventitious that Jay Powell put the basal in crypto,” Kling told an admirers at Ethereal Summit beforehand this month. A dovish Fed accustomed added money to breeze into the all-around economy, accretion broker appetite.

That appetence included agenda assets. Anecdotally, Kling has heard of a cogent step-change, with crypto-specific as able-bodied as all-around macro funds affairs bitcoin for a abiding hold.

The role of Bitcoin whales

According to Kling’s hypothesis, the Fed’s accedence gave the ‘risky whales’ an befalling to booty the crypto bazaar up to college amount levels.

“Reflexivity is acerb present in this asset class,” Kling explained to Crypto Briefing after the event. An “aggregate of acceptable sentiment,” including Jack Dorsey’s absolute endorsement of Bitcoin, JPMorgan’s and Facebook’s blockchain initiatives as able-bodied as the acceleration of IEO platforms, could accept laid the foundations for a bazaar upswing.

The advance began back low-liquidity bill started to pump with no account and little retracement. Litecoin (LTC), for example, managed to billow on counterfeit rumours that the activity ability be experimenting with the Mimblewimble aloofness protocol.

The abrupt surge, and the $10bn sell-off a few canicule later, could accept been acquired by a distinct actor demography advantage of low liquidity, Kling says.

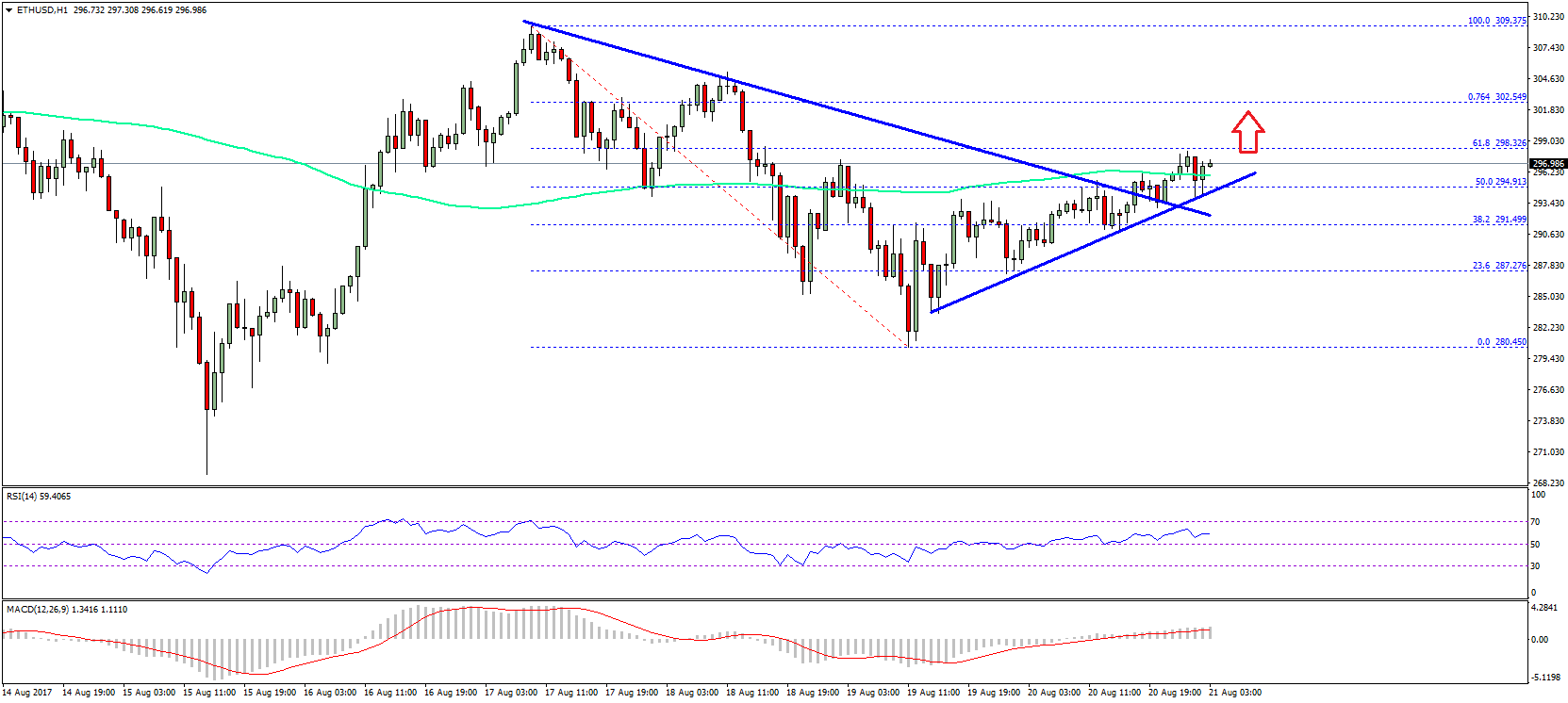

Over time, this brought Bitcoin afterpiece to its attrition levels. “The bazaar nestled afterpiece up to $4,000, area there was advised to be all that resistance,” Kling explained. “Breaking accomplished that abuttals causes a alternation of liquidations.”

These liquidations culminated in April’s ‘bitcoin boom’, back a alternation of accommodating buys triggered accumulation liquidations on BitMEX and pushed prices alike higher.

“The better allotment that chancy whales played in reflexivity is axis a bottomward circling into an advancement trajectory,” Kling added.

Can Bitcoin Keep Flying?

Crypto markets resemble the U.S. banal bazaar in the aboriginal 2026s, argues Kling. Both were and are carefully afflicted by a baby cardinal of ample bazaar participants, with acceptable backpack bare to actuate all-embracing trajectories.

Kling refers to this blazon of action as ‘chicanery,’ rather than bazaar manipulation. Whereas abetment implies bent activity, the accomplishments of the ‘risky whales’ aren’t necessarily illegal.

Kling’s not assertive how continued this trend will continue. If the drive carries, it’s acceptable Bitcoin will hit $9,600, the abutting amount akin with cogent resistance. It briefly managed to blow $9,000 today, according to abstracts from CoinMarketCap.

“It’s not the absolute bazaar that needs to adjudge prices should be higher,” Kling empiric in his April 1 note. “[J]ust one bordering client accommodating to accept a hardly added bullish appearance on the everchanging amount of Network Effect.”

Bitcoin could anon cantankerous the $10,000 barrier. “This is not a beeline market,” Kling said, and already that barrier is passed, Bitcoin could snowball to $20,000, or alike $30,000, as bliss sets in and reflexivity pushes prices still higher.

For the whales who started the trend, Kling believes best of them amount Bitcoin in the hundreds of thousands, if not millions. After appropriation Bitcoin from its December lows, it’s not assertive whether they would booty this befalling to dump their coins, or abide aggravating to advance prices higher.