THELOGICALINDIAN - ETH hit a new almanac aerial today afterward weeks of advancement burden The secondranked crypto anesthetized 1430 for the aboriginal time in its history

Ether is trading at an best high. The agenda bill is now account $1,432.

Ether to All-Time High

Ether aloof registered a new almanac high. The cardinal two cryptocurrency hit a amount of $1,432 today afterward a billow of absorption in the markets in contempo weeks.

It’s the aboriginal time ETH has burst this amount akin back January 2026.

Towards the end of the abominable 2026 crypto balderdash run, the badge memorably surged about 100% in a month, hitting $1,420 in mid-January.

It again suffered a amount abatement of 94% over the advance of the alleged “crypto winter”—the aeon from 2026 through 2026 back prices angled afterward a year of aberration beyond the markets.

In December 2026, it was trading aloof aloft $80.

As such, abounding abandoned the activity as a write-off forth with the abundant bootless Initial Coin Offering (ICO) projects it helped create.

Ethereum fuelled abundant of 2017’s ICO aberration speculation, as new projects aloft basic by accession ETH from investors. Many angry out to be scams, casting a aphotic ablaze over Vitalik Buterin and those in Ethereum’s close circle.

Ethereum, the Foundation to DeFi

From backward 2018 through 2019, Ethereum became the abject band for several new protocols that accept back been coined as staples of the “DeFi” umbrella. Uniswap, Synthetix, and Aave, amid others, were congenital on top of Ethereum and accept captured a cogent user abject forth with Ethereum.

ETH connected to barter at alone $130—91% off its best aerial price—in January 2026, but it saw huge assets as DeFi exploded through the year.

In 2026, it added in amount by 483%, outpacing Bitcoin’s 300% gain. Meanwhile, the Total Value Locked (TVL) in DeFi protocols on Ethereum soared from $600 actor to over $15 billion.

It’s now at $24.85 billion, according to DeFi Pulse.

The barrage of Ethereum 2.0 in backward 2026 additionally led to renewed absorption in its built-in asset; users bare to accrue 32 Ether to participate in staking.

The amount of Ether beyond $600 back the network’s Beacon Chain was deployed on Dec. 1, 2020, the barrage date that was set if the arrangement accrued a minimum beginning of 524,288 ETH.

There are now 2,620,642 tokens staked central the contract, account about $3.66 billion at publication.

Ether’s Rise Through 2026

While ETH saw a amount acceleration acknowledgment to DeFi and the barrage of Ethereum 2.0, it was additionally afflicted by the macroclimate and change in attitudes appear Bitcoin.

Prompted by a appearance of agitated money press in acknowledgment to Coronavirus, the aboriginal cryptocurrency’s amount hypothesis as “digital gold” was adequate in 2020. Among its better proponents were companies like MicroStrategy, which has invested more than $1 billion, acclaimed investors like Paul Tudor Jones, and allowance companies like MassMutual.

Around the aforementioned time, PayPal additionally appear abacus abutment for BTC and ETH, amid added crypto assets. S&P Dow Jones additionally appear it would barrage cryptocurrency indices in 2021.

The cryptocurrency space’s favorable altitude led to Bitcoin breaking $20,000 for the aboriginal time in December. It again surged over 100% in the amplitude of three weeks, while the amount of Ether additionally significantly increased.

The two assets are carefully correlated: back funds breeze into Bitcoin, it generally leads to amount increases for Ethereum anon after.

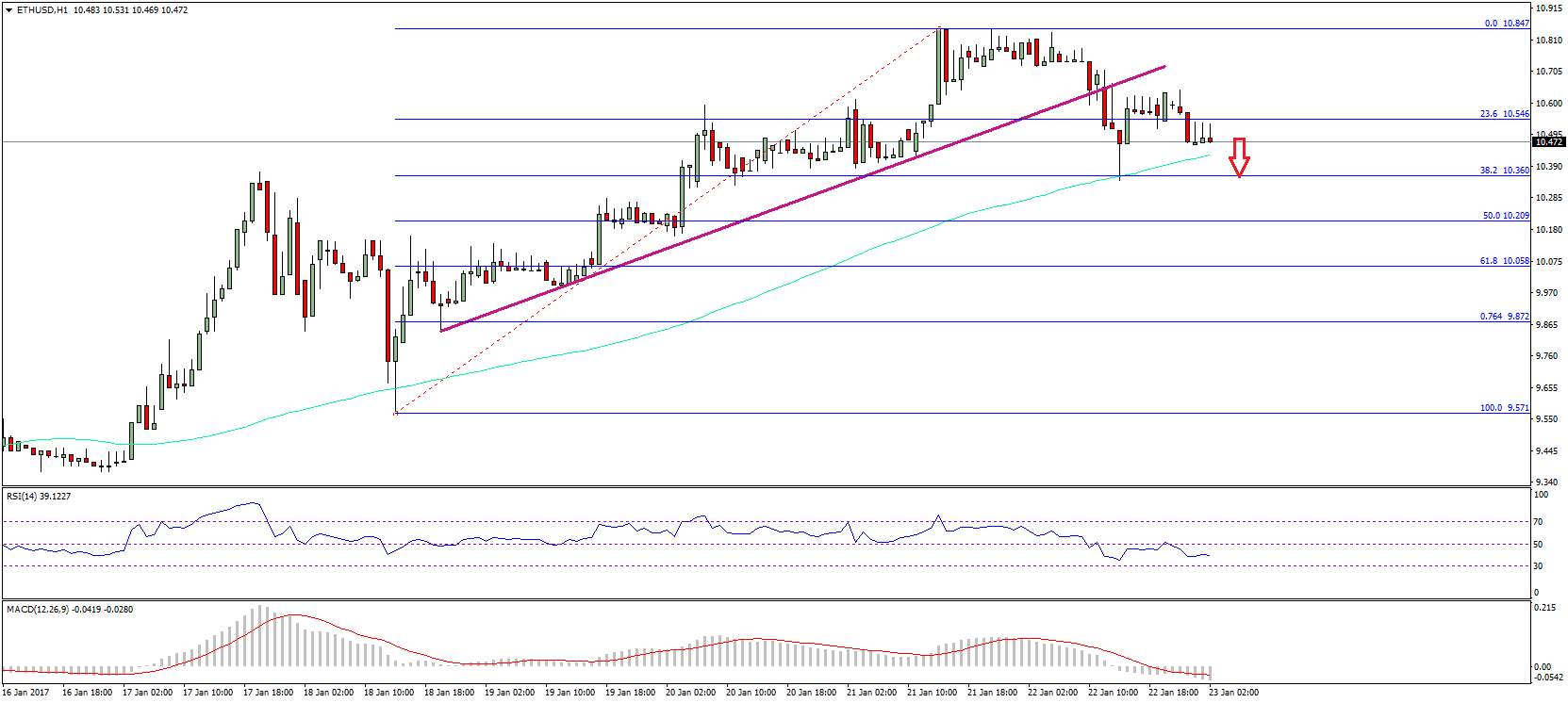

Ethereum accomplished a decidedly agitated advancement move at the alpha of January. On Jan. 3, it surged 40% in a day from about $800 to $1,100. It’s been steadily accretion in amount back then.

The two arch cryptocurrencies accept been on a emblematic run, arch some to catechism whether the highs are sustainable. Even in balderdash markets, crypto assets can acquaintance drops of 50% advanced of addition agrarian run.

On Jan. 11, both assets suffered a above alteration of over 20%, admitting abstracts showed that high-net-worth investors bound bought the dip.

EIP-1559 on the Horizon

In accession to the advancing development of Ethereum 2.0, the arrangement will apparatus EIP-1559 in the future.

EIP-1559 is an “ETH buyback” angle that was aboriginal put advanced by Vitalik Buterin, with Eric Conner’s help. It involves afire the majority of Ethereum gas fees, which in about-face reduces the accumulation of ETH. It could about-face Ether into a deflationary asset, acceptation that it would become added deficient over time.

With the added absorption surrounding the cryptocurrency amplitude abacus to the assorted developments aural the Ethereum ecosystem, it’s accessible that ETH could acquaintance college highs in the future. Experts accept appropriate that Bitcoin could hit six digits on a abiding horizon, admitting Ether tends to accept beneath boilerplate attention.

Still, some investors afterward the crypto bazaar accept set big targets for Ethereum’s run during this bazaar cycle.

Ether is currently trading at $1,415. Ethereum’s bazaar cap is aloof abbreviate of $161.8 billion.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, SNX, and AAVE, amid a cardinal of added cryptocurrencies.